TCF Bank 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

272005 Form 10-K

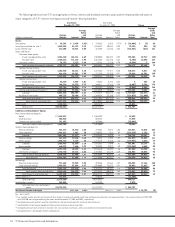

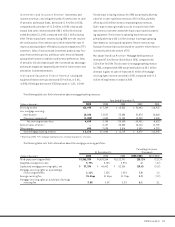

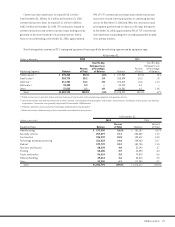

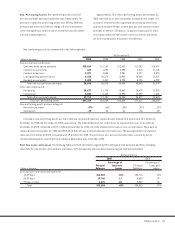

Loans and Leases The following tables set forth information about loans and leases held in TCF’s portfolio, excluding loans held for sale:

Compound Annual

(Dollars in thousands) At December 31, Growth Rate

1-Year 5-Year

Portfolio Distribution: 2005 2004 2003 2002 2001 2005/2004 2005/2000

Consumer home equity and other:

Home equity:

Lines of credit $ 1,389,741 $1,472,165 $1,093,945 $ 923,773 $ 743,983 (5.6)% 15.2%

Closed-end loans 3,758,947 2,909,592 2,493,715 2,031,531 1,699,414 29.2 20.7

Total consumer home

equity 5,148,688 4,381,757 3,587,660 2,955,304 2,443,397 17.5 19.1

Other 38,896 36,831 42,681 50,578 65,936 5.6 (13.9)

Total consumer home equity

and other 5,187,584 4,418,588 3,630,341 3,005,882 2,509,333 17.4 18.4

Commercial real estate 2,297,500 2,154,396 1,916,701 1,835,788 1,622,461 6.6 10.9

Commercial business 435,233 424,135 427,696 440,074 422,381 2.6 1.2

Total commercial 2,732,733 2,578,531 2,344,397 2,275,862 2,044,842 6.0 8.9

Leasing and equipment finance (1) 1,503,794 1,375,372 1,160,397 1,039,040 956,737 9.3 11.9

Residential real estate 770,441 1,014,166 1,212,643 1,800,344 2,733,290 (24.0) (26.8)

Total loans and leases $10,194,552 $9,386,657 $8,347,778 $8,121,128 $8,244,202 8.6 3.6

(1) Excludes operating leases included in other assets.

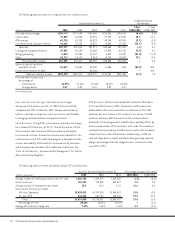

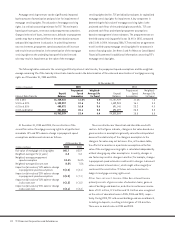

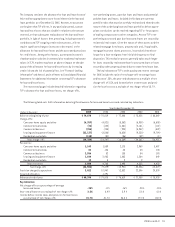

Consumer loans increased $769 million from December 31,

2004 to $5.2 billion at December 31, 2005, driven by an increase

of $766.9 million in home equity loans. TCF’s home equity lines of

credit only require regular payments of interest and do not require

regular payments of principal. TCF’s home equity portfolio does

not contain any loans with multiple payment options or loans

with “teaser” rates. At December 31, 2005, 38% of the home

equity portfolio carries a variable interest rate tied to the prime

rate, compared with 62% at December 31, 2004. This decrease

is related to a shift in customer preferences for fixed-rate loans

with lower yields than current variable-rate loans. Outstanding

balances on home equity lines of credit were 51.8% of total lines

of credit balances at December 31, 2005, compared with 49.6%

at December 31, 2004.

At December 31, 2005, the weighted-average loan-to-value

ratio for the home equity portfolio was 73%, compared with 75%

at December 31, 2004. TCF’s credit standards limit higher loan-

to-value ratio loans to more creditworthy customers, generally

based on credit scoring models. The average FICO (Fair Isaac

Company) credit score for the home equity portfolio was 720

and 716 at December 31, 2005 and 2004, respectively.

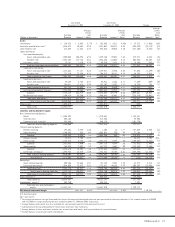

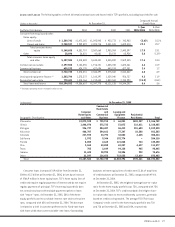

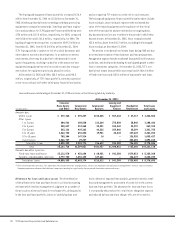

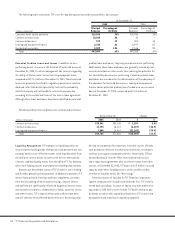

(In thousands) At December 31, 2005

Commercial

Real Estate

Consumer and Leasing and

Home Equity Commercial Equipment Residential

Geographic Distribution: and Other Business Finance Real Estate Total

Minnesota $2,072,538 $ 725,913 $ 66,051 $402,257 $ 3,266,759

Illinois 1,446,076 572,725 51,073 118,611 2,188,485

Michigan 926,737 804,487 86,413 201,683 2,019,320

Wisconsin 466,707 394,661 37,347 22,588 921,303

Colorado 227,925 33,792 34,082 4,625 300,424

California 1,992 9,344 192,774 – 204,110

Florida 8,003 2,665 121,848 734 133,250

Ohio 3,863 40,850 62,237 4,427 111,377

Texas 703 2,649 94,128 965 98,445

Indiana 11,443 28,995 34,306 932 75,676

Other 21,597 116,652 723,535 13,619 875,403

Total $5,187,584 $2,732,733 $1,503,794 $770,441 $10,194,552