Boeing 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Boeing Company and Subsidiaries 53

Notes to Consolidated Financial Statements

Guarantees

We account for guarantees in accordance with FASB

Interpretation No. 45, Guarantor’s Accounting and Disclosure

Requirements for Guarantees, Including Indirect Guarantees of

Indebtedness of Others. We record a liability for the fair value of

guarantees in Accounts Payable and other liabilities that are

issued or modified after December 31, 2002. For a residual

value guarantee where we received a cash premium, the liability

is equal to the cash premium received at the guarantee’s

inception. For credit and performance guarantees, the liability is

equal to the present value of the expected loss. For each future

period the credit or performance guarantee will be outstanding,

we determine the expected loss by multiplying the creditor’s

default rate by the guarantee amount reduced by the expected

recovery, if applicable. If at inception of a guarantee we determine

there is a probable related contingent loss, we will recognize a

liability for the greater of (a) the fair value of the guarantee as

described above or (b) the probable contingent loss amount.

Note 2 – Standards Issued and Not Yet Implemented

In June 2006, the Financial Accounting Standards Board

(FASB) issued Interpretation No. 48, Accounting for Uncertainty

in Income Taxes (FIN 48). FIN 48 prescribes a more-likely-than-

not threshold for financial statement recognition and measure-

ment of a tax position taken or expected to be taken in a tax

return. This Interpretation also provides guidance on derecogni-

tion of income tax assets and liabilities, classification of current

and deferred income tax assets and liabilities, accounting for

interest and penalties associated with tax positions, accounting

for income taxes in interim periods, and income tax disclosures.

This Interpretation is effective as of January 1, 2007 and

the cumulative effects of applying this Interpretation will be

recorded as an adjustment to retained earnings as of

January 1, 2007. Additional guidance from the FASB on FIN 48

is pending. As a result, we are currently unable to finalize our

estimate of the impact that adopting this Interpretation will

have on our financial statements.

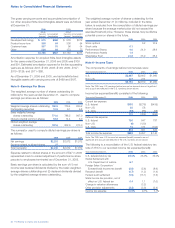

Note 3 – Acquisition

On September 20, 2006, we acquired all of the outstanding

shares of Aviall, Inc. (Aviall) for $1,780, including transaction

fees totaling $46. Aviall is an independent provider of new

aviation parts and services in the aerospace industry. Its

capabilities include global parts distribution and supply chain

services for aerospace, defense and marine industries

worldwide. The Aviall acquisition is intended to complement

existing offerings in our Commercial Airplanes and IDS Support

Systems reporting segments. The acquisition of Aviall was

accounted for under the purchase method of accounting

and the results of operations from the acquisition date are

included in Commercial Airplanes and IDS Support Systems

reporting segments.

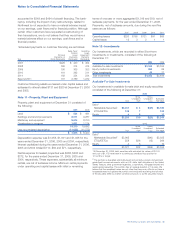

The allocation of the purchase price is as follows:

Accounts receivable $÷«200

Net inventory 539

Other current assets 64

Property, plant and equipment 17

Goodwill 1,055

Finite-lived intangible assets (primarily contractual

supplier and customer relationships)*519

Indefinite-lived intangible assets not subject to

amortization (Aviall brand and trade names) 302

Other assets 42

Accounts payable (196)

Other current liabilities (79)

Debt acquired and repaid (458)

Other long-term liabilities (225)

Total net assets acquired $1,780

*The weighted average amortization period for finite-lived intangible assets

is 11 years.

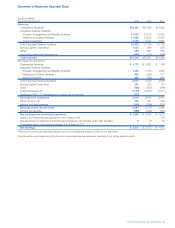

Note 4 – Goodwill and Acquired Intangibles

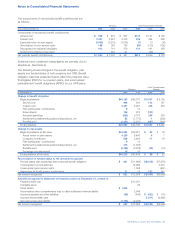

Changes in the carrying amount of goodwill by reportable

segment for the years ended December 31, 2006, 2005 and

2004 were as follows:

Precision

Engagement Network

Commercial & Mobility & Space Support

Airplanes Systems Systems Systems Other Total

Balance at January 1, 2004 $«««282 $588 $922 $118 $3 $1,913

Goodwill Adjustments 25 2 27

Acquisitions 11 11

Impairment Losses (3)(3)

Balance at December 31, 2004 $«««282 $624 $924 $118 $1,948

Goodwill Adjustments 21 (13)(18)11 1

Divestitures (23)(2)(25)

Balance at December 31, 2005 $«««280 $611 $904 $129 $1,924

Aviall acquisition 1,014 41 1,055

Other* 71 (3)68

Balance at December 31, 2006 $1,365 $611 $901 $170 $3,047

*The increase in goodwill is primarily the result of an acquisition in the second quarter of 2006. The purchase price allocation for this acquisition was finalized in the

fourth quarter of 2006.