Boeing 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.72 The Boeing Company and Subsidiaries

Notes to Consolidated Financial Statements

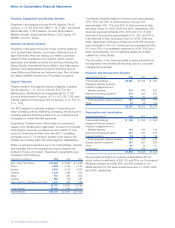

Contingent Repurchase Commitments In conjunction with signing

a definitive agreement for the sale of new aircraft (Sale Aircraft),

we have entered into contingent repurchase commitments with

certain customers. Under such commitments, we agree to

repurchase the Sale Aircraft at a specified price, generally ten

years after delivery of the Sale Aircraft. Our repurchase of the

Sale Aircraft is contingent upon a future, mutually acceptable

agreement for the sale of additional new aircraft.

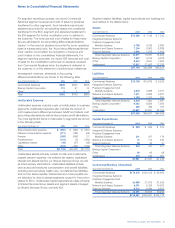

Indemnifications to ULA We agreed to indemnify ULA against

potential losses that ULA may incur from certain contracts

contributed by us. In the event ULA is unable to obtain certain

additional contract pricing to which we believe ULA is entitled,

we will be responsible for any shortfall and may record up to

$322 in pre-tax losses. We recorded a liability of $7 as our best

estimate of the fair value of this indemnification. The term of the

indemnification is indefinite.

We entered into an inventory supply agreement with ULA for

the sale of $1,860 of Delta program inventories which were

not contributed to the joint venture. The term of the inventory

supply agreement extends to March 31, 2021. We have agreed

to indemnify ULA in the event that these inventories are not

recoverable from existing and future orders. We also agreed to

indemnify ULA against potential losses that ULA may incur

relating to the recoverability of $1,375 of inventories included

in the contributed assets. The term of the inventory indemnifica-

tion extends to December 31, 2020. Although we believe that

the $1,375 of contributed inventories and the additional $1,860

of Boeing Delta inventories to be sold to ULA will be recover-

able based on our assessment of the mission manifest, losses

could occur if the manifest is reduced and the inventories are

not recovered by ULA.

Residual Value Guarantees We have issued various residual

value guarantees principally to facilitate the sale of certain

commercial aircraft. Under these guarantees, we are obligated

to make payments to the guaranteed party if the related aircraft

or equipment fair values fall below a specified amount at a

future time. These obligations are collateralized principally by

commercial aircraft and expire in 2 to 12 years.

Credit Guarantees Related to the Sea Launch Venture We have

issued credit guarantees to creditors of the Sea Launch

venture, of which we are a 40% partner, to assist the venture

in obtaining financing. Under these credit guarantees, we are

obligated to make payments to a guaranteed party in the event

that Sea Launch does not make its loan payments. We have

substantive guarantees from the other venture partners, who

are obligated to reimburse us for their share (in proportion to

their Sea Launch ownership percentages) of any guarantee

payment we may make related to the Sea Launch obligations.

These guarantees expire within the next 9 years.

Other Credit Guarantees We have issued credit guarantees,

principally, to facilitate the sale of commercial aircraft. Under

these arrangements, we are obligated to make payments to a

guaranteed party in the event that lease or loan payments are

not made by the original debtor or lessee. A substantial portion

of these guarantees has been extended on behalf of original

debtors or lessees with less than investment-grade credit. Our

commercial aircraft credit-related guarantees are collateralized

by the underlying commercial aircraft. Current outstanding

credit guarantees expire within the next 9 years.

Performance Guarantees We have outstanding performance

guarantees issued in conjunction with joint venture investments.

Pursuant to these guarantees, we would be required to

make payments in the event a third-party fails to perform

specified services. We have guarantees from the other venture

partners, who are obligated to reimburse us for a portion of any

guarantee payments we may make related to the performance

guarantee. Current performance guarantees expire within the

next 11 years.

Other Indemnifications In conjunction with our sales of the EDD

and Rocketdyne businesses and the sale of our Commercial

Airplanes facilities in Wichita, Kansas and Tulsa and McAlester,

Oklahoma in 2005, we provided indemnifications to the buyers

relating to pre-closing environmental contamination and certain

other items. The terms of the indemnifications are indefinite.

As it is impossible to assess whether there will be damages

in the future or the amounts thereof, we cannot estimate the

maximum potential amount of future payments under these

guarantees. Therefore, no liability has been recorded.

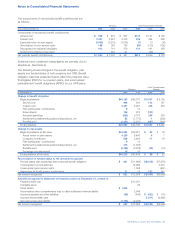

Product Warranties

We provide product warranties in conjunction with certain

product sales. The majority of our warranties are issued by

our Commercial Airplanes segment. Generally, aircraft sales

are accompanied by a three- to four-year standard warranty for

systems, accessories, equipment, parts and software manufac-

tured by us or manufactured to certain standards under our

authorization. These items are included in the programs’

estimate at completion (EAC). Additionally, on occasion we

have made commitments beyond the standard warranty

obligation to correct fleet wide major warranty issues of a

particular model. These costs are expensed as incurred.

These warranties cover factors such as non-conformance to

specifications and defects in material and design. Warranties

issued by our IDS segments principally relate to sales of military

aircraft and weapons hardware. These sales are generally

accompanied by a six- to twelve-month warranty period and

cover systems, accessories, equipment, parts and software

manufactured by us to certain contractual specifications.

These warranties cover factors such as non-conformance to

specifications and defects in material and workmanship.

Estimated costs related to standard warranties are recorded

in the period in which the related product sales occur. The

warranty liability recorded at each balance sheet date reflects

the estimated number of months of warranty coverage out-

standing for products delivered times the average of historical

monthly warranty payments, as well as additional amounts for

certain major warranty issues that exceed a normal claims level.