TCF Bank 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

332005 Form 10-K

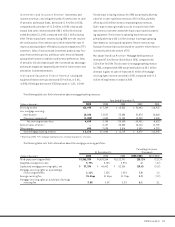

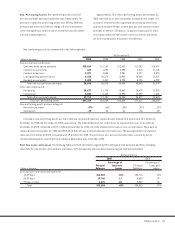

Non-Performing Assets Non-performing assets consist of

non-accrual loans and leases and other real estate owned. The

decrease in total non-performing assets from 2004 to 2005 was

primarily due to the $18.8 million charge-off of the investment

in the leveraged lease and the sale of several foreclosed commer-

cial real estate properties.

Approximately 75% of non-performing assets at December 31,

2005 consisted of, or were secured by, residential real estate. The

accrual of interest income is generally discontinued when loans

and leases become 90 days or more past due with respect to either

principal or interest (150 days or six payments past due for loans

secured by residential real estate) unless such loans and leases

are well secured and in the process of collection.

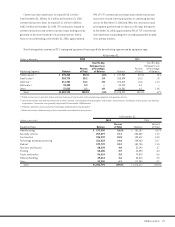

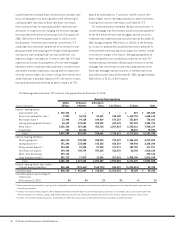

Non-performing assets are summarized in the following table:

At December 31,

(Dollars in thousands) 2005 2004 2003 2002 2001

Non-accrual loans and leases:

Consumer home equity and other $18,410 $12,187 $12,052 $11,163 $16,473

Commercial real estate 188 1,093 2,490 3,213 11,135

Commercial business 2,207 4,533 2,931 4,777 3,550

Leasing and equipment finance 6,434 25,678 13,940 18,689 13,857

Residential real estate 2,409 3,387 3,993 5,798 6,959

Total non-accrual loans and leases 29,648 46,878 35,406 43,640 51,974

Other real estate owned:

Residential 14,877 11,726 20,462 16,479 12,830

Commercial 2,834 5,465 12,992 10,093 1,825

Total other real estate owned 17,711 17,191 33,454 26,572 14,655

Total non-performing assets $47,359 $64,069 $68,860 $70,212 $66,629

Non-performing assets as a percentage of:

Net loans and leases .47% .69% .83% .87% .82%

Total assets .35 .52 .61 .58 .59

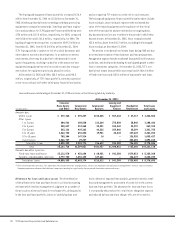

Included in non-performing assets are loans that are considered impaired. Impaired loans totaled $3.8 million and $8.1 million at

December 31, 2005 and December 31, 2004, respectively. The related allowance for credit losses on impaired loans was $1.6 million at

December 31, 2005, compared with $3.7 million at December 31, 2004. All of the impaired loans were on non-accrual status. There were no

impaired loans at December 31, 2005 and 2004 which did not have a related allowance for loan losses. The average balance of impaired

loans was $5.3 million for 2005, compared with $9.8 million for 2004. The increase in non-accrual consumer loans is primarily due to

increased bankruptcies resulting from a change in bankruptcy laws in October, 2005.

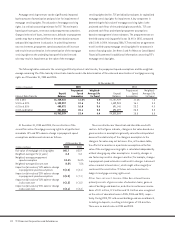

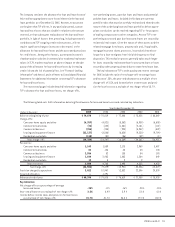

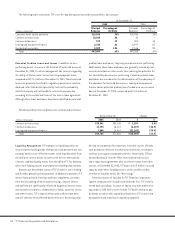

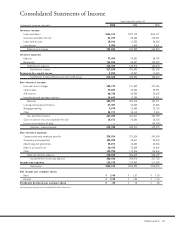

Past Due Loans and Leases The following table sets forth information regarding TCF’s delinquent loan and lease portfolio, excluding

loans held for sale and non-accrual loans and leases. TCF’s delinquency rates are determined using the contractual method.

At December 31,

2005 2004

Percentage of Percentage of

Principal Loans and Principal Loans and

(Dollars in thousands) Balances Leases Balances Leases

Accruing loans and leases delinquent for:

30-59 days $26,383 .26% $20,776 .23%

60-89 days 10,746 .11 8,659 .09

90 days or more 6,475 .06 4,950 .05

Total $43,604 .43% $34,385 .37%