Boeing 2006 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

sources, our orders might be structured as annual follow-on

contracts, or as one large multi-year order or long-term award.

As a result, period-to-period comparisons of backlog are not

necessarily indicative of future workloads. The following discus-

sions of comparative results among periods should be viewed

in this context.

Revenues IDS revenues increased 4% in 2006 and 1% in 2005

as growth in both PE&MS and Support Systems was partially

offset by lower volume in N&SS.

Operating Earnings IDS operating earnings decreased by

$887 million in 2006 from 2005 reflecting a $569 million net

gain on the sale of Rocketdyne in 2005 and $770 million of

charges on the AEW&C development program in 2006 partially

offset by improved margins on other programs. Operating earn-

ings increased by $983 million in 2005 from 2004 primarily due

to the net gain on the Rocketdyne sale in 2005 in addition to

stable performance in the commercial satellite business com-

pared to 2004, when losses were recorded resulting from cost

growth due to technical and quality issues and write-downs of

slow-moving inventory.

Backlog Total backlog is comprised of contractual backlog,

which represents work we are on contract to perform for which

we have received funding, and unobligated backlog, which

represents work we are on contract to perform for which fund-

ing has not yet been authorized and appropriated. IDS total

backlog decreased 6% in 2006, from $80,513 million to

$75,715 million, primarily due to decreases in unobligated

backlog of $10,584 million which resulted from funding released

from new orders and existing contracts on F/A-18, FCS, C-17,

and Proprietary, offset by increases in contractual backlog of

$5,786 million which were driven by funding received from new

orders and existing contracts for C-17, F/A-18, Integrated

Logistics Chinook support, and Proprietary.

For further details on the changes between periods, refer to

the discussions of the individual segments below.

Additional Considerations

Our business includes a variety of development programs

which have complex design and technical challenges. Many of

these programs have cost-type contracting arrangements. In

these cases, the associated financial risks are primarily in lower

profit rates or program cancellation if milestones and technical

progress are not accomplished. Examples of these programs

include Ground-based Midcourse Defense (GMD), FCS, P-8A

(P-8A, formerly Multi-mission Maritime Aircraft), Proprietary pro-

grams, Airborne Laser, Joint Tactical Radio System (JTRS),

Family of Beyond Line-of-Sight Terminals, and the E/A-18G.

Some of our development programs are contracted on a

fixed-price basis. Many of these programs have highly complex

designs. As technical or quality issues arise, we may experi-

ence schedule delays and cost impacts, which could increase

our estimated cost to perform the work or reduce our esti-

mated price, either of which could result in a material charge.

These programs are ongoing, and while we believe the cost

and fee estimates incorporated in the financial statements are

appropriate, the technical complexity of these programs creates

financial risk as additional completion costs may become

necessary or scheduled delivery dates could be missed, which

could trigger termination-for-default provisions, the loss of

satellite on-orbit incentive payments, or other financially signifi-

cant exposure. These programs have risk for reach-forward

losses if our estimated costs exceed our estimated contract

revenues. Examples of these programs include AEW&C,

767 Tanker, commercial and military satellites, Vigilare and

High Frequency Modernisation.

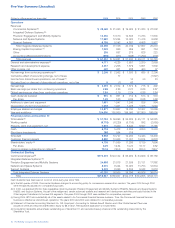

Precision Engagement and Mobility Systems

Operating Results

(Dollars in millions) 2006 2005 2004

Revenues $14,350 $13,510 $12,835

% of Total Company Revenues 23%25%25%

Operating Earnings $÷1,238 $÷1,755 $÷1,697

Operating Margins 8.6%13.0%13.2%

Research and Development $÷÷«404 $÷÷«440 $÷÷«420

Contractual Backlog $24,988 $21,815 $21,539

Unobligated Backlog $÷9,194 $15,189 $20,885

Revenues PE&MS revenues increased 6% in 2006 and 5% in

2005 primarily due to additional aircraft deliveries and other

volume. The revenue growth of $840 million in 2006 was driven

by higher deliveries of F-15 and Apache and higher volume of

P-8A, F-22, and Chinook, partially offset by reduced revenues

of AEW&C. The revenue growth of $675 million in 2005 was

driven by higher deliveries on F-15 and Apache and higher

volume and milestone completions on P-8A and AEW&C,

partially offset by fewer deliveries on F/A-18 and lower volume

resulting from the Comanche termination.

Deliveries of new-build production aircraft, excluding remanu-

factures and modifications, were as follows:

2006 2005 2004

C-17 Globemaster III 16 16 16

F/A-18E/F Super Hornet 42 42 48

T-45 Training Systems 13 10 7

F-15 Eagle 12 63

CH-47 Chinook 2––

C-40 Clipper 123

AH-64 Apache 31 12 3

Total New-Build Production Aircraft 117 88 80

Operating Earnings PE&MS operating earnings decreased

$517 million in 2006 driven by the $770 million AEW&C charges

mentioned above, which were partially offset by earnings from

revenue growth, favorable contract mix, and reduced Company

Sponsored Research & Development (CSR&D) expenditures on

the 767 Tanker program. Operating earnings increased 3% in

2005 driven by earnings from revenue growth and reduced

CSR&D expenditures on 767 Tankers in 2005 and charges

recorded in 2004 to write off pre-contract development costs

on the 767 USAF Tanker program.

Research and Development The PE&MS segment continues

to focus its research and development resources where it can

use its customer knowledge, technical strength and large-scale

integration capabilities to provide transformational solutions

to meet the war fighter’s enduring needs. Research and

development has remained consistent over the past several

years. Research and development activities leverage our

30 The Boeing Company and Subsidiaries

Management’s Discussion and Analysis