Boeing 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Boeing Company and Subsidiaries 71

Notes to Consolidated Financial Statements

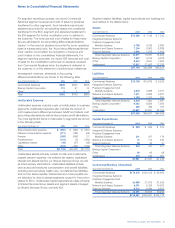

Note 18 – Derivative Financial Instruments

Cash Flow Hedges

Our cash flow hedges include certain interest rate swaps,

cross currency swaps, foreign currency forward contracts,

foreign currency option contracts and commodity purchase

contracts. Interest rate swap contracts under which we agree

to pay fixed rates of interest are designated as cash flow

hedges of variable-rate debt obligations. We use foreign

currency forward contracts to manage currency risk associated

with certain forecasted transactions, specifically sales and

purchase commitments made in foreign currencies. Our foreign

currency forward contracts hedge forecasted transactions

principally occurring within five years in the future, with certain

contracts hedging transactions up to 2021. We use commodity

derivatives, such as fixed-price purchase commitments, to

hedge against potentially unfavorable price changes for items

used in production. These include commitments to purchase

electricity at fixed prices through 2009.

For the years ended December 31, 2006, 2005, and 2004,

gains/(losses) of $24, $3, and ($16), respectively, (net of tax)

were reclassified to cost of products and services from

Accumulated other comprehensive loss. In 2006, additional

gains of $12 were reclassified from Accumulated other

comprehensive loss to Other income, net, as a result of

discontinuance of cash flow hedge designation based on the

probability that the original forecasted transactions will not

occur by the end of the originally specified time period. Such

reclassifications were not significant for the years ended

December 31, 2005 and 2004. Ineffectiveness for cash flow

hedges was insignificant for the years ended December 31, 2006,

2005 and 2004.

At December 31, 2006 and 2005, net gains of $18 and $32

(net of tax) were recorded in Accumulated other comprehensive

loss associated with our cash flow hedging transactions. Based

on our current portfolio of cash flow hedges, we expect to

reclassify to cost of products and services a gain of $21 (net

of tax) during 2007.

Fair Value Hedges

Interest rate swaps under which we agree to pay variable

rates of interest are designated as fair value hedges of fixed-

rate debt. The net change in fair value of the derivatives and

the hedged items is reported in Interest and debt expense.

Ineffectiveness related to the interest rate swaps was insignifi-

cant for the years ended December 31, 2006, 2005 and 2004.

For the years ended December 31, 2006, 2005 and 2004, $8,

$12, and $24 of gains related to the basis adjustment of certain

terminated interest rate swaps and forward-starting interest rate

swaps were amortized to earnings.

Derivative Financial Instruments Not Receiving

Hedge Accounting Treatment

We also hold certain non-hedging instruments such as

interest exchange agreements, interest rate swaps, warrants,

and foreign currency forward contracts. The changes in fair

value of these instruments are recorded in Other income, net.

For the years ended December 31, 2006, 2005 and 2004,

these non-hedging instruments resulted in net (loss)/gains of

($6), $11, and $19, respectively.

Note 19 – Arrangements with Off-Balance Sheet Risk

We enter into arrangements with off-balance sheet risk in

the normal course of business, as discussed below. These

arrangements are primarily in the form of guarantees, product

warranties, and variable interest entities (VIEs).

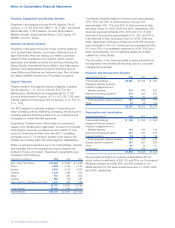

Third-Party Guarantees

The following tables provide quantitative data regarding our

third-party guarantees. The maximum potential payments

represent a “worst-case scenario,” and do not necessarily

reflect our expected results. Estimated proceeds from collateral

and recourse represent the anticipated values of assets we

could liquidate or receive from other parties to offset our

payments under guarantees. The carrying amount of liabilities

recorded on the Consolidated Statements of Financial Position

reflects our best estimate of future payments we may incur as

part of fulfilling our guarantee obligations.

Estimated

Proceeds

Maximum from Carrying

Potential Collateral/ Amount of

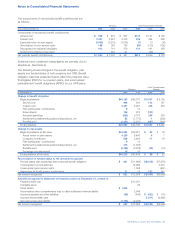

As of December 31, 2006 Payments Recourse Liabilities*

Contingent repurchase

commitments $4,164 $4,155 $««««7

Indemnifications to ULA 1,664 7

Residual value guarantees 252 215 15

Credit guarantees related to

the Sea Launch venture 471 283 188

Other credit guarantees 31 17

Performance guarantees 47 20

*Amounts included in Accounts payable and other liabilities

Estimated

Proceeds

Maximum from Carrying

Potential Collateral/ Amount of

As of December 31, 2005 Payments Recourse Liabilities*

Contingent repurchase

commitments $4,067 $4,059

Residual value guarantees 352 288 $««15

Credit guarantees related to

the Sea Launch venture 490 294 196

Other credit guarantees 41 13 8

Performance guarantees 48 21 1

*Amounts included in Accounts payable and other liabilities