Boeing 2006 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

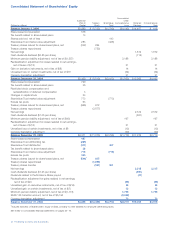

decrease in Shareholders’ equity. This decrease does not affect

cash flows or the funded status of our benefit plans. The

covenants for our debt and credit facilities were amended to

exclude the impacts of SFAS No. 158.

As of December 31, 2006, we were in compliance with the

covenants for our debt and credit facilities.

Disclosures About Contractual Obligations

and Commercial Commitments

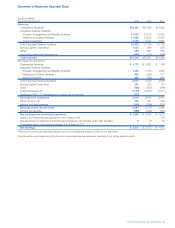

The following table summarizes our known obligations to

make future payments pursuant to certain contracts as of

December 31, 2006, and the estimated timing thereof.

Contractual Obligations

Less than 1-3 3-5 After 5

(Dollars in millions) Total 1 year years years years

Long-term debt

(including

current portion) $««««9,405 $««1,322 $««1,260 $««1,519 $««5,304

Interest on debt* 6,195 557 992 814 3,832

Pension and other

postretirement

cash requirements 7,330 675 1,432 1,549 3,674

Capital lease obligations 153 59 31 20 43

Operating lease

obligations 1,064 239 301 164 360

Purchase obligations not

recorded on statement

of financial position 86,254 34,926 35,076 11,940 4,312

Purchase obligations

recorded on statement

of financial position 10,632 9,394 518 344 376

Total contractual

obligations $121,033 $47,172 $39,610 $16,350 $17,901

*Includes interest on variable rate debt calculated based on interest rates at

December 31, 2006. Variable rate debt was approximately 3% of our total debt

at December 31, 2006.

Pension and Other Postretirement Benefits Pension cash

requirements is an estimate of our minimum funding require-

ments, pursuant to ERISA regulations, although we may make

additional discretionary contributions. Estimates of other post-

retirement benefits are based on both our estimated future

benefit payments and the estimated contribution to the one

plan that is funded through a trust.

Purchase Obligations Purchase obligations represent contrac-

tual agreements to purchase goods or services that are legally

binding; specify a fixed, minimum or range of quantities; specify

a fixed, minimum, variable, or indexed price provision; and

specify approximate timing of the transaction. In addition, the

agreements are not cancelable without substantial penalty.

Purchase obligations include amounts recorded as well as

amounts that are not recorded on the statements of financial

position. Approximately 16% of the purchase obligations dis-

closed above are reimbursable to us pursuant to cost-type

government contracts.

Purchase Obligations Not Recorded on the Consolidated

Statement of Financial Position Production related purchase

obligations not recorded on the Consolidated Statement of

Financial Position include agreements for production goods,

tooling costs, electricity and natural gas contracts, property, plant

and equipment, and other miscellaneous production related

obligations. The most significant obligation relates to inventory

procurement contracts. We have entered into certain significant

inventory procurement contracts that specify determinable prices

and quantities, and long-term delivery timeframes. In addition, we

purchase raw materials on behalf of our suppliers. These agree-

ments require suppliers and vendors to be prepared to build and

deliver items in sufficient time to meet our production schedules.

The need for such arrangements with suppliers and vendors

arises from the extended production planning horizon for many

of our products. A significant portion of these inventory commit-

ments is supported by firm contracts and/or has historically

resulted in settlement through reimbursement from customers

for penalty payments to the supplier should the customer not

take delivery. These amounts are also included in our forecasts

of costs for program and contract accounting. Some inventory

procurement contracts may include escalation adjustments. In

these limited cases, we have included our best estimate of the

effect of the escalation adjustment in the amounts disclosed in

the table above.

Industrial Participation Agreements We have entered into various

industrial participation agreements with certain customers out-

side of the U.S. to facilitate economic flow back and/or technol-

ogy transfer to their businesses or government agencies as the

result of their procurement of goods and/or services from us.

These commitments may be satisfied by our placement of

direct work or vendor orders for supplies, opportunities to bid

on supply contracts, transfer of technology or other forms of

assistance. However, in certain cases, our commitments may

be satisfied through other parties (such as our vendors) who

purchase supplies from our non-U.S. customers. We do not

commit to industrial participation agreements unless a contract

for sale of our products or services is signed. In certain cases,

penalties could be imposed if we do not meet our industrial

participation commitments. During 2006, we incurred no such

penalties. As of December 31, 2006, we have outstanding

industrial participation agreements totaling $7.7 billion that

extend through 2019. Purchase order commitments associated

with industrial participation agreements are included in the table

above. To be eligible for such a purchase order commitment

from us, a country outside the U.S. or customer must have

sufficient capability to meet our requirements and must be

competitive in cost, quality and schedule.

Purchase Obligations Recorded on the Consolidated Statement

of Financial Position Purchase obligations recorded on the

Consolidated Statement of Financial Position primarily include

accounts payable and certain other liabilities including accrued

compensation and dividends payable.

36 The Boeing Company and Subsidiaries

Management’s Discussion and Analysis