Boeing 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.50 The Boeing Company and Subsidiaries

Notes to Consolidated Financial Statements

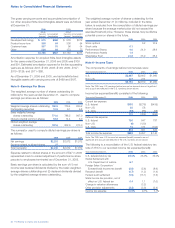

Precontract Costs

We may, from time to time, incur costs to begin fulfilling

the statement of work under a specific anticipated contract

that we are still negotiating with a customer. If we determine

it is probable that we will be awarded the specific anticipated

contract, then we capitalize the precontract costs we incur,

excluding any start-up costs which are expensed as

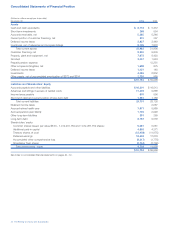

incurred. Capitalized precontract costs of $40 and $39 at

December 31, 2006, and 2005, are included in Inventories,

net of advances and progress billings in the accompanying

Consolidated Statements of Financial Position.

Property, Plant and Equipment

Property, plant and equipment are recorded at cost, including

applicable construction-period interest, less accumulated

depreciation and are depreciated principally over the following

estimated useful lives: new buildings and land improvements,

from 10 to 40 years; and new machinery and equipment, from

3 to 20 years. The principal methods of depreciation are as

follows: buildings and land improvements, 150% declining

balance; and machinery and equipment, sum-of-the-years’ digits.

Capitalized internal use software is included in Other assets and

amortized using the straight line method over five years. We

periodically evaluate the appropriateness of remaining deprecia-

ble lives assigned to long-lived assets, including assets that

may be subject to a management plan for disposition.

We review long-lived assets, which include property, plant and

equipment, for impairment in accordance with SFAS No. 144,

Accounting for the Impairment or Disposal of Long-Lived Assets

(SFAS No. 144). Long-lived assets held for sale are stated at

the lower of cost or fair value less cost to sell. Long-lived

assets held for use are subject to an impairment assessment

whenever events or changes in circumstances indicate that the

carrying amount may not be recoverable. If the carrying value

is no longer recoverable based upon the undiscounted future

cash flows of the asset, the amount of the impairment is the

difference between the carrying amount and the fair value of

the asset.

Asset Retirement Obligations

On December 31, 2005, we adopted Financial Accounting

Standards Board (FASB) Interpretation No. 47, Accounting for

Conditional Asset Retirement Obligations – an interpretation of

FASB Statement No. 143 (FIN 47). In accordance with FIN 47,

we record all known asset retirement obligations for which the

liability’s fair value can be reasonably estimated, including

certain asbestos removal, asset decommissioning and

contractual lease restoration obligations. Recorded amounts

are not material.

We also have known conditional asset retirement obligations,

such as certain asbestos remediation and asset decommission-

ing activities to be performed in the future, that are not reason-

ably estimable due to insufficient information about the timing

and method of settlement of the obligation. Accordingly, these

obligations have not been recorded in the Consolidated

Financial Statements. A liability for these obligations will be

recorded in the period when sufficient information regarding

timing and method of settlement becomes available to make a

reasonable estimate of the liability’s fair value. In addition, there

may be conditional asset retirement obligations that we have

not yet discovered (e.g., asbestos may exist in certain buildings

but we have not become aware of it through the normal course

of business), and therefore, these obligations also have not

been included in the consolidated financial statements.

Goodwill and Other Acquired Intangibles

Goodwill and other acquired intangible assets with indefinite

lives are not amortized, but are tested for impairment annually

and when an event occurs or circumstances change such that

it is reasonably possible that an impairment may exist. Our annual

testing date is April 1. In conjunction with our January 1, 2006

IDS segment realignment, we performed a goodwill impairment

test in addition to our annual goodwill impairment test. Both

tests resulted in no identified impairments.

We test goodwill for impairment by first comparing the carrying

value of net assets to the fair value of the related operations. If

the fair value is determined to be less than carrying value, a

second step is performed to compute the amount of the impair-

ment. In this process, a fair value for goodwill is estimated,

based in part on the fair value of the operations, and is com-

pared to its carrying value. The shortfall of the fair value below

carrying value represents the amount of goodwill impairment.

Our finite-lived acquired intangible assets are amortized on a

straight-line basis over their estimated useful lives as follows:

developed technology, 5 to 12 years; product know-how,

30 years; customer base, 12 to 15 years; and other, 2 to 17

years. In accordance with SFAS No. 144, we evaluate the

potential impairment of finite-lived acquired intangible assets

when appropriate. If the carrying value is no longer recoverable

based upon the undiscounted future cash flows of the asset,

the amount of the impairment is the difference between the

carrying amount and the fair value of the asset.

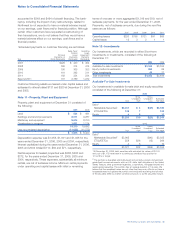

Investments

We classify investments as either operating or non-operating.

Operating investments are strategic in nature, which means

they are integral components of our operations. Non-operating

investments are those we hold for non-strategic purposes.

Earnings from operating investments, including our share of

income or loss from equity method investments, dividend

income from certain cost method investments, and any gain/loss

on the disposition of these investments, are recorded in Income

from operating investments, net. Other income on our

Consolidated Statements of Operations consists primarily of

income from non-operating investments, such as interest and

dividends on marketable securities, as well as interest income

related to income taxes. (See Note 6).