Boeing 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Boeing Company and Subsidiaries 59

Notes to Consolidated Financial Statements

accounted for $349 and $494 of aircraft financing. The bank-

ruptcy, including the impact of any restructurings, related to

Northwest is not expected to have a material adverse impact

on our earnings, cash flows and/or financial position. Although

certain other customers have requested a restructuring of

their transactions, we do not believe that they would have a

material adverse effect on our earnings, cash flows and/or

financial position.

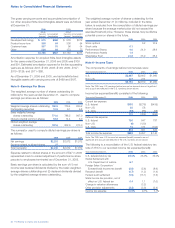

Scheduled payments on customer financing are as follows:

Sales-Type/ Operating

Finance Lease

Principal Lease Equipment

Payments on Payments Payments

Year Notes Receivable Receivable Receivable

2007 $225 $«««440 $«««454

2008 360 314 414

2009 150 305 353

2010 161 292 311

2011 182 334 234

Beyond 2011 737 2,789 1,232

Customer financing assets we leased under capital leases and

subleased to others totaled $137 and $200 at December 31, 2006

and 2005.

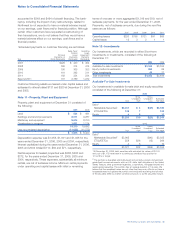

Note 11 – Property, Plant and Equipment

Property, plant and equipment at December 31 consisted of

the following:

2006 2005

Land $««««««524 $««««««481

Buildings and land improvements 8,571 9,287

Machinery and equipment 8,614 8,750

Construction in progress 1,601 1,174

19,310 19,692

Less accumulated depreciation (11,635)(11,272)

$«««7,675 $«««8,420

Depreciation expense was $1,058, $1,001 and $1,028 for the

years ended December 31, 2006, 2005 and 2004, respectively.

Interest capitalized during the years ended December 31, 2006,

2005 and 2004 totaled $110, $84 and $71, respectively.

Rental expense for leased properties was $388, $400 and

$372, for the years ended December 31, 2006, 2005 and

2004, respectively. These expenses, substantially all minimum

rentals, are net of sublease income. Minimum rental payments

under operating and capital leases with initial or remaining

terms of one year or more aggregated $1,019 and $19, net of

sublease payments, for the year ended December 31, 2006.

Payments, net of sublease amounts, due during the next five

years are as follows:

2007 2008 2009 2010 2011

Operating leases $220 $165 $121 $91 $66

Capital leases 123211

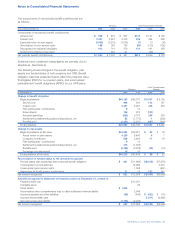

Note 12 – Investments

Our investments, which are recorded in either Short-term

investments or Investments, consisted of the following at

December 31:

2006 2005

Available-for-sale investments $3,344 $3,304

Equity method investments 964 65

Other investments 45 37

Total investments $4,353 $3,406

Available-For-Sale Investments

Our investments in available-for-sale debt and equity securities

consisted of the following at December 31:

2006

Gross Gross

Unrealized Unrealized Estimated

Cost Gain Loss Fair Value

Debt:1

Marketable Securities2$3,201 $««4 $(25)$3,180

ETCs/EETCs 145 7 152

Equity 48 12

$3,350 $19 $(25)$3,344

2005

Gross Gross

Unrealized Unrealized Estimated

Cost Gain Loss Fair Value

Debt:1

Marketable Securities2$3,065 $(40) $3,025

ETCs/EETCs 258 $26 (15) 269

Equity 4 6 10

$3,327 $32 $(55) $3,304

1At December 31, 2006, debt securities with estimated fair values of $1,151

and cost of $1,172 have been in a continuous unrealized loss position for

12 months or longer.

2The portfolio is diversified and highly liquid and primarily consists of investment

grade fixed income instruments such as U.S. dollar debt obligations of the United

States Treasury, other government agencies, corporations, mortgage-backed and

asset-backed securities. The portfolio has an average duration of 1.6 years. We

believe that the unrealized losses are not other-than-temporary. We do not have a

foreseeable need to liquidate the portfolio and anticipate recovering the full value

of the securities either as market conditions improve, or as the securities mature.