Boeing 2006 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

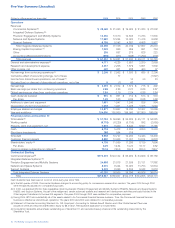

offset by increased earnings in the FCS program in 2006.

The increase from 2004 to 2005 was driven by the favorable

Rocketdyne and Delta IV impacts in 2005 mentioned above,

while losses were recorded in our commercial satellite business

in 2004 caused by performance issues due to cost growth from

technical and quality issues and write-offs of slow-moving

inventory. N&SS operating earnings include equity earnings of

$71 million, $72 million, and $70 million from the United Space

Alliance joint venture in 2006, 2005, and 2004, respectively.

Divestitures On February 28, 2005, we completed the stock

sale of EDD to L-3 Communications. On August 2, 2005 we

completed the sale of our Rocketdyne business to United

Technologies Corporation. (See Note 9).

Research and Development The N&SS research and develop-

ment funding remains focused on the development of communi-

cations and command and control capabilities that support a

network-centric architecture approach for our various govern-

ment customers. We are investing in the communications

market to enable connectivity between existing air/ground plat-

forms, increase communications availability and bandwidth

through more robust space systems, and leverage innovative

communications concepts. Key programs in this area include

JTRS, FCS, GPS, and Transformational Communications

System. Investments were also made to support concepts that

will lead to the development of next-generation space intelligence

systems. Along with increased funding to support these areas of

architecture and network-centric capabilities development, we

also maintained our investment levels in global missile defense

and advanced missile defense concepts and technologies.

Backlog N&SS total backlog decreased 7% from 2005 to 2006

driven by sales from a multi-year order received in prior years

on FCS. Total backlog decreased 6% from 2004 to 2005 driven

by sales from multi-year orders received in prior years on GMD

and FCS, partially offset by new orders on Proprietary programs.

Additional Considerations Items which could have a future

impact on N&SS operations include the following:

United Launch Alliance On December 1, 2006, we completed

the transaction with Lockheed Martin Corporation (Lockheed)

to create a 50/50 joint venture named United Launch Alliance

L.L.C. (ULA). ULA combines the production, engineering, test

and launch operations associated with U.S. Government

launches of Boeing Delta and Lockheed Atlas rockets. In con-

nection with the transaction, we contributed assets and liabili-

ties of $1,609 million and $695 million, respectively, to ULA.

These amounts are subject to adjustment pending final review

of the respective parties’ contributions. Any difference between

the book value of our investment and our proportionate share

of ULA’s net assets would be recognized ratably in future years.

We also entered into an inventory supply agreement with ULA

that provides for the purchase by ULA from us of Boeing Delta

inventories totaling $1,860 million by March 31, 2021. We and

Lockheed each will provide ULA with initial cash contributions

of up to $25 million, and we each have agreed to extend a line

of credit to ULA of up to $200 million to support its working

capital requirements. In connection with the transaction, we

and Lockheed transferred performance responsibility for certain

U.S. Government contracts to ULA as of the closing date. We

and Lockheed agreed to jointly guarantee the performance of

those contracts to the extent required by the U.S. Government.

We agreed to indemnify ULA through December 31, 2020

against potential non-recoverability of $1,375 million of Boeing

Delta inventories included in contributed assets plus $1,860 mil-

lion of inventory subject to the inventory supply agreement. In

addition, in the event ULA is unable to obtain re-pricing of cer-

tain contracts which we contributed to ULA and to which we

believe ULA is entitled, we will be responsible for any shortfall

and may record up to $322 million in pre-tax losses. ULA is

accounted for under the equity method of accounting. N&SS

2006 revenues include $727 million related to Delta rockets and

formation of ULA will reduce N&SS revenues in 2007. We do

not expect ULA to have a material impact to our earnings, cash

flows, or financial position for 2007.

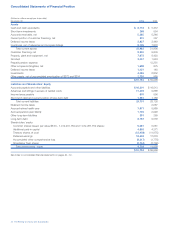

Sea Launch The Sea Launch venture, in which we are a 40%

partner, provides ocean-based launch services to commercial

satellite customers. For the year ended December 31, 2006,

the venture conducted five successful launches.

We have issued credit guarantees to creditors of the Sea Launch

venture to assist it in obtaining financing. In the event we are

required to perform on these guarantees, we believe we can

recover a portion of the cost (estimated at $486 million) through

guarantees from the other venture partners. The components

of this exposure are as follows:

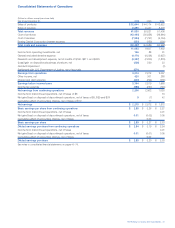

Estimated

Estimated Proceeds Estimated

Maximum Established from Net

(Dollars in millions) Exposure Reserves Recourse Exposure

Credit Guarantees $÷«471 $188 $283

Partner Loans

(Principal and Interest) 451 271 180

Advances to Provide

for Future Launches 76 $÷76

Trade Receivable

from Sea Launch 311 289 22

Performance Guarantees 33 20 13

Other Receivables

from Sea Launch 45 38 3 4

$1,387 $786 $486 $115

We made no additional capital contributions to the Sea Launch

venture during the year ended December 31, 2006.

We suspended recording equity losses after writing our invest-

ment in and direct loans to Sea Launch down to zero in 2001

and accruing our obligation for third-party guarantees on

Sea Launch indebtedness. We are not obligated to provide any

further financial support to the Sea Launch venture. However,

in the event that we do extend additional financial support to

Sea Launch in the future, we will recognize suspended losses

as appropriate.

A Sea Launch Zenit-3SL vehicle, carrying a Boeing-built satel-

lite, experienced an anomaly during launch on January 30, 2007.

The impact to Sea Launch operations, including the remaining

launches scheduled for 2007 is not yet known. Based on our

preliminary assessment, we do not believe that this anomaly

will have a material adverse impact on our results of operations,

financial position, or cash flows.

32 The Boeing Company and Subsidiaries

Management’s Discussion and Analysis