TCF Bank 2005 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2005 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 TCF Financial Corporation and Subsidiaries

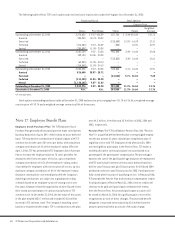

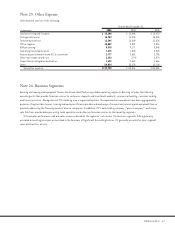

Note 17. Employee Benefit Plans

Employee Stock Purchase Plan The TCF Employees Stock

Purchase Plan generally allows participants to make contributions

by salary deduction of up to 50% of their salary on a tax-deferred

basis. TCF matches the contributions of all participants with TCF

common stock at the rate of 50 cents per dollar, with a maximum

company contribution of 3% of the employee’s salary. Effective

April 1, 2006, TCF has amended the TCF Employees Stock Purchase

Plan to increase the employer match to 75 cents per dollar for

employees with five to ten years of service, up to a maximum

company contribution of 4.5% of the employee’s salary, and to

$1 per dollar for employees with over ten years of service, up to a

maximum company contribution of 6% of the employee’s salary.

Employee contributions vest immediately while the Company’s

matching contributions are subject to a graduated vesting

schedule based on an employee’s years of vesting service over

five years. Employees have the opportunity to diversify and invest

their vested account balance in various mutual funds or TCF

common stock. At December 31, 2005, the fair value of the assets

in the plan totaled $230.7 million and included $218.8 million

invested in TCF common stock. The Company’s matching contri-

butions are expensed when made. TCF’s contributions to the plan

were $4.3 million, $4 million and $3.9 million in 2005, 2004 and

2003, respectively.

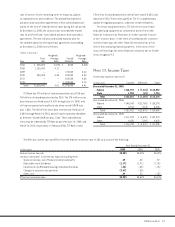

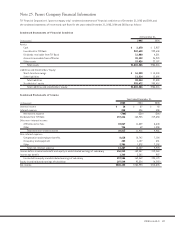

Pension Plan The TCF Cash Balance Pension Plan (the “Pension

Plan”) is a qualified defined benefit plan covering eligible employ-

ees who are at least 21 years old and have completed a year of

eligibility service with TCF. Employees hired after June 30, 2004

are not eligible to participate in the Pension Plan. TCF makes a

monthly allocation to the participant’s account based on a

percentage of the participant’s compensation. The percentage is

based on the sum of the participant’s age and years of employment

with TCF and includes interest on the account balance based on

the five-year Treasury rate plus 25 basis points for 2005 and 2004

and based on the ten-year Treasury rate for 2003. Participants are

fully vested after five years of qualifying service. In February 2006,

TCF amended the Pension Plan to discontinue compensation credits

for all participants effective March 31, 2006. Interest credits will

continue to be paid until participants withdraw their money

from the Pension Plan. All unvested participant accounts will

be vested on March 31, 2006. No significant gain or loss will be

recognized as a result of these changes. The projected benefit

obligation is expected to be reduced by $2.8 million from the

amounts presented below as a result of this plan change.

