Boeing 2006 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Boeing Company and Subsidiaries 77

Notes to Consolidated Financial Statements

unidentified contamination. Although not considered probable,

should we incur remediation charges at the high level of the

range of potential exposure, the additional charges would be

less than 2% of historical annual revenues.

As part of the 2004 purchase and sale agreement with

General Electric Capital Corporation related to the sale of BCC’s

Commercial Financial Services business, we are involved in a

loss sharing arrangement for losses that may exist at the end

of the initial financing terms of transferred portfolio assets, or,

in some instances, prior to the end of the financing term, such

as certain events of default and repossession. The maximum

exposure to loss associated with the loss sharing arrangement

is $218. As of December 31, 2006 and 2005, the accrued

liability under the loss sharing arrangement was $78 and $81.

Due to lack of demand for the 717 and 757 airplanes, we have

concluded production of these airplanes. The last 717 and 757

airplanes were delivered in the second quarter of 2006 and

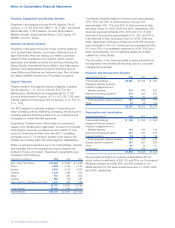

2005, respectively. The following table summarizes the termina-

tion liability remaining in Accounts payable and other liabilities.

December 31, Change in December 31,

Termination liability 2005 Payments Estimate Other* 2006

Supplier termination $239 $(190)$(4)$45

Production disruption

and shutdown

related 33

Pension/

postretirement

related 43 4 $(47)

Severance 19 (11) 1 9

Total $304 $(201)$«1 $(47)$57

*Represents transfer to prepaid pension expense.

The above liability was determined based on available information

and we make revisions to our estimates accordingly as new

information becomes available.

The Boeing-built NSS-8 satellite was declared a total loss due

to an anomaly during launch on January 30, 2007. The NSS-8

satellite was insured for $200. We believe the NSS-8 loss

was the result of an insured event and have so notified our

insurance carriers.

As of December 31, 2006, we have delivered 159 of the 190

C-17s ordered by the USAF, with final deliveries scheduled for

2009. Despite pending orders, which would extend deliveries

of the C-17 to mid-2009, it is reasonably possible that we will

decide in 2007 to suspend work on long-lead items from

suppliers and/or to complete production of the C-17 if further

orders are not received. We are still evaluating the full financial

impact of a production shutdown, including any recovery that

would be available from the government.

We have entered into standby letters of credit agreements

and surety bonds with financial institutions primarily relating

to the guarantee of future performance on certain contracts.

Contingent liabilities on outstanding letters of credit agreements

and surety bonds aggregated approximately $4,368 as of

December 31, 2006 and approximately $3,957 at

December 31, 2005.

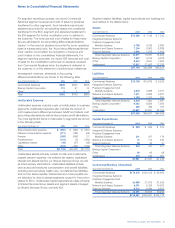

Note 24 – Segment Information

We operate in five principal segments: Commercial Airplanes;

Precision Engagement and Mobility Systems, Network and

Space Systems, and Support Systems, collectively IDS; and

BCC. All other activities fall within the Other segment, principally

made up of Engineering, Operations and Technology (formerly,

Boeing Technology), Connexion by BoeingSM and our Shared

Services Group. On August 17, 2006, we announced that we

would exit the Connexion by BoeingSM high speed broadband

communications business having completed a detailed business

and market analysis. (See Note 9). Our primary profitability

measurements to review a segment’s operating results are

earnings from operations and operating margins. See page 45

for Summary of Business Segment Data, which is an integral

part of this Note.

Our Commercial Airplanes operation principally involves

development, production and marketing of commercial jet

aircraft and providing related support services, principally to

the commercial airline industry worldwide.

Our IDS operations principally involve research, development,

production, modification and support of the following products

and related systems: military aircraft, both land-based and

aircraft-carrier-based, including fighter, transport and attack

aircraft with wide mission capability, and vertical/short takeoff

and landing capability; helicopters and missiles, space systems,

missile defense systems, satellites and satellite launching

vehicles, and information and battle management systems.

Although some IDS products are contracted in the commercial

environment, the primary customer is the U.S. Government.

In 2006, we realigned IDS into three capabilities-driven

businesses: Precision Engagement and Mobility Systems,

Network and Space Systems, and Support Systems. As part

of the realignment, certain advanced systems and research

and development activities previously included in the Other

segment transferred to the new IDS segments. Business

segment data for all periods presented has been adjusted to

reflect the new segments.