TCF Bank 2005 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2005 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

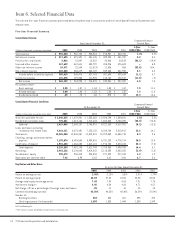

152005 Form 10-K

Item 7. Management’s Discussion

and Analysis of Financial Condition

and Results of Operations

Table of Contents Page

Overview 15

Results of Operations 16

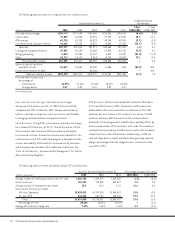

Performance Summary 16

Operating Segment Results 17

Consolidated Income Statement Analysis 17

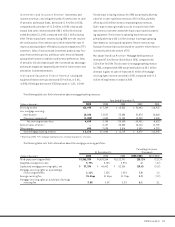

Net Interest Income 17

Provision for Credit Losses 21

Non-Interest Income 21

Non-Interest Expense 25

Income Taxes 26

Consolidated Financial Condition Analysis 26

Securities Available for Sale 26

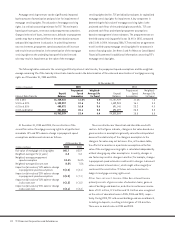

Loans and Leases 27

Allowance for Loan and Lease Losses 30

Non-Performing Assets 33

Past Due Loans and Leases 33

Potential Problem Loans and Leases 34

Liquidity Management 34

Deposits 35

New Branch Expansion 35

Borrowings 36

Contractual Obligations and Commitments 36

Stockholders’ Equity 37

Summary of Critical Accounting Estimates 37

Recent Accounting Developments 37

Fourth Quarter Summary 38

Legislative, Legal and Regulatory Developments 38

Forward-Looking Information 38

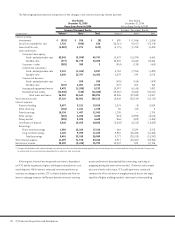

Management’s discussion and analysis of the consolidated financial

condition and results of operations of TCF Financial Corporation

(“TCF” or the “Company”) should be read in conjunction with the

consolidated financial statements in Item 8 and selected financial

data in Item 6.

Overview

TCF is a Delaware national financial holding company based in

Wayzata, Minnesota. Its principal subsidiary, TCF Bank, is head-

quartered in Minnesota and had 453 banking offices in Minnesota,

Illinois, Michigan, Wisconsin, Colorado and Indiana at December

31, 2005.

TCF provides convenient financial services through multiple

channels to customers located primarily in the Midwest. TCF has

developed products and services designed to meet the needs of

all consumers. The Company focuses on attracting and retaining

customers through service and convenience, including branches

that are open seven days a week and on most holidays, extensive

full-service supermarket branches and automated teller machine

(“ATM”) networks, and telephone and internet banking. TCF’s

philosophy is to generate net interest income and fees and other

revenue growth through business lines that emphasize higher

yielding assets and lower or no interest-cost deposits. The

Company’s growth strategies include new branch expansion and

the development of new products and services. New products

and services are designed to build on existing businesses and

expand into complementary products and services through

strategic initiatives.

TCF’s core businesses include retail banking; commercial

banking; small business banking; consumer lending; leasing and

equipment finance; and investments, securities brokerage and

insurance services. The retail banking business includes tradi-

tional and supermarket branches, campus banking, Express Teller

ATMs and Visa U.S.A. Inc. (“Visa”) cards.

TCF emphasizes the checking account as its anchor account,

which provides opportunities to cross-sell other convenience

products and services and generate additional fee income. The

continued growth of checking accounts is a significant part of

TCF’s growth strategy. Total checking accounts were 1,603,173

at December 31, 2005, and increased 68,021 accounts from

December 31, 2004. The number of ATMs that are free to TCF cus-

tomers increased from 1,141 at December 31, 2004, to 1,735 at

December 31, 2005. The increase was primarily the result of an

ATM branding agreement with 7-Eleven®

, Inc., which added 583

TCF branded ATMs during the third quarter of 2005, that are owned

and operated by 7-Eleven, Inc.