TCF Bank 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

352005 Form 10-K

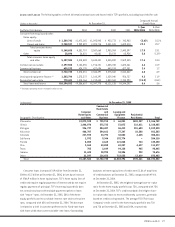

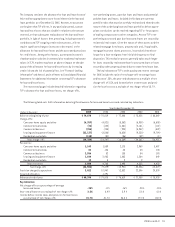

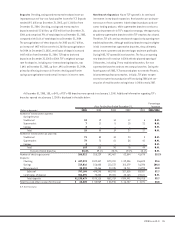

At December 31, 2005, 153, or 34%, of TCF’s 453 branches were opened since January 1, 2000. Additional information regarding TCF’s

branches opened since January 1, 2000 is displayed in the table below:

Percentage

At or For the Year Ended December 31, Increase

(Dollars in thousands) 2005 2004 2003 2002 2001 2005/2004

Number of new branches opened

during the year:

Traditional 18 19 14 12 6 N.M.

Supermarket 711 5 15 21 N.M.

Campus 3––––N.M.

Total 28 30 19 27 27 N.M.

Number of new branches at year end:

Traditional 71 53 34 20 8 N.M.

Supermarket 79 72 61 56 41 N.M.

Campus 3––––N.M.

Total 153 125 95 76 49 N.M.

Percent of total branches 33.8% 29.1% 23.7% 19.2% 13.1% N.M.

Number of checking accounts 266,512 206,229 142,467 82,604 41,870 29.2%

Deposits:

Checking $ 437,074 $322,347 $173,091 $ 89,836 $36,693 35.6

Savings 319,816 156,480 110,372 102,279 16,396 104.4

Money market 30,294 20,466 20,245 15,711 15,998 48.0

Subtotal 787,184 499,293 303,708 207,826 69,087 57.7

Certificates of deposit 351,295 70,832 49,081 42,165 27,621 N.M.

Total deposits $1,138,479 $570,125 $352,789 $249,991 $96,708 99.7

Total fees and other revenue for the year $ 68,220 $ 50,969 $ 28,915 $ 16,747 $ 7,191 33.8

N.M. Not Meaningful.

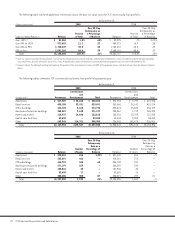

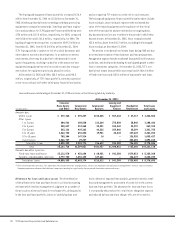

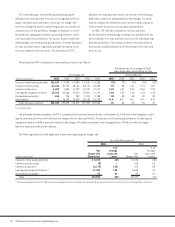

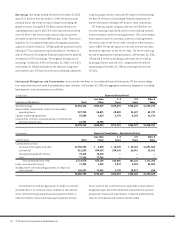

Deposits Checking, savings and money market deposits are an

important source of low-cost funds and fee income for TCF. Deposits

totaled $9.1 billion at December 31, 2005, up $1.1 billion from

December 31, 2004. Checking, savings and money market

deposits totaled $7.2 billion, up $702 million from December 31,

2004, and comprised 79% of total deposits at December 31, 2005,

compared with 81.6% of total deposits at December 31, 2004.

The average balance of these deposits for 2005 was $6.7 billion,

an increase of $457 million over the $6.3 billion average balance

for 2004. At December 31, 2005, certificates of deposit increased

$447 million from December 31,2004. TCF had no brokered

deposits at December 31, 2005 or 2004. TCF’s weighted-average

rate for deposits, including non-interest bearing deposits, was

1.64% at December 31, 2005, up from .69% at December 31, 2004,

primarily reflecting increases in Premier checking and Premier

savings average balances and overall increases in interest rates.

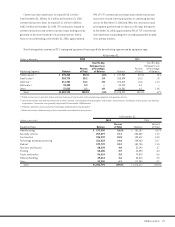

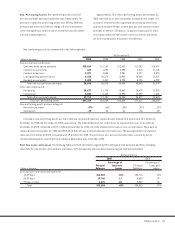

New Branch Expansion Key to TCF’s growth is its continued

investment in new branch expansion. New branches are an impor-

tant source of new customers in both deposit products and con-

sumer lending products. While supermarket branches continue to

play an important role in TCF’s expansion strategy, the opportunity

to add new supermarket branches within TCF’s markets has slowed.

Therefore, TCF will continue new branch expansion by opening more

traditional branches. Although traditional branches require a higher

initial investment than supermarket branches, they ultimately

attract more customers and become larger and more profitable.

During 2005, TCF opened 28 new branches. The focus on opening

new branches will continue in 2006 with the planned opening of

24 branches, including 17 new traditional branches, five new

supermarket branches and two new campus branches. During the

fourth quarter of 2005, TCF announced plans to enter the Phoenix,

Arizona metropolitan area market. Initially, TCF plans to open

several consumer loan production offices during 2006 with con-

struction of retail branches to begin later in 2006 or early 2007.