Boeing 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Boeing Company and Subsidiaries 51

Notes to Consolidated Financial Statements

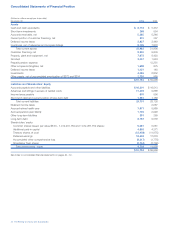

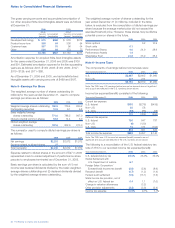

Available-for-sale securities including marketable debt and

equity securities and Enhanced Equipment Trust Certificates

(EETCs) are recorded at their fair values and unrealized gains

and losses are reported as part of Accumulated other compre-

hensive loss on the Consolidated Statements of Financial

Position. Realized gains and losses on marketable securities are

recognized based on the shares whose cost is closest to our

average cost of the specific security. Realized gains and losses

on all other available-for-sale securities are recognized based

on specific identification.

The fair value of marketable securities is based on quoted

market prices. The fair value of non-publicly traded securities,

including certain EETCs, is based on discounted cash flows at

market yield. In cases when we determine that it is probable

that recovery of our investment will come from recovery of

collateral, the fair value is based on the underlying collateral.

Available-for-sale securities are assessed for impairment

quarterly. To determine if an impairment is other than temporary,

we consider the duration of the loss position, the strength of

the underlying collateral, the term to maturity, and credit ratings.

For investments that are deemed other-than-temporarily

impaired, losses are recorded in Cost of products or Cost of

services and payments received on these investments are

recorded using the cost recovery method.

Equity Method Investments The equity method of accounting is

used to account for investments for which we have the ability to

exercise significant influence, but not control, over an investee.

Significant influence is generally deemed to exist if we have an

ownership interest in the voting stock of an investee of between

20% and 50%.

Derivatives

All derivative instruments are recognized in the financial state-

ments and measured at fair value regardless of the purpose

or intent of holding them. We use derivative instruments to

principally manage a variety of market risks. We record our

interest rate swaps, non-U.S. currency swaps and commodity

contracts at fair value based on discounted cash flow analysis.

For derivatives designated as hedges of the exposure to

changes in the fair value of a recognized asset or liability or a

firm commitment (referred to as fair value hedges), the gain or

loss is recognized in earnings in the period of change together

with the offsetting loss or gain on the hedged item attributable

to the risk being hedged. The effect of that accounting is to

reflect in earnings the extent to which the hedge is not effective

in achieving offsetting changes in fair value. For our cash flow

hedges, the effective portion of the derivative’s gain or loss is

initially reported in shareholders’ equity (as a component of

Accumulated other comprehensive loss) and is, subsequently,

reclassified into earnings in the same period or periods during

which the hedged forecasted transaction affects earnings.

The ineffective portion of the gain or loss of a cash flow hedge

is reported in earnings immediately. We also hold certain instru-

ments for economic purposes that do not qualify for hedge

accounting treatment. For these derivative instruments, as well

as other derivatives not receiving hedge accounting treatment,

the changes in their fair value are also recorded in earnings.

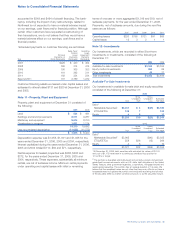

Aircraft Valuation

Used Aircraft Under Trade-in Commitments and Aircraft Under

Repurchase Commitments In conjunction with signing a defini-

tive agreement for the sale of new aircraft (Sale Aircraft), we

have entered into specified-price trade-in commitments with

certain customers that give them the right to trade in used

aircraft upon the purchase of Sale Aircraft. Additionally, we have

entered into contingent repurchase commitments with certain

customers wherein we agree to repurchase the Sale Aircraft at

a specified price, generally ten years after delivery of the Sale

Aircraft. Our repurchase of the Sale Aircraft is contingent upon

a future, mutually acceptable agreement for the sale of addi-

tional new aircraft. If we execute an agreement for the sale of

additional new aircraft, and if the customer exercises its right to

sell the Sale Aircraft to us, a contingent repurchase commitment

would become a trade-in commitment. Our historical experience

is that no contingent repurchase agreements have become

trade-in commitments.

All trade-in commitments at December 31, 2006 and 2005 are

solely attributable to Sale Aircraft and did not originate from

contingent repurchase agreements. Exposure related to trade-in

commitments may take the form of:

(1) Adjustments to revenue for the difference between the

contractual trade-in price in the definitive agreement and our

best estimate of the fair value of the trade-in aircraft as of

the date of such agreement, which are recorded in Inventory

and recognized upon delivery of the Sale Aircraft, and/or

(2) Charges to cost of products for adverse changes in the fair

value of trade-in aircraft that occur subsequent to signing of

a definitive agreement for Sale Aircraft but prior to the

purchase of the used trade-in aircraft. Estimates based on

current aircraft values are included in Accounts payable

and other liabilities.

The fair value of trade-in aircraft is determined using aircraft

specific data such as model age and condition, market condi-

tions for specific aircraft and similar models, and multiple valua-

tion sources. This process uses our assessment of the market

for each trade-in aircraft, which in most instances begins years

before the return of the aircraft. There are several possible mar-

kets in which we continually pursue opportunities to place used

aircraft. These markets include, but are not limited to, the resale

market, which could potentially include the cost of long-term

storage; the leasing market, with the potential for refurbishment

costs to meet the leasing customer’s requirements; or the scrap

market. Trade-in aircraft valuation varies significantly depending

on which market we determine is most likely for each aircraft.

On a quarterly basis, we update our valuation analysis based

on the actual activities associated with placing each aircraft into

a market. This quarterly valuation process yields results that are

typically lower than residual value estimates by independent