TCF Bank 2005 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2005 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 TCF Financial Corporation and Subsidiaries

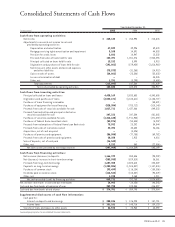

Statement of Cash Flows. It requires that all stock-based compen-

sation now be measured at fair value and recognized as expense

in the income statement. This Statement also clarifies and

expands guidance on measuring fair value of stock compensation,

requires estimation of forfeitures when determining expense,

and requires that excess tax benefits be shown as financing cash

inflows versus a reduction of taxes paid in the Statement of Cash

Flows. Various other changes are also required. This Statement is

effective for TCF beginning January 1, 2006. TCF adopted the

recognition provisions of SFAS 123 in January 2000. TCF expects no

significant effect on TCF financial statements as a result of the

adoption of this Statement.

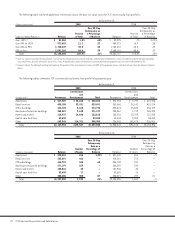

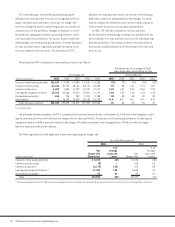

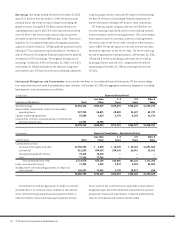

Fourth Quarter Summary In the fourth quarter of 2005, TCF

reported net income of $65.5 million, compared with $67.4 million

in the fourth quarter of 2004. Diluted earnings per common share

was 50 cents for the fourth quarter of 2005, unchanged from the

same 2004 period. TCF opened 13 new branches in the fourth quarter

of 2005, consisting of nine traditional branches, three supermar-

ket branches and one campus branch.

Net interest income was $129.3 million and $126.5 million for

the quarter ended December 31, 2005 and 2004, respectively. The

net interest margin was 4.31% and 4.56% for the fourth quarter of

2005 and 2004, respectively. TCF’s net interest income increased

by $2.8 million, or 2.2% over the fourth quarter of 2004. Of this

increase in net interest income, $9.5 million was due to volume

changes, partially offset by a decrease of $6.7 million due to

interest rate changes.

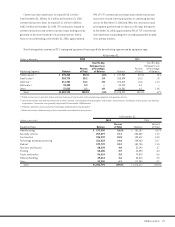

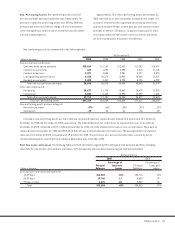

TCF provided $3.6 million for credit losses in the fourth quarter of

2005, compared with $4.1 million in the fourth quarter of 2004. Net

loan and lease charge-offs were $2.3 million, or .09% of average

loans and leases outstanding, compared with $3.2 million, or .14% of

average loans and leases outstanding during the same 2004 period.

Non-interest income decreased $7.4 million, or 5.6%, during

the fourth quarter of 2005 to $125 million. Banking fees and other

revenue increased $2.2 million, or 2.3%, over the fourth quarter of

2004. Card revenues, included in banking fees and other revenue,

totaled $21.4 million for the fourth quarter of 2005, up $3.8 mil-

lion, or 21.6% over the same quarter in 2004. The increase was pri-

marily due to increased customer transaction volumes and related

fees. Leasing and equipment finance revenues were down $5.6

million, or 26.8%, over the fourth quarter of 2004, primarily due

to decreases in sales-type lease revenues.

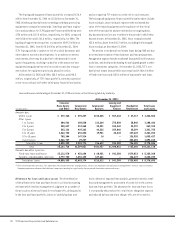

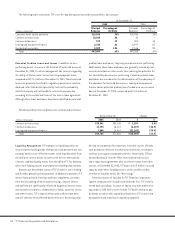

Non-interest expense increased $4.2 million, or 2.7%, in

the fourth quarter of 2005 to $158.5 million. Compensation and

employee benefits decreased $3.6 million, or 4.2%, from the

fourth quarter of 2004, primarily driven by a $3.8 million decrease

in incentive compensation. Occupancy and equipment expenses

increased $2.8 million, or 11%, from the fourth quarter of 2004,

with $936 thousand relating to costs associated with new branch

expansion.

In the fourth quarter of 2005, the effective income tax rate

was 28.91% of income before tax expense compared with 32.96%

for the fourth quarter of 2004. The lower effective tax rate for the

fourth quarter of 2005, compared with the fourth quarter of 2004,

was primarily due to the closing of certain previous years’ tax

returns, clarification of existing state tax legislation and devel-

opments in income tax audits.

Legislative, Legal and Regulatory Developments

Federal and state legislation imposes numerous legal and regula-

tory requirements on financial institutions. Future legislative or

regulatory change, or changes in enforcement practices or court

rulings, may have a dramatic and potentially adverse impact on

TCF and its bank and other subsidiaries.

Pursuant to Section 303A.12 of the New York Stock Exchange

(“NYSE”) Listed Company Manual, TCF’s Chief Executive Officer

submitted a certification to the NYSE on May 18, 2005 indicating

that he was not aware of any violation by TCF of the NYSE’s

Corporate Governance listing standards.

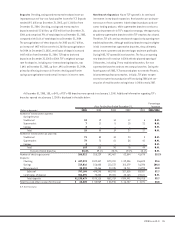

Forward-Looking Information

This annual report on Form 10-K and other reports issued by

the Company, including reports filed with the SEC, may contain

“forward-looking” statements that deal with future results, plans

or performance. In addition, TCF’s management may make such

statements orally to the media, or to securities analysts, investors

or others. Forward-looking statements deal with matters that do

not relate strictly to historical facts. TCF’s future results may dif-

fer materially from historical performance and forward-looking

statements about TCF’s expected financial results or other plans

and are subject to a number of risks and uncertainties. These

include but are not limited to possible legislative changes and

adverse economic, business and competitive developments such

as shrinking interest margins; deposit outflows; an inability to

increase the number of checking accounts and the possibility that

deposit account losses (fraudulent checks, etc.) may increase;

reduced demand for financial services and loan and lease products;

adverse developments affecting TCF’s supermarket banking rela-

tionships or any of the supermarket chains in which TCF maintains

supermarket branches; changes in accounting standards or inter-

pretations of existing standards or monetary, fiscal or tax policies

of the federal or state governments; adverse findings in tax audits

or regulatory examinations; changes in credit and other risks

posed by TCF’s loan, lease and investment portfolios, including