TCF Bank 2005 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2005 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

172005 Form 10-K

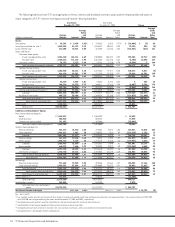

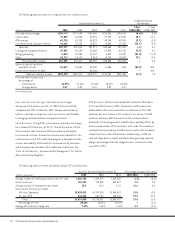

Operating Segment Results BANKING, comprised of deposits

and investment products, commercial banking, small business

banking, consumer lending and treasury services, reported net

income of $229.9 million for 2005, up 4.6% from $219.9 million

in 2004. Banking net interest income for 2005 was $455.5 million,

up 6.6% from $427.5 million for 2004. The provision for credit

losses totaled $1 million in 2005, down from $4.1 million in 2004.

The provision for credit losses for 2005 reflects improved credit

quality, primarily in the consumer and commercial portfolios,

including a $3.3 million commercial business loan recovery in the

first quarter of 2005. Non-interest income totaled $425.1 million,

compared with $426.6 million in 2004. Card revenues, primarily

interchange fees, increased 25.7% in 2005, which was primarily

attributable to a 19.8% increase in sales volume compared with

2004. Fees and service charges were $258.7 million for 2005, down

4.6% from $271.2 million in 2004, as a result of changing customer

behaviors. During 2005, TCF sold several buildings and one branch

including its deposits resulting in total gains of $13.6 million.

There were no branch sales in 2004 or 2003. During 2005, TCF sold

mortgage-backed securities and realized gains of $10.7 million,

compared with gains of $22.6 million for 2004 and $32.8 million

for 2003. See “Consolidated Income Statement Analysis – Non-

Interest Income” for further discussion on the sales of mortgage-

backed securities.

Banking non-interest expense totaled $553.2 million, up 7.1%

from $516.4 million in 2004. The increases were primarily due

to compensation and benefits and occupancy costs associated

with new branch expansion, increases in card processing and

issuance expenses related to the overall increase in card volumes,

and increases in net real estate expense as a result of net recov-

eries on sales of foreclosed properties in 2004, partially offset by

a decrease in deposit account losses.

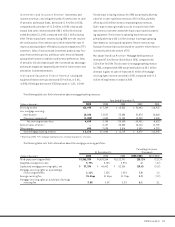

LEASING AND EQUIPMENT FINANCE, an operating segment

comprised of TCF’s wholly-owned subsidiaries TCF Equipment

Finance and Winthrop, provides a broad range of comprehensive

lease and equipment finance products. Leasing and Equipment

Finance reported net income of $33.4 million for 2005, down

6.9% from $35.9 million in 2004. Net interest income for 2005

was $57 million, up 2.4% from $55.7 million in 2004. The provision

for credit losses for this operating segment totaled $4 million

in 2005, down from $6.8 million in 2004. Delta Airlines, Inc.,

(“Delta”), declared bankruptcy on September 14, 2005, and TCF

charged off its $18.8 million investment in the related leveraged

lease through a reduction in the allowance for loan and lease

losses. The decrease in the provision for credit losses from 2004

was primarily related to improved credit quality of the portfolio

excluding leveraged leases. Non-interest income totaled $47.5

million in 2005, down $3.2 million from $50.7 million in 2004. The

decrease in leasing and equipment finance revenues for 2005,

compared with 2004, was primarily due to lower sales-type lease

revenues, partially offset by higher operating lease revenues and

other transaction fees. Leasing and equipment finance revenues

may fluctuate from period to period based on customer-driven

factors not entirely within the control of TCF. Non-interest expense

totaled $48.6 million in 2005, up $4.9 million from $43.7 million

in 2004, primarily related to an increase in operating lease depre-

ciation expense.

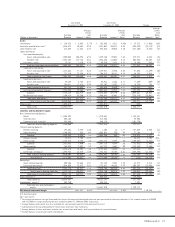

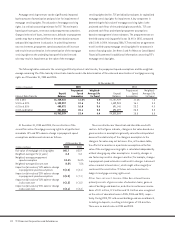

Consolidated Income Statement Analysis

Net Interest Income Net interest income, which is the differ-

ence between interest earned on loans and leases, securities

available for sale, investments and other interest-earning assets

(interest income), and interest paid on deposits and borrowings

(interest expense), represented 52% of TCF’s revenue in 2005.

Net interest income divided by average interest-earning assets is

referred to as the net interest margin, expressed as a percentage.

Net interest income and net interest margin are affected by

changes in interest rates, loan and deposit pricing strategies

and competitive conditions, the volume and the mix of interest-

earning assets and interest-bearing liabilities, and the level of

non-performing assets.