TCF Bank 2005 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2005 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lynn Nagorske, Chief Executive Officer

12005 Annual Report

Dear Stockholders:

While 2005 was a challenging year for TCF,

it was still a good year.

Summarizing the year:

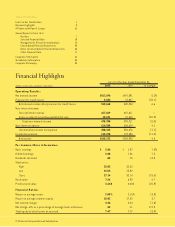

• TCF earned record net income of $265

million and record diluted earnings per

share (EPS) of $2.00, up 7.5 percent

from $1.86 in 2004.

• TCF’s return on average assets (ROA)

was 2.08 percent, return on average equity

(ROE) was 28.03 percent, and net interest

margin was 4.46 percent. Based on these

ratios, TCF remains one of the best per-

forming banks of the Top 50 Banks in the

United States.

• TCF’s stock price closed at $27.14 on

December 31, 2005, down 16 percent from

$32.14 per share on December 31, 2004.

This was a disappointing result.

• TCF recently increased its annual divi-

dend rate eight percent to $.92 per share.

This is the 15th consecutive year we have

increased the dividend. TCF’s 10-year

compounded annual dividend growth

rate ranks sixth of the Top 50 Banks in

the country.

Major factors affecting TCF’s performance

in 2005 were:

1. Interest Rates

While short-term interest rates rose

eight times in 2005, the 10-year Treasury

rate remained approximately the same,

resulting in a further flattening of the

yield curve in 2005.

In the early part of the year when long-

term Treasury rates dipped, we held back

Letter to Stockholders

Lynn A. Nagorske, Chief Executive Officer

arecord

year for TCF