TCF Bank 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

132005 Form 10-K

Item 5. Market for Registrant’s

Common Equity, Related

Stockholder Matters and Issuer

Purchases of Equity Securities

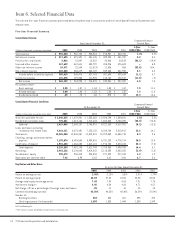

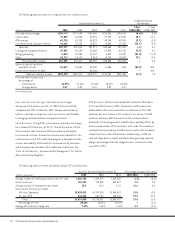

TCF’s common stock trades on the New York Stock Exchange under

the symbol “TCB.” The following table sets forth the high and low

prices and dividends declared for TCF’s common stock. The stock

prices represent the high and low sale prices for the common

stock on the New York Stock Exchange Composite Tape, as

reported by Bloomberg.

Dividends

High Low Declared

2005

First Quarter $32.03 $26.42 $.2125

Second Quarter 28.56 24.55 .2125

Third Quarter 28.82 25.81 .2125

Fourth Quarter 28.78 25.02 .2125

2004

First Quarter $26.37 $23.92 $.1875

Second Quarter 29.03 24.35 .1875

Third Quarter 32.62 28.01 .1875

Fourth Quarter 32.36 29.46 .1875

As of January 31, 2006, there were approximately 9,571 record

holders of TCF’s common stock.

The Board of Directors of TCF Financial has not adopted a for-

mal dividend policy. The Board of Directors intends to continue

its present practice of paying quarterly cash dividends on TCF’s

common stock as justified by the financial condition of TCF.

The declaration and amount of future dividends will depend on

circumstances existing at the time, including TCF’s earnings,

financial condition and capital requirements, the cash available

to pay such dividends (derived mainly from dividends and distri-

butions from TCF Bank), as well as regulatory and contractual

limitations and such other factors as the Board of Directors may

deem relevant. In general, TCF Bank may not declare or pay a

dividend to TCF in excess of 100% of its net profits for that year

combined with its retained net profits for the preceding two cal-

endar years without prior approval of the OCC. Restrictions on the

ability of TCF Bank to pay cash dividends or possible diminished

earnings of the indirect subsidiaries of TCF Financial may limit

the ability of TCF Financial to pay dividends in the future to holders

of its common stock. See “Regulation — Regulatory Capital

Requirements,” “Regulation — Restrictions on Distributions” and

Note 15 of Notes to Consolidated Financial Statements.

Part II

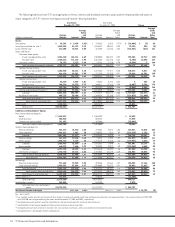

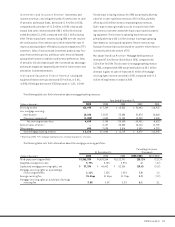

For the quarter ended December 31, 2005, there was no share repurchase activity, as summarized in the following table:

Share

Shares Repurchase

Repurchased Authorizations(1)

Average Price July 21, May 21,

(Dollars in thousands) Number Per Share 2003 2005

Balance, September 30, 2005 2,820 6,725,487

October 1-31, 2005 – $ – – –

November 1-30, 2005 ––––

December 1-31, 2005 – – – –

Balance, December 31, 2005 – $ – 2,820 6,725,487

(1) The current share repurchase authorizations were approved by the Board of Directors on July 21, 2003 and May 21, 2005. Each authorization was for a repurchase of up to

an additional 5% of TCF’s common stock outstanding at the time of the authorization, or 7.1 million shares and 6.7 million shares, respectively. These authorizations do

not have expiration dates.