TCF Bank 2005 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2005 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

472005 Form 10-K

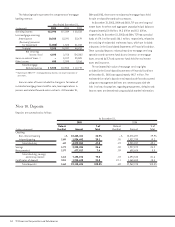

TCF periodically evaluates its capitalized mortgage servicing

rights for impairment. Loan type and note rate are the predomi-

nant risk characteristics of the underlying loans used to stratify

capitalized mortgage servicing rights for purposes of measuring

impairment. The fair value of mortgage servicing rights is

estimated by calculating the present value of estimated future

net servicing cash flows, taking into consideration actual and

expected mortgage loan prepayment rates, discount rates, serv-

icing costs, and other economic factors. The expected and actual

rate of mortgage loan prepayments are the most significant

factors driving the value of mortgage servicing rights.

Adjustments to the mortgage servicing rights valuation

allowance for other than permanent impairment are recorded in

mortgage banking revenues. Permanent impairment is recognized

as a reduction in the capitalized mortgage servicing rights and a

charge to the related valuation allowance.

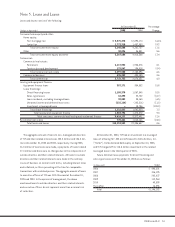

Lease Financing TCF provides various types of lease financing

that are classified for accounting purposes as either direct

financing, sales-type, leveraged or operating leases. Leases that

transfer substantially all of the benefits and risks of equipment

ownership to the lessee are classified as direct financing or sales-

type leases and are included in loans and leases. Direct financing

and sales-type leases are carried at the combined present value

of the future minimum lease payments and the lease residual value.

Investments in leveraged leases are the sum of all lease payments

(less non-recourse debt payments) plus estimated residual values,

less unearned income. The determination of the lease classifica-

tion requires various judgments and estimates by management

including the fair value of the equipment at lease inception, useful

life of the equipment under lease, and collectability of minimum

lease payments.

Sales-type leases generate dealer profit which is recognized at

lease inception by recording lease revenue net of the lease cost.

Lease revenue consists of the present value of the future minimum

lease payments discounted at the rate implicit in the lease. Lease

cost consists of the leased equipment’s book value, less the pres-

ent value of its residual. The revenues associated with other types

of leases are recognized over the term of the underlying leases.

Interest income on direct financing and sales-type leases is rec-

ognized using methods which approximate a level yield over the

fixed, non-cancelable term of the leases. TCF receives pro-rata

rent payments for the variable interim period until the lease

contract commences and the fixed, non-cancelable, lease term

begins. TCF recognizes these interim payments in the month they

are earned and records the income in interest income on direct

finance leases. Income from leveraged leases is recognized using

a method which approximates a level yield over the term of the

leases based on the unrecovered equity investment. Management

has policies and procedures in place for the determination of lease

classification and review of the related judgments and estimates

for all lease financings.

Additionally, some lease financings include a residual value

component, which represents the estimated fair value of the

leased equipment at the expiration of the initial term of the

transaction. The estimation of residual values involves judgments

regarding product and technology changes, customer behavior,

shifts in supply and demand and other economic assumptions.

These estimates are reviewed at least annually and downward

adjustments, if necessary, are charged to non-interest expense

in the periods in which they become known.

Leases which do not transfer substantially all benefits and

risks of ownership are classified as operating leases. Operating

leases represent a rental agreement where ownership of the

underlying equipment resides with the lessor. Such leased

equipment and related initial direct costs are included in other

assets on the balance sheet and is depreciated on a straight-line

basis over the term of the lease to estimated salvage value.

Depreciation expense is recorded as operating lease expense

in other non-interest expense. Operating lease rental income is

recognized when it is due according to the provisions of the lease

and is recorded as a component of non-interest income. No

reserves for lease losses are carried on operating leases.

Pension Plan As summarized in Note 17, TCF provides pension

benefits to eligible employees in the TCF Cash Balance Pension

Plan. In accordance with Statement of Financial Accounting

Standard (“SFAS”) No. 87 “Employers’ Accounting for Pensions,”

the Company does not consolidate the assets and liabilities

associated with the pension plan.

The measurement of the projected benefit obligation, pre-

paid pension asset and annual pension expense involves complex

actuarial valuation methods and the use of actuarial and economic

assumptions. Due to the long-term nature of the pension plan

obligation, actual results may differ significantly from the

actuarial-based estimates. Differences between estimates and

actual experience are required to be deferred and under certain

circumstances amortized over the future expected working life-

time of plan participants. As a result, these differences are not

recognized when they occur. TCF closely monitors all assumptions

and updates them annually.

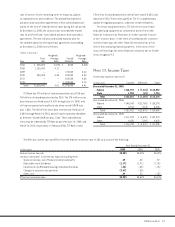

Income Taxes Income taxes are accounted for using the asset

and liability method. Under this method, deferred tax assets and

liabilities are recognized for the future tax consequences attrib-

utable to differences between the financial statement carrying

amounts of existing assets and liabilities and their respective

tax bases. Deferred tax assets and liabilities are measured using

enacted tax rates expected to apply to taxable income in the years