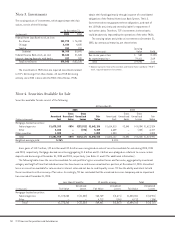

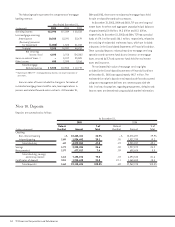

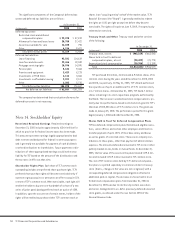

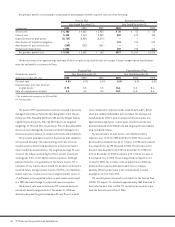

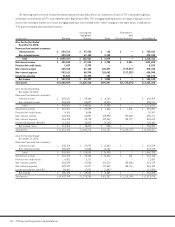

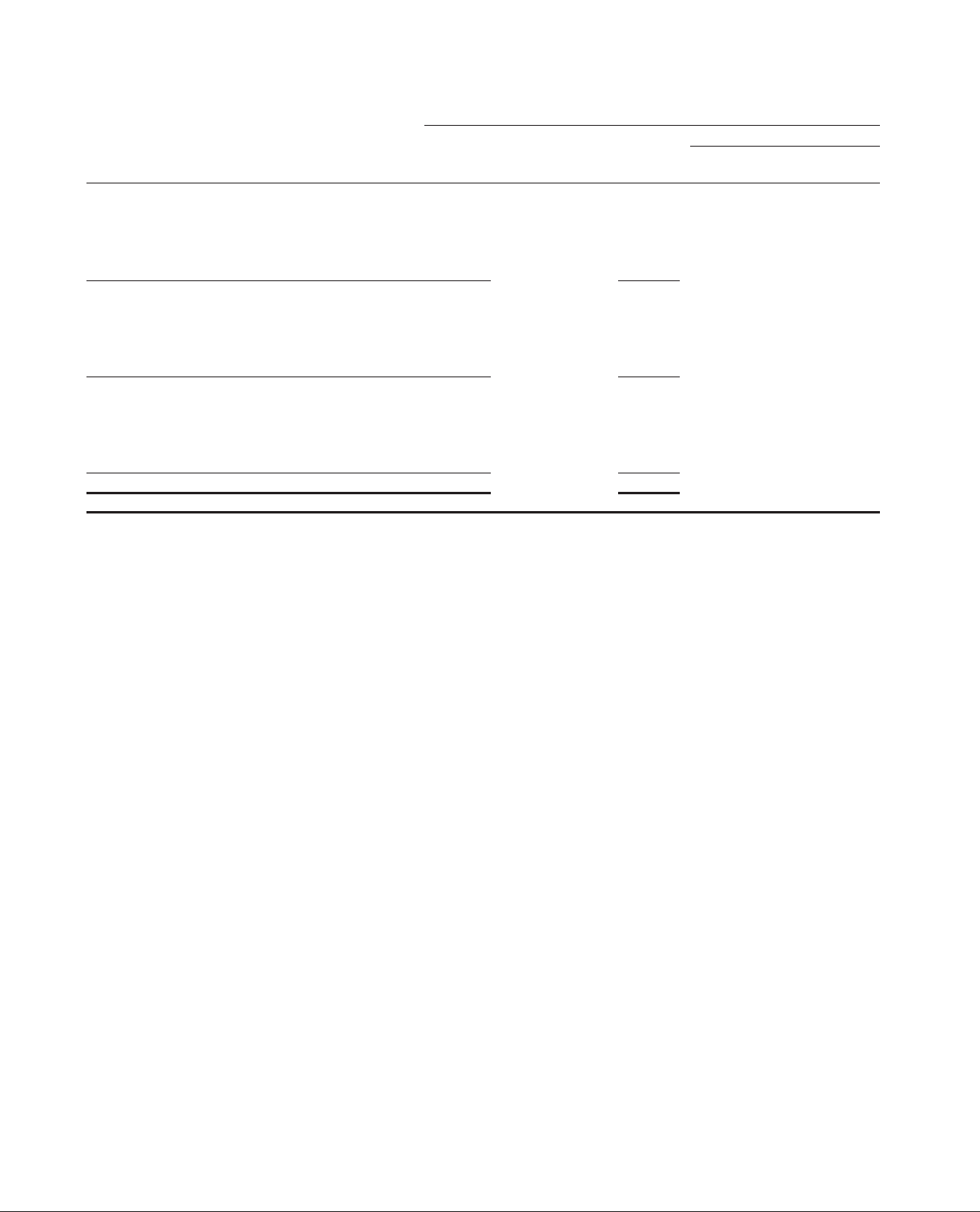

The following table reflects TCF’s stock option and restricted stock transactions under the Program since December 31, 2002:

Restricted Stock Stock Options

Exercise Price

Weighted-

Shares Price Range Shares Range Average

Outstanding at December 31, 2002 3,270,632 $ 9.87-$26.39 607,754 $ 3.44-$16.64 $12.72

Granted 255,900 18.73- 25.32 – – –

Exercised – – (125,558) 10.91- 16.09 12.11

Forfeited (214,480) 9.87- 26.39 (500) 10.91 10.91

Vested (250,898) 11.05- 20.38 – – –

Outstanding at December 31, 2003 3,061,154 9.87- 20.38 481,696 3.44- 16.64 12.88

Granted 149,120 24.33- 30.28 – – –

Exercised – – (155,832) 3.44- 16.64 12.81

Forfeited (62,980) 11.05- 30.13 – – –

Vested (115,068) 11.05- 24.10 – – –

Outstanding at December 31, 2004 3,032,226 9.87- 30.28 325,864 5.71- 16.64 12.91

Granted 526,400 25.97- 28.71 – – –

Exercised – – (66,064) 5.71- 16.64 9.60

Forfeited (111,185) 11.05- 30.28 – – –

Vested (1,138,165) 9.87- 21.85 – – –

Outstanding at December 31, 2005 2,309,276 9.87- 30.28 259,800 11.78- 16.64 13.76

Exercisable at December 31, 2005 N.A. N.A. 259,800 11.78- 16.64 13.76

N.A. Not Applicable.

Stock options outstanding and exercisable at December 31, 2005 had exercise prices ranging from $11.78 to $16.64, a weighted-average

exercise price of $13.76 and a weighted-average contractual life of three years.