TCF Bank 2005 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2005 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52005 Annual Report

demographics. We are excited about

this expansion opportunity.

We believe TCF’s de novo strategy is a

better use of capital than paying high

premiums for bank acquisitions. While

we always review acquisition opportuni-

ties, we intend to stick to this disciplined

approach in 2006.

Strategy

Our formula for success over the coming

years remains the same:

1. It’s all about convenience for our cus-

tomers. We are “Open 7 Days” and longer

hours in our branches. We have a large

and growing number of branch locations

and ATMs conveniently located for our

many customers. This is still a major

competitive advantage for TCF.

2. We will continue to grow through de

novo expansion of branches, products

and lines of business.

3. A large portion of our profits will be

earned through the liability side of the

balance sheet (deposits). We will

continue to focus on growing both

accounts and deposits in the future.

4. We will emphasize growing Power

Assets and Power Liabilities. This simple

strategy has produced Power Profits

and made TCF an industry leader.

5. We will continue to repurchase TCF stock;

however, repurchases may slow in future

years due to our balance sheet growth.

6. We will continue to focus on the devel-

opment of management and employee

talent. People make the difference.

In order to continue our success, we must

move faster, innovate and customize our

products, and give great service to our

customers. All of these things are easy

to say, hard to do. Execution is the key

to success.

Risks

Major issues to focus on in 2006 are a

flat or inverted yield curve, our continu-

ing de novo expansion, and checking

account dynamics, including fee income.

A particular concern for TCF is the intense

competition for checking accounts. Almost

all banks have now copied our Totally

Free Checking product. This impact was

felt in 2005 with a slowing growth in

checking accounts. We must find new

and better ways to beat the competition

in this area. Furthermore, checking

account behavior is changing. How people

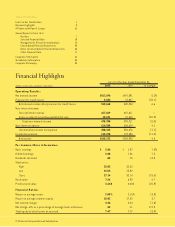

Net Income

millions of dollars

0504030201

$207

$233

$216

$255

$265

Net Interest Income

millions of dollars

0504030201

$481

$499

$481

$492

$518