TCF Bank 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 TCF Financial Corporation and Subsidiaries

$3.8 million in 2004 as a result of increased customer transaction

activity. See Note 1 of Notes to Consolidated Financial Statements

for additional information concerning deposit account losses.

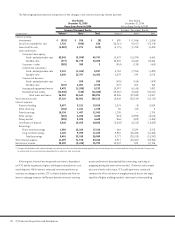

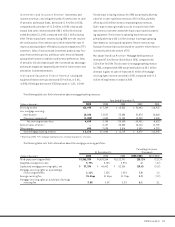

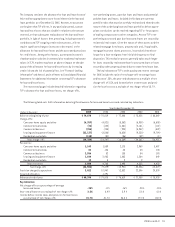

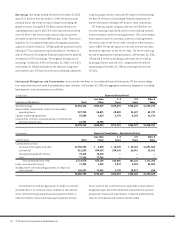

Other Non-Interest Expense Other non-interest expense

increased $14.4 million, or 12.1%, in 2005, primarily due to

increases in card processing and issuance expenses related to the

overall increase in card volumes and increases in net real estate

expense as a result of net recoveries on sales of foreclosed

properties in 2004. In 2004, non-interest expense decreased

$5 million, or 4%, primarily attributable to net real estate

expense, which decreased $3.1 million, driven by $3.4 million of

net recoveries on sales of foreclosed properties and a decrease

in mortgage banking expenses of $2 million due to the decline in

refinance activity and the previously discussed restructuring of

the mortgage banking business. In 2003, other non-interest

expense increased $3.8 million, or 3.1%, primarily due to higher

levels of mortgage banking production and prepayment activity.

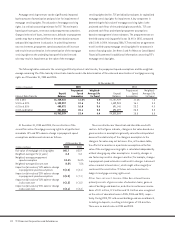

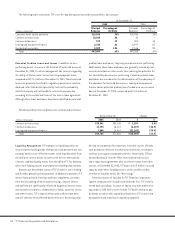

Income Taxes Income tax expense represented 30.30% of income

before income tax expense during 2005, compared with 33.68%

and 34.14% in 2004 and 2003, respectively. The lower effective

income tax rate in 2005 was primarily due to the closing of certain

previous years’ tax returns, clarification of existing state tax

legislation and developments in income tax audits. The lower

effective tax rate in 2004 compared with 2003 primarily reflects

increases in investments in tax-advantaged affordable housing

limited partnerships and lower state income taxes.

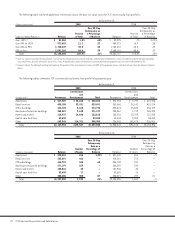

TCF has a Real Estate Investment Trust (“REIT”) and a related

foreign operating company (“FOC”) that acquire, hold and man-

age real estate loans and other assets. These companies are

consolidated with TCF Bank and are therefore included in the

consolidated financial statements of TCF Financial Corporation.

The REIT and related companies must meet specific provisions of

the Internal Revenue Code and state tax laws. If these companies

fail to meet any of the required provisions of federal and state

tax laws, TCF’s tax expense could increase. TCF’s FOC operates

under laws in certain states (including Minnesota and Illinois)

that allow deductions for income derived from FOCs. Use of these

companies is and has been the subject of federal and state audits.

The determination of current and deferred income taxes is a

critical accounting estimate which is based on complex analyses

of many factors including interpretation of federal and state

income tax laws, the differences between the tax and financial

reporting bases of assets and liabilities (temporary differences),

estimates of amounts due or owed such as the timing of reversal

of temporary differences and current financial accounting stan-

dards. Additionally, there can be no assurances that estimates

and interpretations used in determining income tax liabilities

may not be challenged by federal and state taxing authorities.

Actual results could differ significantly from the estimates and

income tax law interpretations used in determining the current

and deferred income tax liabilities. In addition, under generally

accepted accounting principles, deferred income tax assets

and liabilities are recorded at the current prevailing federal and

state income tax rates. If such rates change, deferred income

tax assets and liabilities must be adjusted in the period of

change through a charge or credit to income tax expense.

Further detail on income taxes is provided in Note 13 of Notes

to Consolidated Financial Statements.

Consolidated Financial Condition Analysis

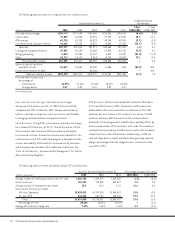

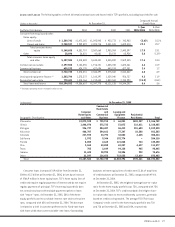

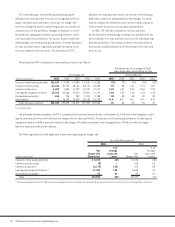

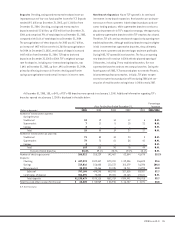

Securities Available for Sale Securities available for sale

increased $28.7 million to $1.6 billion at December 31, 2005. This

increase reflects purchases of $1.3 billion of mortgage-backed

securities, partially offset by sales of $1 billion of mortgage-backed

securities, in which the company recognized $10.7 million in gains,

and normal payment and prepayment activity. At December 31,

2005, the increase in mortgage-backed securities partially offsets

the declines in residential loans in the treasury services portfolio.

TCF’s securities available for sale portfolio included $1.6 billion

and $5.3 million of fixed-rate and adjustable-rate mortgage-

backed securities, respectively. Net unrealized losses on securities

available for sale totaled $33.2 million at December 31, 2005,

compared with net unrealized losses of $2.2 million at December

31, 2004. TCF may, from time to time, sell mortgage-backed

securities and utilize the proceeds to either reduce borrowings

or fund growth in loans and leases.