TCF Bank 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

292005 Form 10-K

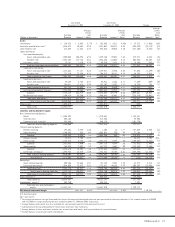

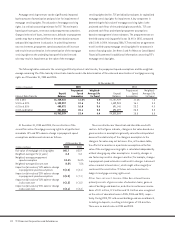

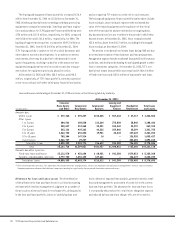

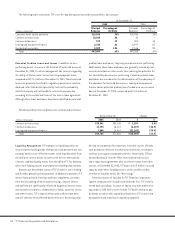

The following tables summarize TCF’s leasing and equipment finance portfolio by marketing segment and by equipment type:

At December 31,

(Dollars in thousands) 2005 2004

Over 30-Day Over 30-Day

Delinquency as Delinquency as

Percent a Percentage Percent a Percentage

Marketing Segment Balance of Total of Balance Balance of Total of Balance

Middle market (1) $ 878,414 58.4% .26% $ 747,964 54.4% .51%

Small ticket(2) 303,778 20.2 .53 258,094 18.8 .75

Winthrop(3) 211,741 14.1 .98 200,819 14.6 1.10

Wholesale (4) 78,338 5.2 – 83,913 6.1 –

Other 31,523 2.1 .60 84,582 6.1 1.68

Total $1,503,794 100.0% .41% $1,375,372 100.0% .67%

(1) Middle market consists primarily of loan and lease financing of construction and manufacturing equipment and speciality vehicles.

(2) Small ticket includes loan and lease financings to small- and mid-size companies through programs with vendors, manufacturers, distributors, buying groups, and franchise

organizations. Transaction sizes generally range from $25 thousand to $250 thousand.

(3) Winthrop’s portfolio consists primarily of technology and data processing equipment.

(4) Wholesale includes the discounting of lease receivables sourced by third-party lessors.

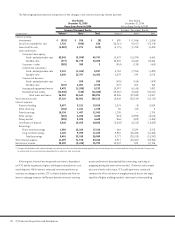

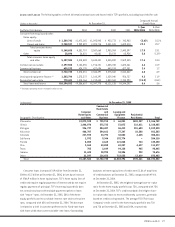

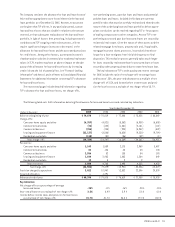

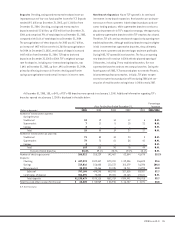

At December 31,

(Dollars in thousands) 2005 2004

Percent Percent

Equipment Type Balance of Total Balance of Total

Manufacturing $ 277,895 18.5% $ 251,157 18.2%

Specialty vehicles 257,497 17.1 236,582 17.2

Construction 236,939 15.8 182,612 13.3

Technology and data processing 222,623 14.8 229,160 16.7

Medical 199,729 13.3 157,745 11.5

Furniture and fixtures 60,278 4.0 51,192 3.7

Printing 58,600 3.9 45,394 3.3

Trucks and trailers 56,824 3.8 74,870 5.4

Material handling 39,814 2.6 33,810 2.5

Other 93,595 6.2 112,850 8.2

Total $1,503,794 100.0% $1,375,372 100.0%

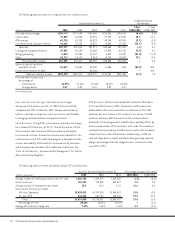

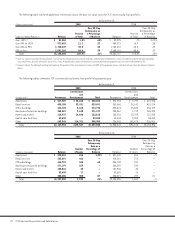

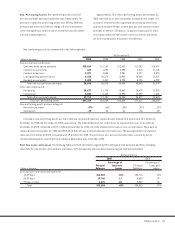

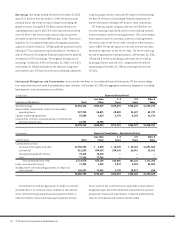

Commercial real estate loans increased $143.1 million

from December 31, 2004 to $2.3 billion at December 31, 2005.

Commercial business loans increased $11.1 million in 2005 to

$435.2 million at December 31, 2005. TCF continues to expand its

commercial business and commercial real estate lending activity

generally to borrowers located in its primary markets. With a

focus on secured lending, at December 31, 2005, approximately

99% of TCF’s commercial real estate and commercial business

loans were secured either by properties or underlying business

assets. At December 31, 2005 and 2004, the construction and

development portfolio had no loans over 30-days delinquent.

At December 31, 2005, approximately 93% of TCF’s commercial

real estate loans outstanding were secured by properties located

in its primary markets.