TCF Bank 2005 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2005 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

372005 Form 10-K

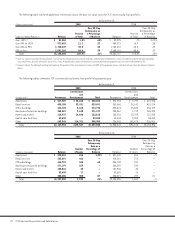

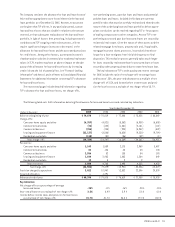

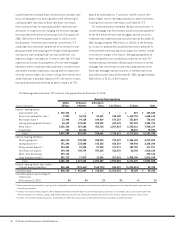

Campus marketing agreements consist of fixed or minimum

obligations for exclusive marketing and naming rights with 11

campuses. TCF is obligated to make various annual payments

for these rights in the form of royalties and scholarships through

2023. TCF also has various renewal options which may extend

the terms of these agreements. On April 21, 2005, TCF’s Board

of Directors and the University of Minnesota Board of Regents

ratified contracts for TCF’s sponsorship of a new on-campus

football stadium to be called “TCF Bank Stadium” and an

extension of TCF’s sponsorship of the U Card. The U Card serves

as a key for access to a variety of university services. TCF also

sponsors similar cards for other campuses. These obligations

are included in the table above. The naming rights agreement with

the University of Minnesota is dependent upon several contingen-

cies, including receipt of necessary state and private funding

and completion of stadium construction. On December 22, 2005,

TCF and the University of Minnesota announced an extension of

the funding contingency period under the stadium naming rights

agreement to June 30, 2006. The extension was necessary because

the Minnesota Legislature has not taken action on a bill to finance

the state’s portion of the stadium’s cost. Campus marketing agree-

ments are an important element of TCF’s campus banking strategy.

See Note 19 of Notes to Consolidated Financial Statements for

information on loans serviced with recourse and standby letters

of credit and guarantees.

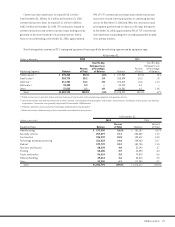

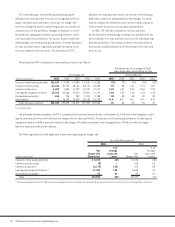

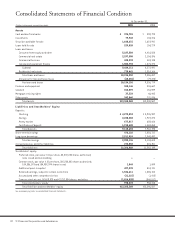

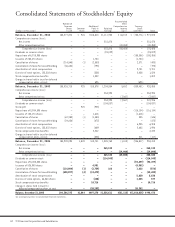

Stockholders’ Equity Stockholders’ equity at December 31, 2005

was $998.5 million, or 7.5% of total assets, up from $958.4 million,

or 7.8% of total assets, at December 31, 2004. The increase in

stockholders’ equity was primarily due to net income of $265.1

million, partially offset by the repurchase of 3.5 million shares

of TCF’s common stock at a cost of $93.5 million, the payment of

$114.5 million in dividends on common stock and a $19.8 million

decrease in accumulated comprehensive income for the year

ended December 31, 2005. On May 21, 2005, TCF’s Board of

Directors authorized the repurchase of up to an additional 5% of

TCF’s common stock, or 6.7 million shares. At December 31, 2005,

TCF had 6.7 million shares remaining in its stock repurchase

programs authorized by its Board of Directors. For the year ended

December 31, 2005, average total equity to average assets was

7.43%, compared with 7.94% for the year ended December 31, 2004.

Dividends paid to common shareholders on a per share basis totaled

85 cents in 2005, an increase of 13.3% from 75 cents in 2004. TCF’s

dividend payout ratio was 42.5% in 2005 and 40.3% in 2004. The

Company’s primary funding sources for common dividends are

dividends received from its subsidiary bank. At December 31, 2005,

TCF Financial and TCF Bank exceeded their regulatory capital

requirements and are considered “well-capitalized” under guide-

lines established by the Federal Reserve Board and the Office of

the Comptroller of the Currency. See Notes 14 and 15 of Notes to

Consolidated Financial Statements. TCF has used stock options as

a form of employee compensation to a limited extent in prior years.

At December 31, 2005, the number of incentive stock options out-

standing was 259,800, or .19%, of total shares outstanding.

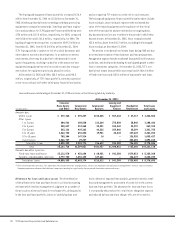

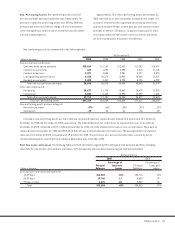

Summary of Critical Accounting Estimates Critical

accounting estimates occur in certain accounting policies and

procedures and are particularly susceptible to significant change.

Policies that contain critical accounting estimates include the

determination of the allowance for loan and lease losses, mortgage

servicing rights, income taxes, lease financings and pension liability

and expenses. See Note 1 of Notes to Consolidated Financial

Statements for further discussion of critical accounting estimates.

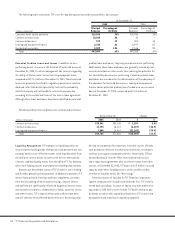

Recent Accounting Developments In May 2005, the Financial

Accounting Standards Board issued Statement of Financial

Accounting Standard (“SFAS”) No. 154, Accounting Changes and

Error Corrections. This Statement replaces APB Opinion No. 20,

Accounting Changes, and FASB Statement No. 3, Reporting

Accounting Changes in Interim Financial Statements. SFAS 154

carries forward the guidance contained in Opinion 20 for reporting

the correction of an error in previously issued financial statements

and a change in accounting estimate. However, SFAS 154 changes

the requirements for the accounting and reporting of a change

in accounting principle. Under this Statement, every voluntary

change in accounting principle requires retrospective application

to prior periods’ financial statements, unless it is impracticable.

It also applies to changes required by an accounting pronounce-

ment in the unusual instance that the pronouncement does not

include specific transition provisions. When a pronouncement

includes specific transition provisions, those provisions should

be followed. This Statement is effective for accounting changes

and corrections of errors made in fiscal years beginning after

December 15, 2005, although earlier application is permitted for

changes and corrections made in fiscal years beginning after June 1,

2005. TCF expects no significant effect on TCF financial statements

as a result of the adoption of this statement.

In December 2004, the Financial Accounting Standards Board

issued Statement of Financial Accounting Standard No. 123R,

Share-Based Payment which revised SFAS No. 123, Accounting

for Stock-Based Compensation. This Statement supersedes APB

Opinion No. 25, Accounting for Stock Issued to Employees, and

related implementation guidance and amends SFAS No. 95,