TCF Bank 2005 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2005 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

552005 Form 10-K

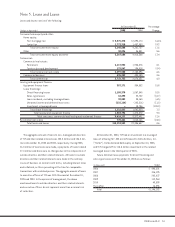

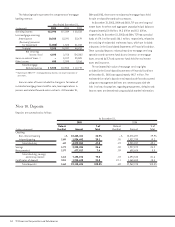

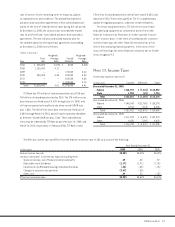

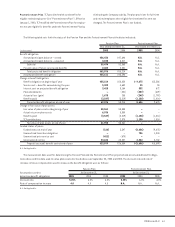

Certificates of deposit had the following remaining maturities at December 31, 2005:

(In thousands) $100,000

Maturity Minimum Other Total

0-3 months $177,658 $ 320,190 $ 497,848

4-6 months 116,097 320,759 436,856

7-12 months 102,933 494,703 597,636

13-24 months 47,910 237,201 285,111

25-36 months 5,721 35,745 41,466

37-48 months 8,214 27,520 35,734

49-60 months 3,096 12,730 15,826

Over 60 months 902 4,241 5,143

Total $462,531 $1,453,089 $1,915,620

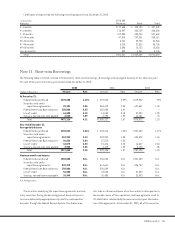

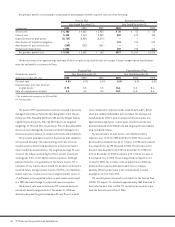

Note 11. Short-term Borrowings

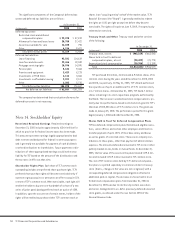

The following table sets forth selected information for short-term borrowings (borrowings with an original maturity of less than one year)

for each of the years in the three year period ended December 31, 2005:

2005 2004 2003

(Dollars in thousands) Amount Rate Amount Rate Amount Rate

At December 31,

Federal funds purchased $270,000 4.30% $ 219,000 2.29% $219,000 .95%

Securities sold under

repurchase agreements 29,101 3.86 568,319 2.38 607,631 1.30

Federal Home Loan Bank advances 150,000 4.03 250,000 2.41 – –

Line of credit 16,500 5.15 14,000 3.18 37,000 1.95

Treasury, tax and loan note payable 6,525 3.89 4,792 1.92 14,781 .73

Total $472,126 4.21 $1,056,111 2.37 $878,412 1.23

Year ended December 31,

Average daily balance

Federal funds purchased $308,062 3.46% $ 203,216 1.45% $231,060 1.12%

Securities sold under

repurchase agreements 518,953 3.13 528,942 1.53 504,328 1.26

Federal Home Loan Bank advances 68,630 2.84 57,513 2.02 – –

Line of credit 18,075 4.52 15,316 2.78 16,637 2.63

Treasury, tax and loan note payable 3,945 3.06 4,119 1.02 5,103 .86

Total $917,665 3.25 $ 809,106 1.57 $757,128 1.25

Maximum month-end balance

Federal funds purchased $583,000 N.A. $ 336,000 N.A. $321,000 N.A.

Securities sold under

repurchase agreements 828,378 N.A. 614,641 N.A. 896,752 N.A.

Federal Home Loan Bank advances 350,000 N.A. 300,000 N.A. – N.A.

Line of credit 56,000 N.A. 43,000 N.A. 47,000 N.A.

Treasury, tax and loan note payable 10,949 N.A. 30,438 N.A. 31,903 N.A.

N.A. Not Applicable.

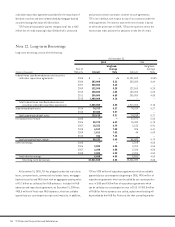

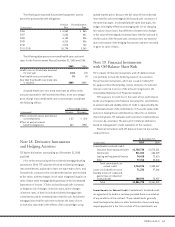

The securities underlying the repurchase agreements are book

entry securities. During the borrowing period, book entry securi-

ties were delivered by appropriate entry into the counterparties’

accounts through the Federal Reserve System. The dealers may

sell, loan or otherwise dispose of such securities to other parties in

the normal course of their operations, but have agreed to resell to

TCF identical or substantially the same securities upon the maturi-

ties of the agreements. At December 31, 2005, all of the securities