Boeing 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 The Boeing Company and Subsidiaries

Notes to Consolidated Financial Statements

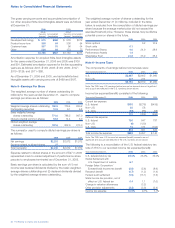

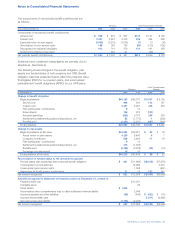

The gross carrying amounts and accumulated amortization of

our other acquired finite-lived intangible assets were as follows

at December 31:

2006 2005

Gross Gross

Carrying Accumulated Carrying Accumulated

Amount Amortization Amount Amortization

Developed technology $«««615 $369 $«««576 $312

Product know-how 308 64 308 54

Customer base 307 51 96 34

Other 536 83 173 75

$1,766 $567 $1,153 $475

Amortization expense for acquired finite-lived intangible assets

for the years ended December 31, 2006 and 2005 was $100

and $91. Estimated amortization expense for the five succeeding

years are as follows: 2007–$148; 2008–$148; 2009–$147;

2010– $129; and 2011– $86.

As of December 31, 2006 and 2005, we had indefinite-lived

intangible assets with carrying amounts of $499 and $197.

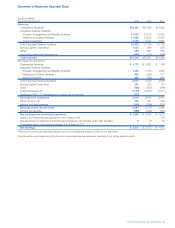

Note 5 – Earnings Per Share

The weighted average number of shares outstanding (in

millions) for the years ended December 31, used to compute

earnings per share are as follows:

2006 2005 2004

Weighted average shares outstanding 760.5 779.4 800.2

Participating securities 10.5 9.1 6.8

Basic weighted average

shares outstanding 771.0 788.5 807.0

Diluted potential common shares 16.6 14.4 6.0

Diluted weighted average

shares outstanding 787.6 802.9 813.0

The numerator used to compute diluted earnings per share is

as follows:

2006 2005 2004

Net earnings $2,215 $2,572 $1,872

Expense related to diluted shares 27

Total numerator $2,242 $2,572 $1,872

Expense related to diluted shares in the amount of $27 in 2006

represented mark-to-market adjustment of performance share

payouts to employees terminated as of December 31, 2005.

Basic earnings per share is calculated by the sum of (1) net

income less declared dividends divided by the basic weighted-

average shares outstanding and (2) declared dividends divided

by the weighted average shares outstanding.

The weighted average number of shares outstanding for the

year ended December 31 (in millions), included in the table

below, is excluded from the computation of diluted earnings per

share because the average market price did not exceed the

exercise/threshold price. However, these shares may be dilutive

potential common shares in the future.

