Boeing 2006 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

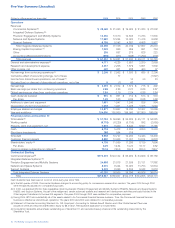

(Dollars in millions except per share data) 2006 2005 2004 2003 2002

Operations

Revenues

Commercial Airplanes(a) $÷28,465 $÷21,365 $÷19,925 $÷21,380 $÷27,202

Integrated Defense Systems:(b)

Precision Engagement and Mobility Systems 14,350 13,510 12,835 11,783 11,635

Network and Space Systems 11,980 12,254 13,023 11,416 9,658

Support Systems 6,109 5,342 4,881 4,408 3,977

Total Integrated Defense Systems 32,439 31,106 30,739 27,607 25,270

Boeing Capital Corporation(c) 1,025 966 959 991 764

Other 299 657 275 625 223

Accounting differences/eliminations (698)(473)(498)(1,292)(739)

Total revenues $÷61,530 $÷53,621 $÷51,400 $÷49,311 $÷52,720

General and administrative expense(c) 4,171 4,228 3,657 3,200 2,959

Research and development expense 3,257 2,205 1,879 1,651 1,639

Other income, net 420 301 288 460 37

Net earnings from continuing operations(c) $««««2,206 $÷÷2,562 $÷÷1,820 $÷÷÷«685 $÷÷2,296

Cumulative effect of accounting change, net of taxes 17 (1,827)

Income from discontinued operations, net of taxes(c) 10 33 23

Net gain/(loss) on disposal of discontinued operations, net of tax 9(7)42

Net earnings $÷÷2,215 $÷÷2,572 $÷÷1,872 $÷÷÷«718 $÷÷÷«492

Basic earnings per share from continuing operations 2.88 3.26 2.27 0.86 2.87

Diluted earnings per share from continuing operations 2.84 3.19 2.24 0.85 2.84

Cash dividends declared $÷÷÷«991 $÷÷÷«861 $÷÷÷«714 $÷÷÷«573 $÷÷÷«570

Per share 1.25 1.05 0.85 0.68 0.68

Additions to plant and equipment 1,681 1,547 1,246 836 954

Depreciation of plant and equipment 1,058 1,001 1,028 1,005 1,094

Employee salaries and wages 15,871 13,667 12,700 12,067 12,566

Year-end workforce 154,000 153,000 159,000 157,000 166,000

Financial position at December 31

Total assets(d) $÷51,794 $÷59,996 $÷56,224 $÷55,171 $÷54,225

Working capital (6,718)(6,220)(5,735)892 (2,955)

Property, plant and equipment, net 7,675 8,420 8,443 8,597 8,765

Cash 6,118 5,412 3,204 4,633 2,333

Short-term investments 268 554 319

Total debt 9,538 10,727 12,200 14,443 14,403

Customer financing assets 8,890 10,006 11,001 10,914 9,878

Shareholders’ equity(d) 4,739 11,059 11,286 8,139 7,696

Per share 6.25 14.54 14.23 10.17 9.62

Common shares outstanding (in millions)(e) 757.8 760.6 793.2 800.3 799.7

Contractual Backlog

Commercial Airplanes(a) $174,276 $124,132 $÷65,482 $÷63,929 $÷68,159

Integrated Defense Systems:(b)

Precision Engagement and Mobility Systems 24,988 21,815 21,539 23,131 17,862

Network and Space Systems 8,001 6,324 10,923 11,753 12,634

Support Systems 9,302 8,366 6,834 6,042 5,518

Total Integrated Defense Systems 42,291 36,505 39,296 40,926 36,014

Total $216,567 $160,637 $104,778 $104,855 $104,173

Cash dividends have been paid on common stock every year since 1942.

(a) In the first quarter of 2006, Commercial Airplanes changed its accounting policy for concessions received from vendors. The years 2005 through 2002

were retroactively adjusted for comparative purposes.

(b) In 2006, we realigned IDS into three capabilities-driven businesses: Precision Engagement and Mobility Systems (PE&MS), Network and Space Systems

(N&SS), and Support Systems. As part of the realignment, certain advanced systems and research and development activities previously included in the

Other segment transferred to the new IDS segments. The years 2005 through 2002 were restated for comparative purposes.

(c) During 2004, BCC sold substantially all of the assets related to its Commercial Financial Services business. Thus, the Commercial Financial Services

business is reflected as discontinued operations. The years 2003 and 2002 were restated for comparative purposes.

(d) Statement of Financial Accounting Standard No. 158, Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans was

adopted in 2006 and reduced shareholders’ equity by $8.2 billion. Retrospective application is not permitted.

(e) Computation represents actual shares outstanding as of December 31, and excludes treasury shares and the outstanding shares held by the

ShareValue Trust.

22 The Boeing Company and Subsidiaries

Five-Year Summary (Unaudited)