TCF Bank 2005 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2005 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

Structure

One of TCF’s most important assets is its

management bench strength and depth.

TCF is organized geographically and by

function. Our bank presidents are

responsible for the operational goals

of their state as well as a functional

operation such as consumer lending,

commercial banking, retail branches,

or affinity banking. We strongly believe

local management teams make the

best decisions regarding local issues.

Each of our bank management teams is

responsible for local business decisions,

business development, customer

relations, and community involvement.

As firmly as TCF believes local, geograph-

ically-based management is best suited

to run our businesses, we also believe

functional product line management

benefits from a more centralized approach.

Centralized functional management

facilitates efficient product development,

effective communication, consistent

implementation, and close monitoring of

our strategic initiatives, as well as central

accountability for the success of each of

our major product areas.

TCF’s newest functional operation, TCF

Affinity Banking, was developed out

of the success of our campus banking

program. Affinity banking encompasses

building relationships and providing

specialized banking services and products

to a number of unique groups including

colleges, employers, property managers,

and youth sports associations. Affinity

banking seeks to earn new account

relationships of group members while

providing value to their organizations.

The cornerstone of affinity banking is our

campus card checking account offered to

students, faculty and staff of 11 partici-

pating colleges and universities. During

2005, TCF proudly added DePaul University

(Illinois) and Milwaukee Area Technical

College (Wisconsin) to its impressive list

of schools.

By organizing management teams to

most efficiently and effectively manage

our local banks and our strategic product

areas, TCF has the best of both worlds.

We enjoy informed, timely local decision-

making that allows us to compete in our

markets on a daily basis while long-term

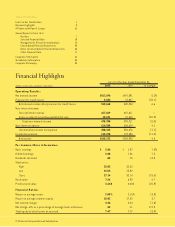

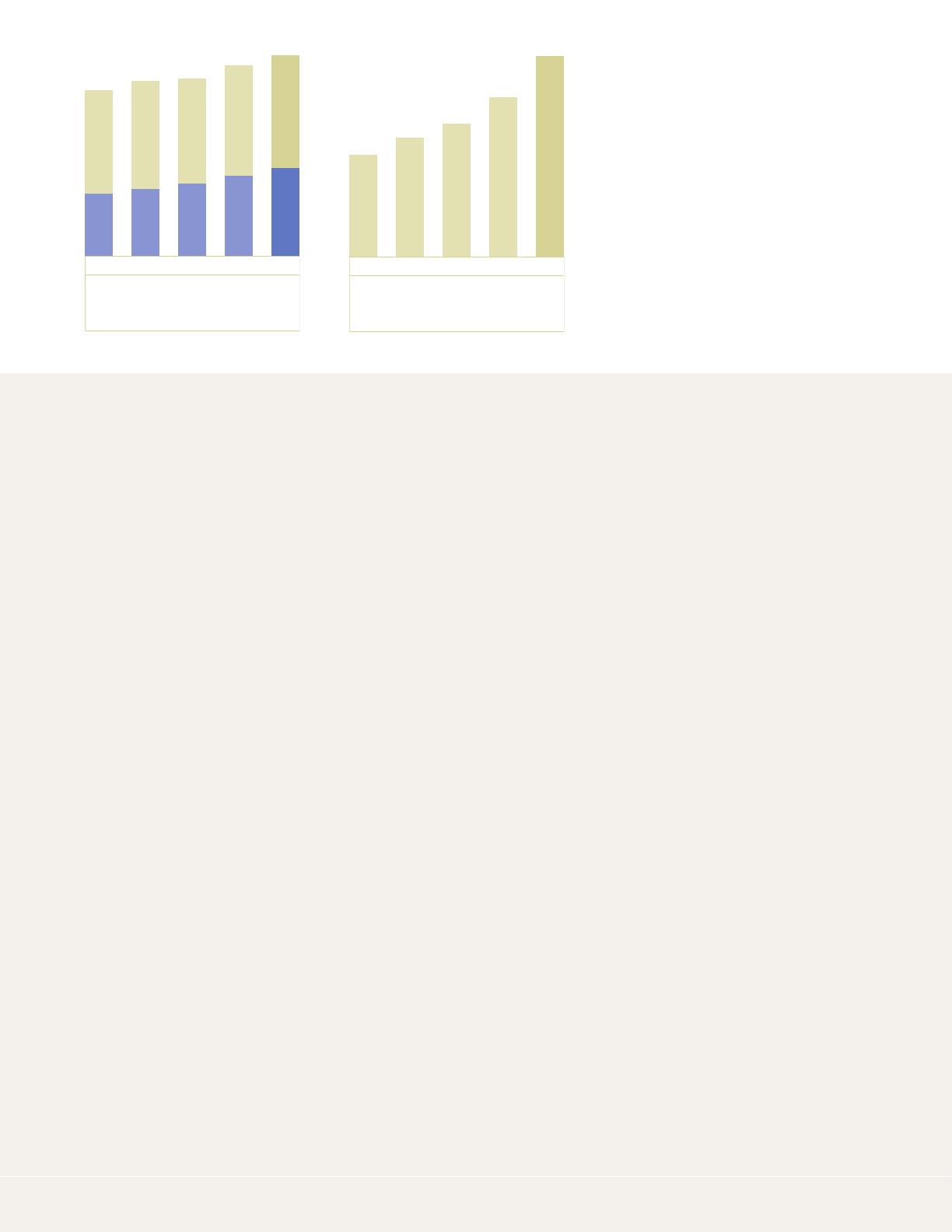

■ Supermarket Branches

Retail Distribution Growth

number of branches

12/0512/0412/0312/0212/01

375

395

401

430

453

■ Traditional and Campus Branches

Card Revenue

millions of dollars

$40.5

$47.2

$53.0

$63.5

$79.8

0504030201