Boeing 2006 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

reflect increasing pressures on the 787 program as well as

modified and increased scope on the 747-8 program to sup-

port customer expectations. We are also continuing to develop

derivatives and features for our other programs primarily the

737 and 777 programs.

Integrated Defense Systems

Business Environment and Trends

IDS consists of three capabilities-driven businesses: Precision

Engagement and Mobility Systems (PE&MS), Network and

Space Systems (N&SS), and Support Systems.

Defense Environment Overview The U.S. is faced with continuous

force deployments overseas, stability operations in Afghanistan

and Iraq, and the requirement both to recapitalize important

defense capabilities and to transform the force to take advantage

of available technologies to meet the changing national security

environment as outlined in the 2006 Quadrennial Defense Review

Report (QDR). All of this must be carried out against a backdrop

of significant Federal budget deficits and an administration pledge

to reduce and ultimately eliminate annual deficit spending. We

anticipate that the national security environment will remain chal-

lenging for at least the next decade.

Because U.S. DoD spending makes up about half of worldwide

defense spending and represented approximately 84% of IDS

revenue in 2006, the trends and drivers associated with the

U.S. DoD budget are critical. The U.S. DoD budget has grown

substantially over the past decade, particularly after the terrorist

attacks of September 11, 2001. Although the growth rate had

moderated in recent years, the 2008 submittal equates to an

11% increase over the projected 2007 enacted level. The

President’s request for fiscal year 2008 is $481 billion, excluding

the additional $142 billion request to continue the fight in the

Global War on Terror (GWOT) in fiscal year 2008. In the past,

emergency supplementals had been used to cover the on-

going costs of the GWOT. In addition to the fiscal year 2008

budget request, the President also submitted a fiscal year 2007

Emergency Supplemental requesting $93 billion to cover opera-

tions in the GWOT for the remainder of fiscal year 2007. This

Supplemental is in addition to the $70 billion previously pro-

vided by Congress. The Procurement account continues to see

growth with a request of $102 billion, a 25% increase over

2007, while the Research, Development, Test & Evaluation

(RDT&E) account remains flat at $75 billion. (All projections and

percentage increases are made without taking inflation into

account and without accounting for Supplemental funding.)

Even though we continue to see some growth in the U.S. DoD

budget, it is unlikely that the U.S. DoD will be able to fully fund

the hardware programs already in development as well as new

initiatives in order to address the capability gaps identified in the

2006 QDR. This imbalance between future costs of hardware

programs and expected funding levels is not uncommon in the

U.S. DoD and is routinely managed by internally adjusting priori-

ties and schedules, restructuring programs, and lengthening

production runs to meet the constraints of available funding.

We expect the U.S. DoD will respond to future budget con-

straints by focusing on affordability strategies that emphasize

jointness, network-centric operations, persistent intelligence,

surveillance, and reconnaissance, long-range strike, special

operations, unmanned systems, precision guided kinetic and

non-kinetic weapons, and continued privatization of logistics

and support activities to improve overall effectiveness while

maintaining control over costs.

Consolidation of contractor-provided U.S. Government launch

capabilities was completed with the formation of the United

Launch Alliance L.L.C. (ULA) joint venture in 2006. This consoli-

dation was driven by the limited schedule of government

launches as well as the downturn in the commercial launch

market. Launch contractors had built business cases around

the government market being supplemented by a robust com-

mercial market, but as the commercial market declined these

business cases were re-evaluated. The U.S. Government has

an assured access to space policy which requires that two

separate vehicles be available for use. The ULA joint venture is

intended to provide this assurance.

Civil Space Transportation and Exploration Environment NASA

has had stable but very little growth in their funding in this

decade. NASA’s fiscal year 2006 appropriation of $16.6 billion

was approximately equal to the fiscal year 2005 funding level,

and presently the agency is operating under a “Continuing

Resolution” in 2007. NASA’s budget remains focused on

needed funds for Space Shuttle Operations, International Space

Station, and new initiatives associated with the Vision for Space

Exploration. We anticipate funding levels to remain in the

$16 billion range in the near future. NASA is continuing to pur-

sue elements of the Vision for Space Exploration, which will

provide additional opportunities.

Commercial Satellite Environment The commercial satellite mar-

ket has strengthened since the downturn earlier in the decade

and is expected to stabilize with replacement demand through

the end of the decade. The market remains extremely competi-

tive however, with overcapacity across the overall industry and

strong pressure on pricing. We will continue to pursue profitable

commercial satellite opportunities where the customer values

our technical expertise and unique solutions.

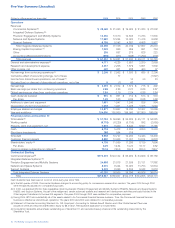

Integrated Defense Systems Operating Results

(Dollars in millions) 2006 2005 2004

Revenues $32,439 $31,106 $30,739

% of Total Company Revenues 53%58%60%

Operating Earnings $÷3,032 $÷3,919 $÷2,936

Operating Margins 9.3%12.6%9.6%

Research and Development $÷÷«791 $÷÷«855 $÷÷«834

Contractual Backlog $42,291 $36,505 $39,296

Unobligated Backlog $33,424 $44,008 $47,472

Since our operating cycle is long-term and involves many

different types of development and production contracts with

varying delivery and milestone schedules, the operating results

of a particular year, or year-to-year comparisons of revenues

and earnings, may not be indicative of future operating results.

In addition, depending on the customer and their funding

The Boeing Company and Subsidiaries 29

Management’s Discussion and Analysis