TCF Bank 2005 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2005 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58 TCF Financial Corporation and Subsidiaries

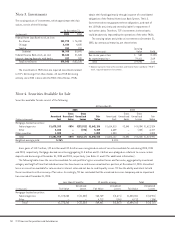

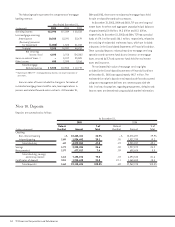

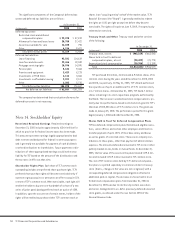

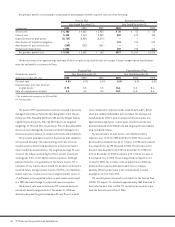

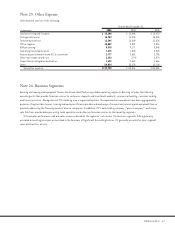

The significant components of the Company’s deferred tax

assets and deferred tax liabilities are as follows:

At December 31,

(In thousands) 2005 2004

Deferred tax assets:

Restricted stock and deferred

compensation plans $ 33,225 $ 37,819

Allowance for loan and lease losses 20,780 27,422

Securities available for sale 12,028 796

Other 6,196 9,427

Total deferred tax assets 72,229 75,464

Deferred tax liabilities:

Lease financing 95,541 114,619

Loan fees and discounts 22,466 19,339

Mortgage servicing rights 10,996 14,090

Pension plan 8,124 9,464

Premises and equipment 5,429 8,273

Investments in FHLB Stock 3,116 3,066

Investments in affordable housing 3,021 2,101

Other 6,205 5,715

Total deferred tax liabilities 154,898 176,667

Net deferred tax liabilities $ 82,669 $101,203

The company has determined that a valuation allowance for

deferred tax assets is not necessary.

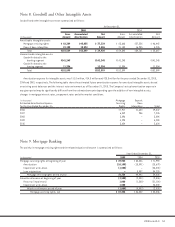

Note 14. Stockholders’ Equity

Restricted Retained Earnings Retained earnings at

December 31, 2005 includes approximately $134.4 million for

which no provision for federal income taxes has been made.

This amount represents earnings legally appropriated to bad

debt reserves and deducted for federal income tax purposes

and is generally not available for payment of cash dividends

or other distributions to shareholders. Future payments or dis-

tributions of these appropriated earnings could invoke a tax

liability for TCF based on the amount of the distributions and

the tax rates in effect at that time.

Shareholder Rights Plan Each share of TCF common stock

outstanding includes one preferred share purchase right. TCF’s

preferred share purchase rights will become exercisable only if

a person or group acquires or announces an offer to acquire 15%

or more of TCF’s common stock. When exercisable, each right will

entitle the holder to buy one one-hundredth of a share of a new

series of junior participating preferred stock at a price of $200.

In addition, upon the occurrence of certain events, holders of the

rights will be entitled to purchase either TCF’s common stock or

shares in an “acquiring entity” at half of the market value. TCF’s

Board of Directors (the “Board”) is generally entitled to redeem

the rights at $.001 per right at any time before they become

exercisable. The rights will expire on June 9, 2009, if not previously

redeemed or exercised.

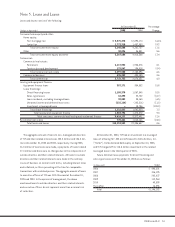

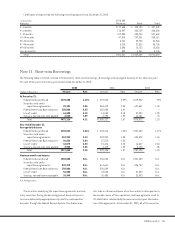

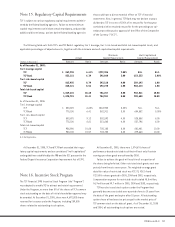

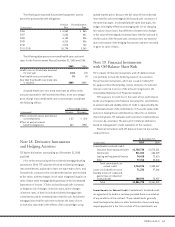

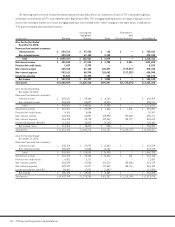

Treasury Stock and Other Treasury stock and other consists

of the following:

At December 31,

(In thousands) 2005 2004

Treasury stock, at cost $ (945,159) $(862,543)

Shares held in trust for deferred

compensation plans, at cost (50,493) (70,775)

Unamortized stock compensation (20,386) (13,199)

Total $(1,016,038) $(946,517)

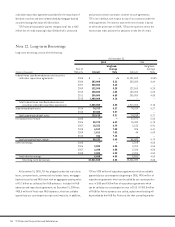

TCF purchased 3.5 million, 4 million and 6.9 million shares of its

common stock during the years ended December 31, 2005, 2004

and 2003, respectively. On May 21, 2005, TCF’s Board authorized

the repurchase of up to an additional 5% of TCF’s common stock,

or 6.7 million shares. At December 31, 2005, TCF had 6.7 million

shares remaining in its stock repurchase programs authorized by

the Board. The increase in unamortized stock compensation is pri-

marily due to a performance-based restricted stock grant to TCF’s

Chairman of 300,000 shares of TCF common stock. This grant was

made on January 25, 2005. The performance period for this grant

begins January 1, 2006 and ends December 31, 2008.

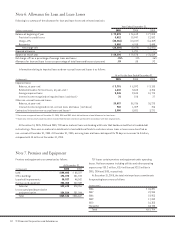

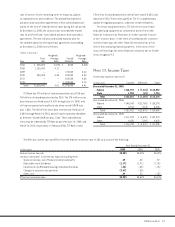

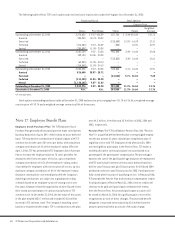

Shares Held in Trust for Deferred Compensation Plans

TCF has deferred compensation plans that allowed eligible execu-

tives, senior officers and certain other employees and Directors

to defer payment of up to 100% of their base salary and bonus

as well as grants of restricted stock. There are no company con-

tributions to these plans, other than payment of administrative

expenses. The amounts deferred are invested in TCF stock or other

publicly traded stocks, bonds or mutual funds. At December 31,

2005, the fair value of the assets in the plans totaled $179.8 mil-

lion and included $172.9 million invested in TCF common stock.

The cost of TCF common stock held by TCF’s deferred compensa-

tion plans is reported separately in a manner similar to treasury

stock (that is, changes in fair value are not recognized) with a

corresponding deferred compensation obligation reflected in

additional paid-in capital. The decrease in shares held in trust

for deferred compensation plans from December 31, 2004 to

December 31, 2005 was due to elections by certain executives

and senior management to un-defer previously deferred unvested

stock grants, as allowed under the new Section 409A of the

Internal Revenue Code.