TCF Bank 2005 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2005 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16 TCF Financial Corporation and Subsidiaries

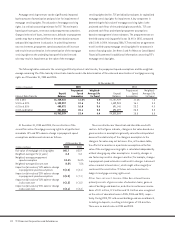

Opening new branches is an integral part of TCF’s growth

strategy for generating new deposit accounts and the related

revenue that is associated with the accounts and other products.

New branches typically produce net losses during the first 20-24

months of operations before they become profitable, and there-

fore the level and timing of new branch expansion can have a

significant impact on TCF’s profitability. TCF’s growth in checking

accounts is primarily occurring in new branches with growth in

older, mature branches being slower. The success of TCF’s branch

expansion is dependent on the continued long-term success and

viability of branch banking.

TCF’s lending strategy is to originate high credit quality, pri-

marily secured, loans and leases. Commercial loans are generally

made on local properties or to local customers. TCF’s largest core

lending business is its consumer home equity loan operation, which

offers fixed- and variable-rate loans and lines of credit secured

by residential real estate properties. The leasing and equipment

finance businesses consist of TCF Equipment Finance, Inc. (“TCF

Equipment Finance”), a company that delivers equipment finance

solutions to businesses in select markets, and Winthrop Resources

Corporation (“Winthrop”), a leasing company that primarily leases

technology and data processing equipment. TCF’s leasing and

equipment finance businesses operate in all 50 states and source

equipment installations domestically and, to a limited extent, in

foreign countries.

As a primarily secured lender, TCF emphasizes credit quality

over asset growth. As a result, TCF’s credit losses are generally

lower than those experienced by other banks. The allowance for

loan and lease losses, while generally lower as a percent of loans

and leases than the average in the banking industry, reflects

the lower historical charge-offs and management’s expectation

of the risk of loss inherent in the loan and lease portfolio. See

“Consolidated Financial Condition Analysis – Allowance for Loan

and Lease Losses.”

Net interest income, the difference between interest income

earned on loans and leases and on investments, and interest

expense paid on deposits and short-term and long-term borrow-

ings, represented 52% of TCF’s total revenue in 2005. Net interest

income can change significantly from period to period based on

general levels of interest rates, customer prepayment patterns,

the mix of interest-earning assets and the mix of interest-bearing

and non-interest bearing deposits and borrowings. TCF manages

the risk of changes in interest rates on its net interest income

through an Asset/Liability Committee and through related interest-

rate risk monitoring and management policies.

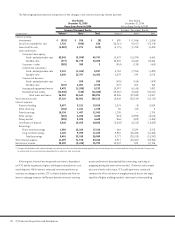

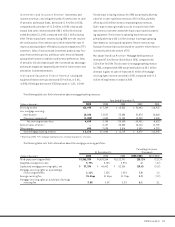

During 2005, TCF’s net interest margin declined from 4.54%

for 2004 to 4.46% for 2005. This decline was primarily due to

growth in deposits with higher interest rates and increased fixed-

rate loans with lower yields than variable-rate loans as a result

of the flattening yield curve and changing customer preferences.

See “Quantitative and Qualitative Disclosures About Market Risk”

for further discussion on TCF’s interest-rate risk position.

Non-interest income is a significant source of revenue for

TCF and an important factor in TCF’s results of operations. A

key driver of non-interest income is checking accounts and their

related activities. Increasing fee and service charge revenues

has been challenging during 2005 as a result of slower growth

in checking accounts and changing customer behaviors. Fee

revenue per retail checking account was $217 for 2005, down

from $232 in 2004. TCF is focusing on checking account growth

to increase future fee revenue. See “Management’s Discussion

and Analysis of Financial Condition and Results of Operations –

Consolidated Income Statement Analysis – Non-Interest

Income” for additional information.

The Company’s Visa debit card program has grown significantly

since its inception in 1996. TCF is one of the largest issuers of Visa

Classic debit cards in the United States. TCF earns interchange

revenue from customer debit card transactions.

The following portions of the Management’s Discussion and

Analysis of Financial Condition and Results of Operations focus

in more detail on the results of operations for 2005, 2004 and

2003 and on information about TCF’s balance sheet, credit quality,

liquidity and funding resources, capital and other matters.

Results of Operations

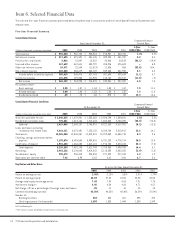

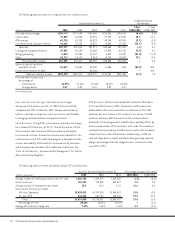

Performance Summary TCF reported diluted earnings per com-

mon share of $2.00 for 2005, compared with $1.86 for 2004 and

$1.53 for 2003. Net income was $265.1 million for 2005, compared

with $255 million for 2004 and $215.9 million for 2003. Return on

average assets was 2.08% in 2005, compared with 2.15% in 2004

and 1.85% in 2003. Return on average common equity was 28.03%

in 2005, compared with 27.02% in 2004 and 23.05% in 2003. During

2003, TCF prepaid $954 million of high-cost FHLB borrowings,

incurring early termination fees of $44.3 million ($29.2 million

after-tax) which reduced diluted earnings per share by 21 cents.

There were no debt terminations in 2005 or 2004. The effective

income tax rate for 2005 was 30.30%, compared with 33.68% in

2004 and 34.14% in 2003.