Boeing 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Boeing Company and Subsidiaries 73

Notes to Consolidated Financial Statements

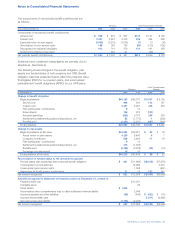

The following table summarizes product warranty activity

recorded during 2006 and 2005:

Product Warranty

Liabilities*

Beginning balance – January 1, 2005 $«781

Additions for new warranties 119

Reductions for payments made (146)

Changes in estimates 27

Ending balance – December 31, 2005 781

Additions for new warranties 171

Reductions for payments made (206)

Changes in estimates 15

Ending balance – December 31, 2006 $«761

*Amounts included in Accounts payable and other liabilities.

Material Variable Interests in Unconsolidated Entities

Our investments in EETCs and other VIEs are included

within the scope of Revised Interpretation No. 46 (FIN 46(R)),

Consolidation of Variable Interest Entities. We have certain

investments in EETCs which were acquired between 1999 and

2005. EETCs are trusts that passively hold investments in aircraft

or pools of aircraft. The EETCs provide investors with collateral

position in the related assets and tranched rights to cash flows

from a financial instrument. Our investments in EETCs do not

require consolidation under FIN 46(R). At December 31, 2006

our maximum exposure to economic loss from our EETCs is

$152. At December 31, 2006, the EETC investments had

total assets of $559 and total debt of $407. This debt is non-

recourse to us. During 2006, we recorded income of $9 and

received cash of $18 related to these investments.

Industrial Revenue Bonds

Industrial Revenue Bonds (IRBs) issued by the City of Wichita

are used to finance the purchase and/or construction of real

and personal property at our Wichita site. Tax benefits associ-

ated with IRBs include a ten-year property tax abatement and a

sales tax exemption from the Kansas Department of Revenue.

We record the property on our Consolidated Statements of

Financial Position, along with a capital lease obligation to repay

the proceeds of the IRB. We have also purchased the IRBs and,

therefore, are the bondholder as well as the borrower/lessee of

the property purchased with the IRB proceeds.

We have a similar arrangement with the Development Authority

of Fulton County, Georgia where we are both borrower and

bondholder. Tax benefits associated with these IRBs are the

provision of a ten-year partial property tax abatement.

The capital lease obligation and IRB asset are recorded net in

the Consolidated Statements of Financial Position pursuant to

FIN 39, Offsetting of Amounts Related to Certain Contracts. As

of December 31, 2006 and 2005, the assets and liabilities

associated with the City of Wichita IRBs were $1,419 and

$1,416, and the amounts associated with the Fulton County

IRBs were $16 and $17.

Note 20 – Significant Group Concentrations of Risk

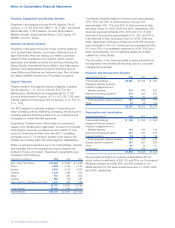

Credit Risk

Financial instruments involving potential credit risk are

predominantly with commercial aircraft customers and the

U.S. Government. Of the $14,175 in Accounts receivable and

Customer financing included in the Consolidated Statements

of Financial Position as of December 31, 2006, $8,562 related

to commercial aircraft customers ($358 of Accounts receivable

and $8,204 of Customer financing) and $2,832 related to the

U.S. Government. Of the $8,204 of aircraft customer financing,

$7,712 related to customers we believe have less than

investment-grade credit. AirTran Airways, AMR, United Airlines

and Midwest Airlines Inc. were associated with 19%, 14%,

9% and 8%, respectively, of our aircraft financing portfolio.

Financing for aircraft is collateralized by security in the related

asset. As of December 31, 2006, there was $10,164 of financ-

ing commitments related to aircraft on order including options

described in Note 23, of which $8,356 related to customers

we believe have less than investment-grade credit.

Other Risk

As of December 31, 2006, approximately 37% of our employ-

ees were represented by collective bargaining agreements and

approximately 4% of our employees were represented by

agreements expiring during 2007.

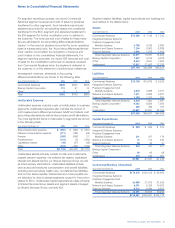

Note 21 – Disclosures About Fair Value

of Financial Instruments

The estimated fair value of our Investments and Notes receiv-

able balances at December 31, 2006 and 2005 approximate

their carrying value.

As of December 31, 2006, the carrying amounts of Accounts

receivable and Accounts payable were $5,285 and $5,643,

and the related fair values, based on current market rates for

loans of the same risk and maturities, were estimated at

$4,876 and $5,356. The estimated fair values of our Accounts

receivable and Accounts payable balances at December 31, 2005

approximate their carrying value. The estimated fair value of our

Other liabilities balance at December 31, 2006 and 2005

approximates its carrying value.

As of December 31, 2006 and 2005, the carrying amount of

debt, net of capital leases, was $9,395 and $10,516 and the

fair value of debt, based on current market rates for debt of the

same risk and maturities, was estimated at $10,297 and

$11,643. Our debt is generally not callable until maturity.

With regard to financial instruments with off-balance sheet

risk, it is not practicable to estimate the fair value of future

financing commitments because there is not a market for

such future commitments. Residual value and credit guarantees

are estimated to have a fair value of $113 and $148 at

December 31, 2006 and 2005. Contingent repurchase commit-

ments are estimated to have a fair value of $91 and $80 at

December 31, 2006 and 2005.