Boeing 2006 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 The Boeing Company and Subsidiaries

Notes to Consolidated Financial Statements

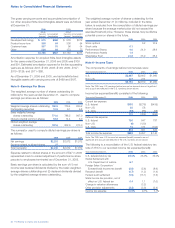

Note 7– Accounts Receivable

Accounts receivable at December 31 consisted of the following:

2006 2005

U.S. Government contracts $2,667 $2,620

Commercial and customers 1,423 1,155

Other 1,278 1,561

Less valuation allowance (83)(90)

$5,285 $5,246

The following table summarizes our accounts receivable under

long-term contracts that were not billable or related to out-

standing claims as of December 31: 2006 2005

Unbillable

Current $«««830 $«««687

Expected to be collected after one year 705 404

$1,535 $1,091

Claims

Current $«««««10 $«««««15

Expected to be collected after one year 84 90

$«««««94 $«««105

Unbillable receivables on long-term contracts arise when the

sales or revenues based on performance attainment, though

appropriately recognized, cannot be billed yet under terms of

the contract as of the balance sheet date. Accounts receivable

related to claims are items that we believe are earned, but are

subject to uncertainty concerning their determination or ultimate

realization. Accounts receivable, other than those described

above, expected to be collected after one year are not material.

As of December 31, 2006 and 2005, other accounts receivable

included $538 and $621 of reinsurance receivables held by

Astro Ltd., a wholly-owned subsidiary, which operates as a

captive insurance company. Other also included $308 and

$650 at December 31, 2006 and 2005, related to non-U.S.

military contracts.

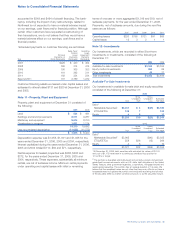

Note 8 – Inventories

Inventories at December 31 consisted of the following:

2006 2005

Long-term contracts in progress $«12,329 $«14,194

Commercial aircraft programs 8,743 7,745

Commercial spare parts, used aircraft,

general stock materials and other 2,888 2,235

23,960 24,174

Less advances and progress billings (15,855)(16,296)

$«««8,105 $«««7,878

Included in long-term contracts in progress inventories at

December 31, 2006, are Delta launch program inventories of

$1,860 that will be sold at cost to United Launch Alliance L.L.C.

(ULA) under an inventory supply agreement that terminates on

March 31, 2021. We have agreed to indemnify ULA in the event

that these inventories are not recoverable from existing and

future orders; however, based on our assessment of the mis-

sion manifest for the Delta launch program, we believe ULA will

recover these costs. (See Note 19).

As a normal course of our Commercial Airplanes segment

production process, our inventory may include a small

quantity of airplanes that are completed but unsold. As of

December 31, 2006 and 2005, the value of completed but

unsold aircraft in inventory was insignificant. Inventory balances

included $234 subject to claims or other uncertainties relating

to the A-12 program as of December 31, 2006 and 2005.

(See Note 22).

Commercial aircraft program inventory includes amounts

credited in cash or other consideration (early issued sales

consideration), to airline customers totaling $1,375 and $1,140

as of December 31, 2006 and 2005. As of December 31, 2006

and 2005, early issued sales consideration, net of advance

deposits, included $151 and $194 related to one financially

troubled customer, which we believe is fully recoverable as of

December 31, 2006.

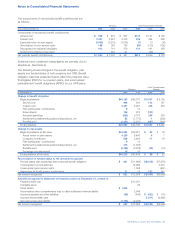

Deferred production costs represent commercial aircraft

programs and integrated defense programs inventory production

costs incurred on in-process and delivered units in excess of

the estimated average cost of such units to be produced. As

of December 31, 2006 and 2005, the balance of deferred

production costs and unamortized tooling related to commercial

aircraft programs, except the 777 program, was insignificant

relative to the programs’ balance-to-go estimates. As of

December 31, 2006 and 2005, all significant excess deferred

production costs or unamortized tooling costs are recoverable

from existing firm orders for the 777 program. The deferred

production costs and unamortized tooling are summarized in

the following table:

2006 2005

Deferred production costs:

777 program $871 $683

Delta II & IV programs 271

Unamortized tooling:

777 program 329 411

Delta II & IV programs 194

During 2002, we were selected by the US Air Force (USAF)

to supply 100 767 Tankers and entered into a preliminary

agreement with the USAF for the procurement of the 100

Tankers. During 2004, we recognized pre-tax charges totaling

$275 related to the USAF 767 Tanker program. The charge

reflected our updated assessment of securing the specific

USAF 767 Tanker contract that was being negotiated, given

the continued delay and then likely re-competition of the

contract. The charge included inventory write-downs of $179

(Commercial Airplanes) and $47 (IDS).