2006 2005 2004

Stock options 0.2 10.9

Stock units 0.1

Performance Shares 4.0 24.9 28.6

Performance Awards 1.4

ShareValue Trust 24.6 33.9 38.4

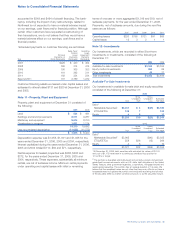

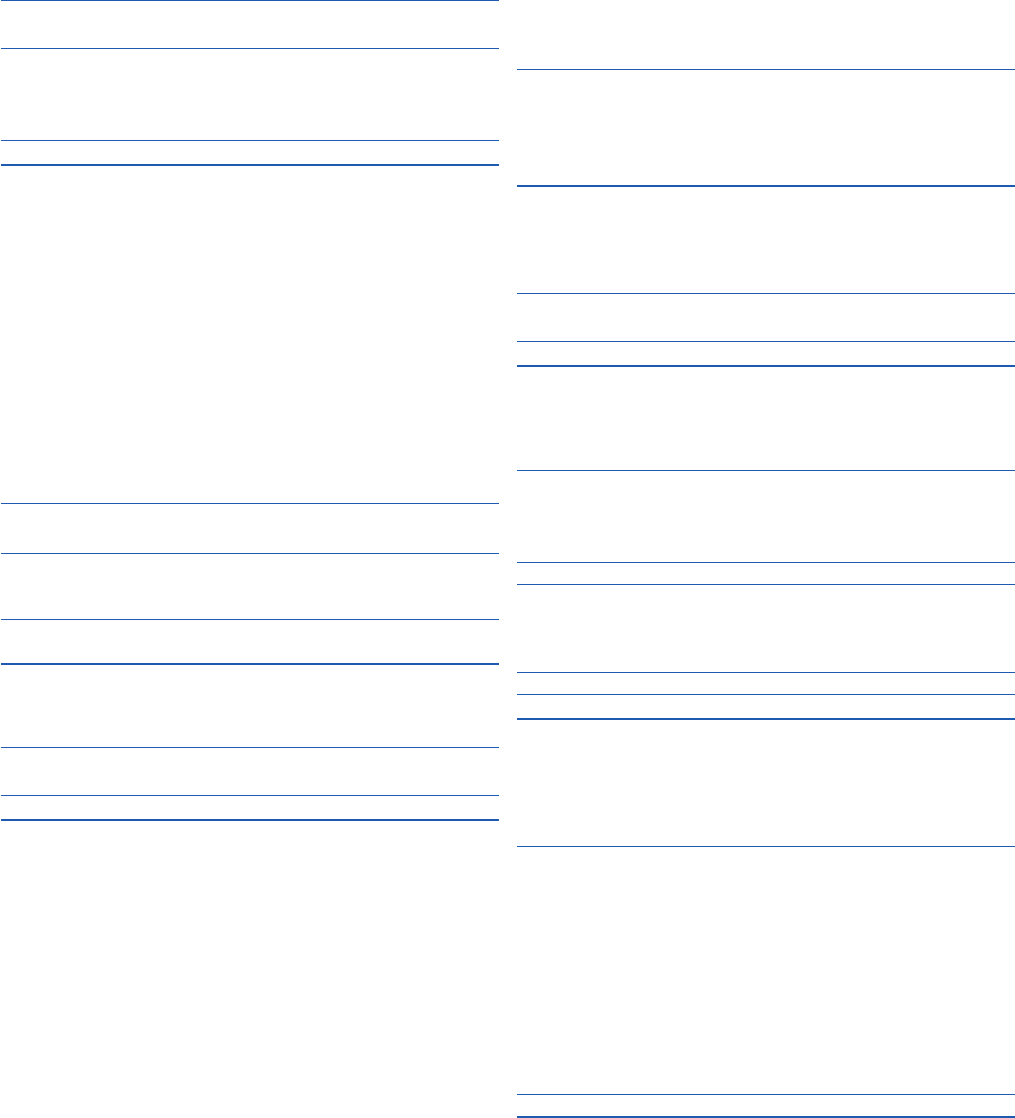

Note 6 – Income Taxes

The components of earnings before income taxes were:

Year ended December 31, 2006 2005 2004

U.S. $3,067 $2,605 $1,960

Non-U.S. 127 214

$3,194 $2,819 $1,960

Note: The 2004 non-U.S. earnings before income tax amounts are not significant

and as such are reflected in the U.S. numbers shown above.

Income tax expense/(benefit) consisted of the following:

Year ended December 31, 2006 2005 2004

Current tax expense

U.S. federal $193 $(276)$(435)

Non-U.S. 35 58

U.S. state (58)(86)(58)

170 (304)(493)

Deferred tax expense

U.S. federal 750 547 787

Non-U.S. (6)(120)

U.S. state 74 134 (154)

818 561 633

Total income tax expense $988 $«257 $«140

Note: The 2004 non-U.S. income tax expense/(benefit) amounts are not

significant and as such are reflected in the U.S. numbers shown above.

The following is a reconciliation of the U.S. federal statutory tax

rate of 35% to our recorded income tax expense/(benefit):

Year ended December 31, 2006 2005 2004

U.S. federal statutory tax 35.0%35.0%35.0%

Global Settlement with

U.S. Department of Justice 6.7

Foreign Sales Corporation/

Extraterritorial Income tax benefit (5.8)(5.6)(8.6)

Research benefit (0.7)(1.2)(1.4)

Federal audit settlement (1.5)(13.1)(7.5)

State income tax provision, net of

effect on U.S. federal tax 0.4 1.1 (7.0)

Change in valuation allowances (3.2)

Other provision adjustments (3.2)(3.9)(3.4)

Income tax expense 30.9%9.1%7.1%