Boeing 2006 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Off-Balance Sheet Arrangements

We are a party to certain off-balance sheet arrangements

including certain guarantees and variable interests in un-

consolidated entities. For discussion of these arrangements.

(See Note 19).

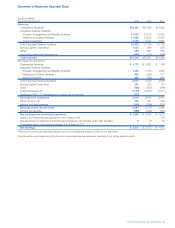

Commercial Commitments

The following table summarizes our commercial commitments

outstanding as of December 31, 2006.

Total Amounts

Committed/

Maximum Less than 1-3 4-5 After 5

(Dollars in millions) Amount of Loss 1 year years years years

Standby letters of credit

and surety bonds $««4,368 $2,849 $1,381 $«««««««3 $135

Aircraft financing

commercial commitments 10,164 1,534 5,525 3,025 80

Total commercial

commitments $14,532 $4,383 $6,906 $3,028 $215

Related to the issuance of certain standby letters of credit and

surety bonds included in the above table, we received advance

payments of $2,869 million as of December 31, 2006.

Aircraft financing commercial commitments include commit-

ments to arrange or provide financing related to aircraft on

order or under option for deliveries based on estimated earliest

funding dates. Based on historical experience, it is not antici-

pated that all of these commitments will be exercised by our

customers. (See Note 19).

Industrial Revenue Bonds

We utilize Industrial Revenue Bonds (IRB) issued by the City

of Wichita, Kansas and Fulton County, Georgia to finance the

purchase and/or construction of real and personal property.

(See Note 19).

Critical Accounting Policies and Standards Issued

and Not Yet Implemented

Contract Accounting

Contract accounting involves a judgmental process of estimat-

ing the total sales and costs for each contract, which results in

the development of estimated cost of sales percentages. For

each contract, the amount reported as cost of sales is deter-

mined by applying the estimated cost of sales percentage to

the amount of revenue recognized.

Due to the size, length of time and nature of many of our

contracts, the estimation of total sales and costs through com-

pletion is complicated and subject to many variables. Total con-

tract sales estimates are based on negotiated contract prices

and quantities, modified by our assumptions regarding contract

options, change orders, incentive and award provisions associ-

ated with technical performance, and price adjustment clauses

(such as inflation or index-based clauses). The majority of these

contracts are with the U.S. Government. Generally the price is

based on estimated cost to produce the product or service plus

profit. The Federal Acquisition Regulations provide guidance on

the types of cost that will be reimbursed in establishing contract

price. Total contract cost estimates are largely based on negoti-

ated or estimated purchase contract terms, historical perform-

ance trends, business base and other economic projections.

Factors that influence these estimates include inflationary

trends, technical and schedule risk, internal and subcontractor

performance trends, business volume assumptions, asset uti-

lization, and anticipated labor agreements.

The development of cost of sales percentages involves proce-

dures and personnel in all areas that provide financial or pro-

duction information on the status of contracts. Estimates of

each significant contract’s sales and costs are reviewed and

reassessed quarterly. Any changes in these estimates result in

recognition of cumulative adjustments to the contract profit in

the period in which changes are made.

Due to the significance of judgment in the estimation process

described above, it is likely that materially different cost of sales

amounts could be recorded if we used different assumptions,

or if the underlying circumstances were to change. Changes in

underlying assumptions/estimates, supplier performance, or cir-

cumstances may adversely or positively affect financial perform-

ance in future periods. If the combined gross margin for all

contracts in IDS for all of 2006 had been estimated to be higher

or lower by 1.0%, it would have increased or decreased income

for the year by approximately $324 million.

Program Accounting

Program accounting requires the demonstrated ability to reliably

estimate the relationship of sales to costs for the defined pro-

gram accounting quantity. A program consists of the estimated

number of units (accounting quantity) of a product to be pro-

duced in a continuing, long-term production effort for delivery

under existing and anticipated contracts. For each program, the

amount reported as cost of sales is determined by applying the

estimated cost of sales percentage for the total remaining pro-

gram to the amount of sales recognized for airplanes delivered

and accepted by the customer.

Factors that must be estimated include program accounting

quantity, sales price, labor and employee benefit costs, material

costs, procured parts, major component costs, overhead costs,

program tooling costs, and routine warranty costs. Underlying

all estimates used for program accounting is the forecasted

market and corresponding production rates. Estimation of the

accounting quantity for each program takes into account sev-

eral factors that are indicative of the demand for the particular

program, such as firm orders, letters of intent from prospective

customers, and market studies. Total estimated program sales

are determined by estimating the model mix and sales price for

all unsold units within the accounting quantity, added together

with the sales for all undelivered units under contract. The sales

prices for all undelivered units within the accounting quantity

include an escalation adjustment that is based on projected

escalation rates, consistent with typical sales contract terms.

The Boeing Company and Subsidiaries 37

Management’s Discussion and Analysis