TCF Bank 2005 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2005 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32 TCF Financial Corporation and Subsidiaries

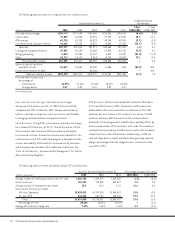

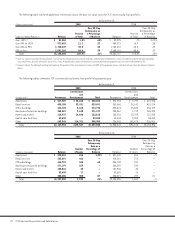

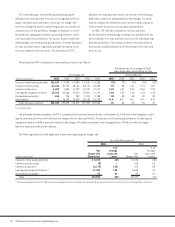

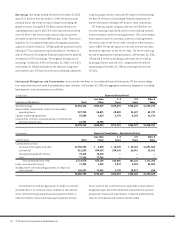

The allocation of TCF’s allowance for loan and lease losses is as follows:

Allocations as a Percentage of Total

Loans and Leases Outstanding by Type

At December 31, At December 31,

(Dollars in thousands) 2005 2004 2003 2002 2001 2005 2004 2003 2002 2001

Consumer home equity and other $16,643 $ 9,939 $ 9,084 $ 8,532 $ 8,355 .32% .22% .25% .28% .33%

Commercial real estate 21,222 20,742 25,142 22,176 24,459 .92 .96 1.31 1.21 1.51

Commercial business 6,602 7,696 11,797 15,910 12,117 1.52 1.81 2.76 3.62 2.87

Leasing and equipment finance 15,313 24,566 13,515 12,881 11,774 1.02 1.79 1.16 1.24 1.23

Residential real estate 616 796 942 1,370 2,184 .08 .08 .08 .08 .08

Unallocated – 16,139 16,139 16,139 16,139 N.A. N.A. N.A. N.A. N.A.

Total allowance balance $60,396 $79,878 $76,619 $77,008 $75,028 .59 .85 .92 .95 .91

N.A. Not Applicable.

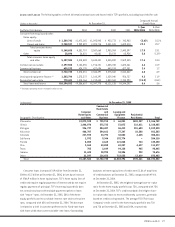

The allocated allowance balances for TCF’s residential and consumer loan portfolios, at December 31, 2005 reflect the Company’s credit

quality and related low level of historical net charge-offs for these portfolios. The decrease in the allocated allowance for leasing and

equipment finance in 2005 is primarily related to the charge-off of the investment in the leveraged lease. TCF has no other leveraged

leases or exposure to the airline industry.

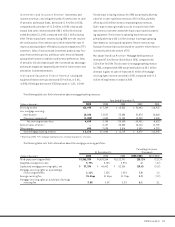

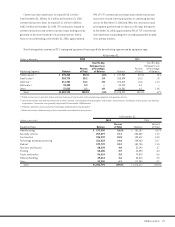

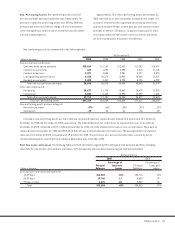

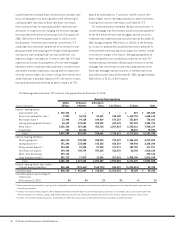

The following table sets forth additional information regarding net charge-offs:

Year Ended December 31,

2005 2004

% of % of

Net Average Average

Charge-offs Loans and Net Loans and

(Dollars in thousands) (Recoveries) Leases Charge-offs Leases

Consumer home equity and other $ 5,210 .11% $3,232 .08%

Commercial real estate (8) – 476 .02

Commercial business (2,173) (.51) 153 .04

Leasing and equipment finance (1) 21,384 1.50 5,545 .43

Residential real estate 91 .01 73 .01

Total $24,504 .25% $9,479 .11%

(1) For the year ended December 31, 2005, leasing and equipment finance net charge-offs excluding the leveraged lease were $2.6 million, or .18% of average loans and leases.

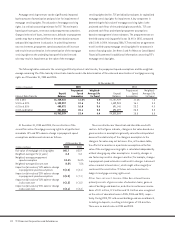

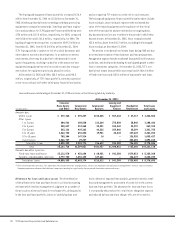

TCF’s methodologies for determining and allocating the

allowance for loan and lease losses focus on ongoing reviews of

larger individual loans and leases, historical net charge-offs,

the level of impaired and non-performing assets, the overall risk

characteristics of the portfolios, changes in character or size of

the portfolios, geographic location, prevailing economic condi-

tions and other relevant factors. The various factors used in the

methodologies are reviewed on a periodic basis. The total allowance

for loan and lease losses is generally available to absorb losses

from any segment of the portfolio. The allocation of TCF’s

allowance for loan and lease losses is disclosed in the following

table and is subject to change based on the changes in criteria

used to evaluate the allowance and is not necessarily indicative

of the trend of future losses in any particular portfolio.

In 2005, TCF refined its allowance for loan and lease

losses allocation methodology resulting in an allocation of the

entire allowance for loan and lease losses to the individual loan

and lease portfolios. This change resulted in the allocation of

the previous unallocated portion of the allowance for loan and

lease losses.