Boeing 2006 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58 The Boeing Company and Subsidiaries

Notes to Consolidated Financial Statements

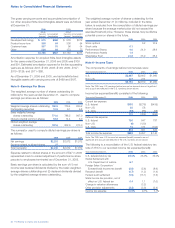

The components of investment in sales-type/finance leases at

December 31 were as follows:

2006 2005

Minimum lease payments receivable $«4,475 $«4,778

Estimated residual value of leased assets 701 690

Unearned income (2,262)(2,432)

$«2,914 $«3,036

Interest rates on fixed-rate notes ranged from 5.99% to

11.42%, and interest rates on variable-rate notes ranged from

7.40% to 11.43%.

Aircraft financing operating lease equipment primarily includes

jet and commuter aircraft. At December 31, 2006 and 2005,

aircraft financing operating lease equipment included $259 and

$11 of equipment available for re-lease. At December 31, 2006

and 2005, we had firm lease commitments for $253 and $6 of

this equipment.

When our Commercial Airplanes segment is unable to immedi-

ately sell used aircraft, it may place the aircraft under an operating

lease. It may also finance the sale of new aircraft with a note

receivable. The carrying amount of the Commercial Airplanes

segment used aircraft under operating leases and aircraft sales

financed with notes receivable included as a component of cus-

tomer financing totaled $480 and $640 as of December 31, 2006

and 2005.

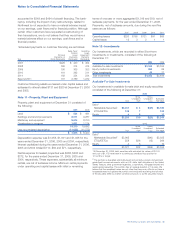

Impaired receivables and the allowance for losses on those

receivables consisted of the following at December 31:

2006 2005

Impaired receivables with no specific

impairment allowance $1,032 $1,008

Impaired receivables with specific

impairment allowance 74 503

Allowance for losses on

impaired receivables 20 51

The average recorded investment in impaired receivables as

of December 31, 2006, 2005 and 2004, was $1,191, $1,196,

and $1,940, respectively. Income recognition is generally

suspended for receivables at the date full recovery of income

and principal becomes doubtful. Income is recognized when

receivables become contractually current and performance is

demonstrated by the customer. Interest income recognized on

such receivables was $104, $90, and $118 for the years

ended December 31, 2006, 2005 and 2004, respectively.

The change in the allowance for losses on receivables for the

years ended December 31, 2006, 2005 and 2004, consisted of

the following:

Allowance for

Losses

Beginning balance – January 1, 2004 $(404)

Charge to costs and expenses (45)

Reduction in customer financing assets 46

Ending balance – December 31, 2004 (403)

Charge to costs and expenses (73)

Reduction in customer financing assets 202

Ending balance – December 31, 2005 $(274)

Charge to costs and expenses (32)

Reduction in customer financing assets 52

Ending balance – December 31, 2006 $(254)

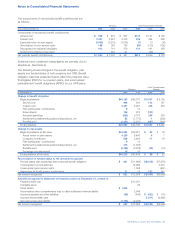

Aircraft financing is collateralized by security in the related

asset. The value of the collateral is closely tied to commercial

airline performance and may be subject to reduced valuation

with market decline. Our financing portfolio has a concentration

of various model aircraft. Aircraft financing related to major

aircraft concentrations at December 31 were as follows:

2006 2005

717 Aircraft ($760 and $621 accounted

for as operating leases)* $2,595 $2,490

757 Aircraft ($904 and $958 accounted

for as operating leases)* 1,167 1,245

767 Aircraft ($201 and $309 accounted

for as operating leases) 740 910

MD-11 Aircraft ($555 and $580 accounted

for as operating leases)* 645 672

737 Aircraft ($550 and $705 accounted

for as operating leases) 583 796

*Out of production aircraft

We recorded charges related to customer financing asset

impairment in operating earnings, primarily as a result of

declines in projected future cash flows. These charges for the

years ended December 31 were as follows:

2006 2005 2004

BCC Segment $53 $33 $27

Other Boeing 710 2

$60 $43 $29

As of December 31, 2006, Northwest Airlines, Inc. (Northwest)

has filed for bankruptcy protection and the bankruptcy court

has approved the restructured terms of certain obligations

owed to us. At December 31, 2006 and 2005, Northwest