TCF Bank 2005 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2005 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92005 Form 10-K

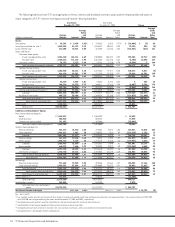

mainly from the structure of the balance sheet. The primary

goal of interest-rate risk management is to control exposure

to interest-rate risk within acceptable tolerances established

by ALCO and the Board of Directors.

The major sources of the Company’s interest-rate risk are

timing differences in the maturity and repricing characteristics

of assets and liabilities, changes in relationships between rate

indices (basis risk) and changes in the shape of the yield curve.

Management measures these risks and their impact in various

ways, including use of simulation analysis and valuation analysis.

Simulation analysis is used to model net interest income from

asset and liability positions over a specified time period (gener-

ally one year), and the sensitivity of net interest income, under

various interest rate scenarios. The interest rate scenarios may

include gradual or rapid changes in interest rates, rate shocks,

spread narrowing and widening, yield curve twists, and changes

in assumptions about customer behavior in various interest

rate scenarios. The simulation analysis is based on various key

assumptions which relate to the behavior of interest rates and

spreads, changes in product balances, the repricing characteris-

tics of products, and the behavior of loan and deposit customers

in different rate environments. The simulation analysis does

not necessarily take into account actions management may

undertake in response to anticipated changes in interest rates.

In addition to the valuation analysis, management utilizes an

interest rate gap measure (difference between interest-earning

assets and interest-bearing liabilities repricing within a given

period). While the interest rate gap measurement has some

limitations, including no assumptions regarding future asset or

liability production and a static interest rate assumption (large

changes may occur related to those items), the interest rate gap

represents the net asset or liability sensitivity at a point in time.

An interest rate gap measure could be significantly affected by

external factors such as loan prepayments, early withdrawals of

deposits, changes in the correlation of various interest-bearing

instruments, competition or a rise or decline in interest rates.

See “Item 7A. Quantitative and Qualitative Disclosures About

Market Risk” for further information about TCF’s interest-rate

risk, gap analysis and simulation analysis.

Management also uses valuation analysis to measure risk in

the balance sheet that might not be taken into account in the net

interest income simulation analysis. Whereas net interest income

simulation highlights exposure over a relatively short time period

(12 months), valuation analysis incorporates all cash flows over

the estimated remaining life of all balance sheet positions. The

valuation of the balance sheet, at a point in time, is defined as the

discounted present value of asset cash flows minus the discounted

value of liability cash flows. Valuation analysis addresses only

the current balance sheet and does not incorporate the growth

assumptions that are used in the net interest income simulation

model. As with the net interest income simulation model, valuation

analysis is based on key assumptions about the timing and variabil-

ity of balance sheet cash flows. It also does not necessarily take

into account actions management may undertake in response to

anticipated changes in interest rates.

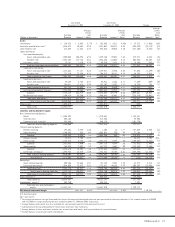

ALCO meets regularly and is responsible for reviewing the

Company’s interest rate sensitivity position and establishing

policies to monitor and limit exposure to interest-rate risk.

Liquidity Risk Liquidity risk is defined as the risk to earnings or

capital arising from the Company’s inability to meet its obligations

when they come due without incurring unacceptable losses. The

primary goal of liquidity risk management is to ensure that the

Company’s entire funding needs are met promptly, in a cost-

efficient and reliable manner.

ALCO and the Board of Directors have adopted a Liquidity

Management Policy to direct management of the Company’s liq-

uidity risk. Under the Liquidity Management Policy, the Treasurer

reviews current and forecasted funding needs for the Company

on a daily basis, and periodically reviews market conditions for

issuing debt securities to wholesale investors. Key liquidity ratios

and the amount available from alternative funding sources are

reported to ALCO on a monthly basis.

The Treasurer maintains diverse and reliable sources of fund-

ing. This includes federal funds lines totaling at least $500 million,

repurchase agreement lines totaling at least 150% of the amount

of the Company’s financeable collateral (defined as any piece or

pool of collateral that is greater than $5 million in current par),

access to Federal Home Loan Bank (“FHLB”) advances and the

Federal Reserve Bank discount window, “treasury, tax and loan

notes,” commercial repurchase sweeps, and wholesale deposits.

The Treasurer ensures that liability maturities are staggered to

limit forecasted daily funding needs. The daily funding guideline is

$500 million, which may be met with a mix of approved borrowing

types. Cash flow variances may cause minor day-to-day excesses

over this guideline. A contingency funding plan is in place should

certain liquidity triggers occur.

Other Market Risks Other sources of market risk include

the Company’s investment in mortgage servicing rights and FHLB

stock. Mortgage servicing rights are the discounted present value

of future net cash flows that are expected to be received from the

mortgage servicing portfolio. The value of the mortgage servicing

rights asset is dependent on the assumed prepayment speed of

the mortgage servicing portfolio. Future expected net cash flows

from servicing a loan in the mortgage serving portfolio would