Boeing 2006 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In addition to disclosing results that are determined in accor-

dance with U.S. generally accepted accounting principles

(GAAP), the company also discloses non-GAAP results that

exclude certain significant charges or credits that are important

to an understanding of the company’s ongoing operations.

The company provides reconciliations of its non-GAAP financial

reporting to the most comparable GAAP reporting. The

company believes that discussion of results excluding certain

significant charges or credits provides additional insights into

underlying business performance. Adjusted earnings per share

is not a measure recognized under GAAP. The determination

of significant charges or credits may not be comparable to

similarly titled measures used by other companies and may

vary from quarter to quarter.

The Boeing Company and Subsidiaries 21

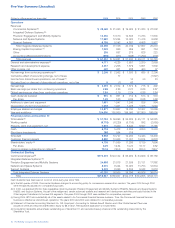

Reconciliation of Non-GAAP Measures Adjusted Earnings Per Share (Unaudited)

Twelve months ended

December 31 Increase/

(Dollars in millions except per share data) 2006 2005 (Decrease)

GAAP Diluted earnings per share* $÷2.85 $«÷3.20 (11) %

Global settlement with U.S. Department of Justice 0.75 (a)

Business Shutdown/Asset Dispositions/Divestitures 0.24 (b) (0.04)(c)

Income tax adjustments (0.20)(d) (0.71)(e)

Interest associated with income tax benefits (0.01)(f) (0.05)(g)

Cumulative effect of Accounting Change, Net of Taxes (0.02)(h)

Net (gain)/loss on Discontinued Operations, Net of Taxes (0.01)(i) 0.01 (i)

Adjusted earnings per share* “Core Earnings” per share $÷3.62 $÷«2.39 51%

Weighted average diluted shares (millions) 787.6 802.9

(a) Represents the net earnings per share impact for the global settlement of the Evolved Expendable Launch Vehicle (EELV) and Druyun matters with the

U.S. Department of Justice ($571 pre-tax charge and reversal of a tax benefit of $16, which was recorded on previous accruals of $44) at 37.3%. No tax

benefit recognized relating to global settlement.

(b) Represents the net earnings per share impact related to shutdown of the Connexion business ($320 pre-tax charge) and the EDD divestiture which was

completed in 2005 ($15 pre-tax benefit). The per share amount is presented net of income taxes at 37.3%.

(c) Represents the net earnings per share impact including pension and other postretirement benefits on the sale of Rocketdyne, Wichita, and EDD.

The per share amount for the year is presented net of income taxes at 37.8%.

(d) Represents tax benefits of $155 due to a settlement with the Internal Revenue Service for the years 1993–1997 ($46 tax benefit), tax benefit from a

state income tax audit settlement ($25 tax benefit), and provision adjustments primarily related to tax filings for 2005 and prior years ($84 tax benefit).

(e) Represents tax benefits of $570 due to a settlement with the Internal Revenue Service for the years 1998–2001, a change in valuation allowances and

provision adjustments related to tax filings for 2004 and prior years partly offset by the tax cost of repatriating foreign earnings.

(f) Represents interest income of $16 related to income tax audit settlements. The per share amount is net of income taxes at 37.3%.

(g) Represents interest income of $64 related to income tax audit settlements. The per share amount is net of income taxes at 37.8%.

(h) Primarily represents the adoption of SFAS No. 123 (revised 2004) Share-Based Payment in Q1 2005 and the adoption of FASB Interpretation No. 47,

Accounting for Conditional Asset Retirement Obligations in Q4 2005.

( i ) Represents an after-tax adjustment to the 2004 sale of assets from BCC’s Commercial Financial Services to General Electric Capital Corporation.

*GAAP diluted earnings per share and adjusted earnings per share exclude the pro-forma impact of 29 missed commercial aircraft deliveries as a result of the

International Association of Machinists (IAM) strike. The strike reduced EPS by $0.35 per share.