TCF Bank 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 TCF Financial Corporation and Subsidiaries

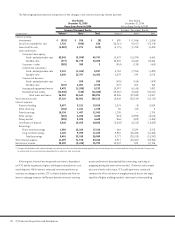

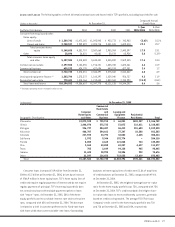

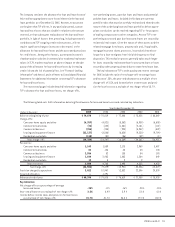

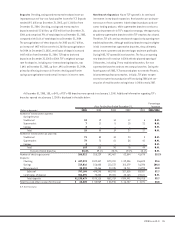

Loan and leases outstanding at December 31, 2005 are shown in the following table by maturity:

At December 31, 2005(1)

Consumer Leasing and

Home Equity Commercial Commercial Equipment Residential Total Loans

(In thousands) and Other Real Estate Business Finance Real Estate and Leases

Amounts due:

Within 1 year $ 277,363 $ 295,257 $215,325 $ 557,442 $ 37,117 $ 1,382,504

After 1 year:

1 to 2 years 284,566 288,520 122,264 375,050 38,046 1,108,446

2 to 3 years 328,047 213,268 30,031 262,042 35,922 869,310

3 to 5 years 563,126 429,162 44,322 259,846 65,299 1,361,755

5 to 10 years 1,362,725 896,283 19,981 44,442 157,622 2,481,053

10 to 15 years 785,104 147,314 14 – 126,995 1,059,427

Over 15 years 1,566,787 29,227 – – 302,601 1,898,615

Total after 1 year 4,890,355 2,003,774 216,612 941,380 726,485 8,778,606

Total $5,167,718 $2,299,031 $431,937 $1,498,822 $763,602 $10,161,110

Amounts due after 1 year on:

Fixed-rate loans and leases $3,112,570 $ 452,654 $ 68,951 $ 941,380 $579,813 $ 5,155,368

Variable- and adjustable-rate loans 1,777,785 1,551,120 147,661 – 146,672 3,623,238

Total after 1 year $4,890,355 $2,003,774 $216,612 $ 941,380 $726,485 $ 8,778,606

(1) Gross of deferred fees and costs. This table does not include the effect of prepayments, which is an important consideration in management’s interest-rate risk analysis.

Company experience indicates that the loans remain outstanding for significantly shorter periods than their contractual terms.

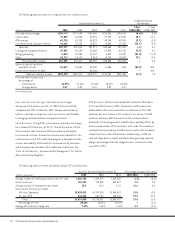

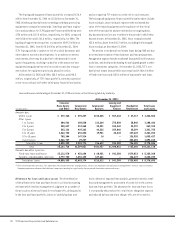

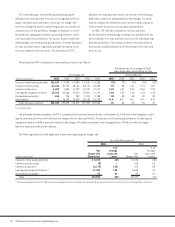

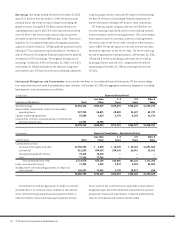

Allowance for Loan and Lease Losses The determination

of the allowance for loan and lease losses is a critical accounting

estimate which involves management’s judgment on a number of

factors such as historical trends in net charge-offs, delinquencies

in the loan and lease portfolio, values of underlying loan and

lease collateral, impaired loan analysis, general economic condi-

tions and management’s assessment of credit risk in the current

loan and lease portfolio. The allowance for loan and lease losses

is increased by the provision for credit losses charged to expense

and reduced by loan and lease charge-offs, net of recoveries.

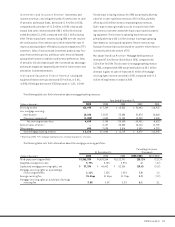

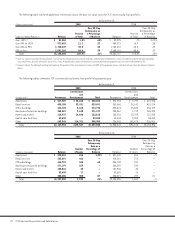

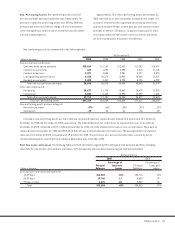

The leasing and equipment finance portfolio increased $128.4

million from December 31, 2004 to $1.5 billion at December 31,

2005. Winthrop primarily leases technology and data processing

equipment to companies nationwide. Total loan and lease origina-

tions and purchases for TCF Equipment Finance and Winthrop were

$728 million and $117.8 million, respectively, for 2005, compared

with $616 million and $101.8 million, respectively, for 2004. The

backlog of approved transactions increased to $249.2 million at

December 31, 2005, from $195.3 million at December 31, 2004.

TCF’s leasing activity is subject to risk of cyclical downturns and

other adverse economic developments. In an adverse economic

environment, there may be a decline in the demand for some

types of equipment, resulting in a decline in the amount of new

equipment being placed into service as well as a decline in equip-

ment values for equipment previously placed in service.

At December 31, 2005 and 2004, $55.2 million, and $48.5

million, respectively, of TCF’s lease portfolio, were discounted on

a non-recourse basis with other third-party financial institutions

and consequently TCF retains no credit risk on such amounts.

The leasing and equipment finance portfolio tables above include

lease residuals. Lease residuals represent the estimated fair

value of the leased equipment at the expiration of the initial

term of the transaction and are reviewed on an ongoing basis.

Any downward revisions are recorded in the periods in which they

become known. At December 31, 2005, lease residuals totaled

$32.8 million, down from $35.2 million, excluding the leveraged

lease residual, at December 31, 2004.

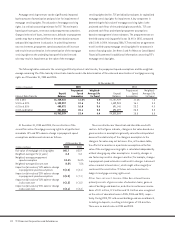

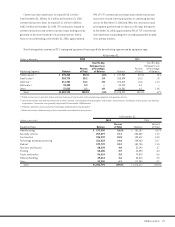

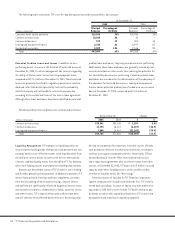

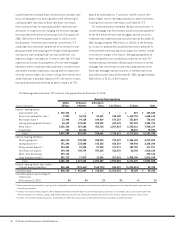

The decline in residential real estate loans during 2005 was due

to normal amortization of loan balances and loan prepayments.

Management expects that the residential loan portfolio will continue

to decline, which will provide funding for anticipated growth in other

loan or investment categories. At December 31, 2005, TCF’s resi-

dential real estate loan portfolio was comprised of $616.8 million

of fixed-rate loans and $153.6 million of adjustable-rate loans.