Boeing 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

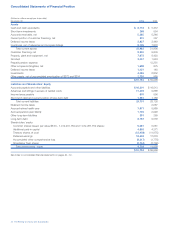

Financial Position

The following table presents selected financial data for BCC:

(Dollars in millions) 2006 2005

BCC Customer Financing and

Investment Portfolio $8,034 $9,206

Valuation Allowance as a % of Total Receivables 2.4%2.0%

Debt $5,590 $6,322

Debt-to-Equity Ratio 5.0-to-1 5.0-to-1

BCC’s customer financing and investment portfolio at

December 31, 2006 decreased from December 31, 2005 due

to portfolio run-off and sale of certain portfolio assets. At

December 31, 2006 and 2005, BCC had $259 million and

$47 million of assets that were held for sale or re-lease of which

$253 million and $6 million had firm contracts to be sold or

placed on lease. Additionally, leases with a carrying value of

approximately $144 million are scheduled to terminate in the

next 12 months and the related aircraft are being remarketed

or the leases are being extended.

BCC enters into certain transactions with the Other segment in

the form of intercompany guarantees and other subsidies.

Finance Restructurings

Delta Air Lines, Inc. At December 31, 2006 and 2005, Delta Air

Lines, Inc. (Delta) accounted for $135 million and $161 million

of BCC’s total assets. At December 31, 2006, the Delta portfo-

lio consisted of an investment in an Enhanced Equipment Trust

Certificate (EETC) secured by 12 aircraft. Delta retains certain

rights by operating under Chapter 11 bankruptcy protection.

As of December 31, 2006, Delta has made the contractually

required payments relating to the remaining EETC held by

BCC. BCC does not expect that the Delta bankruptcy, including

the possible return of some or all of the aircraft financed, will

have a material effect on its future earnings, cash flows and/or

financial position.

Northwest Airlines, Inc. At December 31, 2006 and 2005,

Northwest Airlines, Inc. (Northwest) accounted for $349 million

and $494 million of BCC’s total assets. At December 31, 2006,

the Northwest portfolio consisted of notes receivable on six

aircraft and two additional notes receivable. Northwest retains

certain rights by operating under Chapter 11 bankruptcy pro-

tection. On November 8, 2006, the bankruptcy court approved

the restructured terms of certain obligations relating to the

notes receivable. At December 31, 2006, Northwest is current

on payments relating to the notes receivable held by BCC. We

do not expect the Northwest bankruptcy, including the impact

of any restructurings, to have a material effect on our future

earnings, cash flows and/or financial position.

In addition to the customers discussed above, certain other

customers have requested a restructuring of their transactions

with BCC. BCC has not reached agreement on any restruc-

turing requests that it believes would have a material adverse

effect on its earnings, cash flows and/or financial position.

Other Segment

Other segment operating losses were $738 million during

2006 as compared to losses of $363 million in 2005. Major

factors contributing to operating results of the segment are

described below.

During the third quarter of 2006, we announced that we would

exit the Connexion by Boeing high speed broadband communi-

cations business having completed a detailed business and

market analysis. Our decision resulted in a pre-tax charge of

$320 million. (See Note 9). We have not reached final settle-

ments with all customers or suppliers. We do not believe the

final settlements will have a material adverse effect on our

earnings, cash flows and/or financial position.

In 2006, the Other segment recorded valuation allowances for

customer financing losses of $24 million due to deteriorated

airline credit ratings and depressed aircraft values. In 2005,

such provisions were $98 million, which consisted of losses of

$76 million and $22 million, due to decreases in the collateral

values of the 717 and 757, respectively.

In 2006, the Other segment recorded an increase in environ-

mental expense of $68 million primarily related to a write-down

of previously capitalized environmental costs.

In 2005, the Other segment recognized earnings of $63 million

associated with the buyout of several operating lease aircraft by

a customer.

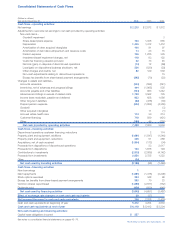

Liquidity and Capital Resources

Cash Flow Summary

(Dollars in millions)

Year ended December 31, 2006 2005 2004

Net earnings $«2,215 $«2,572 $«1,872

Non-cash items 3,097 3,494 3,126

Changes in working capital 2,187 934 (1,494)

Net cash provided by

operating activities 7,499 7,000 3,504

Net cash (used)/provided by

investing activities (3,186)(98)(1,446)

Net cash used by financing activities (3,645)(4,657)(3,487)

Effect of exchange rate changes on

cash and cash equivalents 38 (37)

Net increase/(decrease) in cash and

cash equivalents 706 2,208 (1,429)

Cash and cash equivalents

at beginning of year 5,412 3,204 4,633

Cash and cash equivalents

at end of year $«6,118 $«5,412 $«3,204

Operating Activities Net cash provided by operating activities

increased by $499 million to $7,499 million in 2006. The

increase was primarily due to working capital improvements

which were partially offset by lower Net earnings. The working

capital improvements in 2006 compared with 2005 reflect

$1,340 million of lower pension contributions in 2006. Working

capital reductions in 2006 also reflect higher advances driven

by commercial airplane orders, decreased investment in

34 The Boeing Company and Subsidiaries

Management’s Discussion and Analysis