TCF Bank 2005 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2005 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

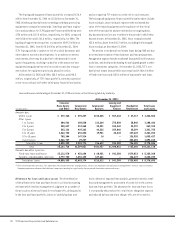

232005 Form 10-K

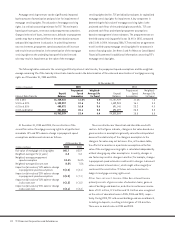

Investments and Insurance Revenue Investments and

insurance revenue, consisting principally of commissions on sales

of annuities and mutual funds, decreased $1.9 million in 2005,

compared with a decrease of $1.3 million in 2004. Annuity and

mutual fund sales volumes totaled $188.2 million for the year

ended December 31, 2005, compared with $212.2 million during

2004. The decreased sales volumes during 2005 were the result of

the continuation of low interest rates which reduced the rate of

return on annuity products offered by insurance companies to TCF’s

customers. Sales of insurance and investment products may fluc-

tuate from period to period, and future sales levels will depend

upon general economic conditions and investor preferences. Sales

of annuities will also depend upon their continued tax advantage

and may be negatively impacted by the level of interest rates and

alternative investment products.

Leasing and Equipment Finance Revenue Leasing and

equipment finance revenues decreased $2.9 million, or 5.8%,

in 2005, following a decrease of $765 thousand, or 1.5%, in 2004.

The decrease in leasing revenues for 2005 was primarily driven by

a decline in sales-type lease revenues of $10 million, partially

offset by a $6.5 million increase in operating lease revenues.

Sales-type revenues generally occur at or near the end of the

lease term as customers extend the lease or purchase the underly-

ing equipment. The increase in operating lease revenues was

primarily driven by a $25.1 million increase in average operating

lease balances. Leasing and equipment finance revenues may

fluctuate from period to period based on customer-driven factors

not entirely within the control of TCF.

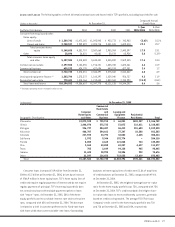

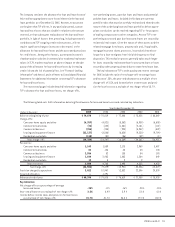

Mortgage Banking Revenue Mortgage banking revenue

decreased $7.4 million to $5.6 million in 2005, compared with

$13 million for 2004. The decrease in mortgage banking revenue

for 2005, compared with 2004 was primarily due to a $8.1 million

decrease in gains on sales of loans and $1 million of mortgage

servicing rights recovery recorded in 2005, compared with $1.5

million of impairment recorded in 2004.

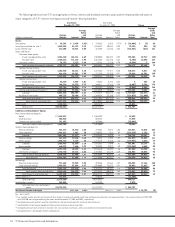

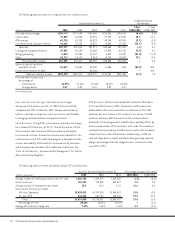

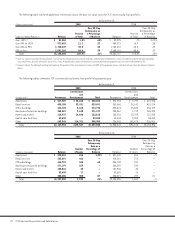

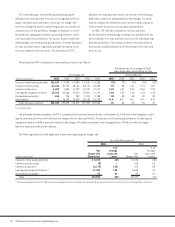

The following table sets forth information about mortgage banking revenues:

Year Ended December 31,

(Dollars in thousands) 2005 2004 2003 2002 2001

Servicing income $13,998 $17,349 $ 20,533 $ 20,443 $16,932

Less mortgage servicing:

Amortization 10,108 13,091 23,680 22,874 16,564

(Recovery) impairment (1,000) 1,500 21,153 12,500 4,400

Net servicing income (loss) 4,890 2,758 (24,300) (14,931) (4,032)

Gains on sales of loans (1) –8,107 33,505 18,110 11,795

Other income 688 2,095 3,514 3,800 4,279

Total mortgage banking revenue $ 5,578 $12,960 $ 12,719 $ 6,979 $12,042

(1) Beginning in 2005, TCF’s mortgage banking business no longer originates or sells loans.

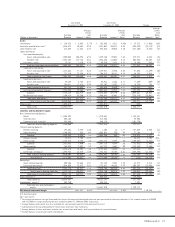

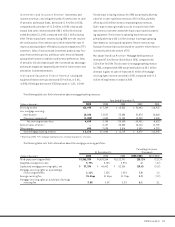

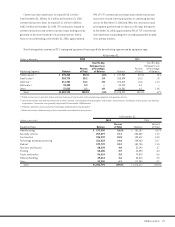

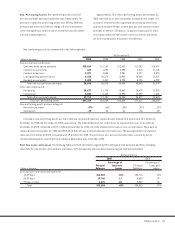

The following table sets forth information about the mortgage servicing portfolio:

Percentage Increase

At December 31, (Decrease)

(Dollars in thousands) 2005 2004 2003 2005/2004 2004/2003

Third-party servicing portfolio $3,362,339 $4,503,564 $5,122,741 (25.3)% (12.1)%

Weighted-average note rate 5.79% 5.78% 5.97% .2 (3.2)

Capitalized mortgage servicing rights, net $ 37,334 $ 46,442 $ 52,036 (19.6) (10.8)

Mortgage servicing rights as a percentage

of servicing portfolio 1.11% 1.03% 1.02% 7.8 1.0

Average servicing fee 31.4 bps 31.0bps 31.7bps 1.3 (2.2)

Mortgage servicing rights as a multiple of average

servicing fee 3.5 X 3.3X 3.2X 6.1 3.1