Boeing 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Boeing Company and Subsidiaries 65

Notes to Consolidated Financial Statements

Plan Assets

Pension assets totaled $46,203 and $43,484 at September 30,

2006 and 2005. In late 2006, the pension asset strategy was

modified, with a goal to reduce volatility relative to pension

liabilities, achieve a competitive investment return, achieve

diversification between and within various asset classes, and

manage other risks. In order to reduce the volatility between

the value of pension assets and liabilities, the company is

increasing its allocation to fixed income securities and increas-

ing the duration of its fixed income holdings. The company will

additionally address return and diversification objectives by

increasing its allocation to alternative investments, such as

private equity, real estate, real assets, and hedge funds. Key

risk management areas which we address through this modified

strategy include funded status risk, interest rate risk, market

risk, operational risk, and liquidity.

Actual investment allocations vary from target allocations due

to periodic investment strategy changes and the length of time

it takes to complete investments in asset classes such as

private equity, real estate, and other investments. Additionally,

actual and target allocations vary due to the timing of benefit

payments or contributions made on or near the measurement

date, September 30.

Pension investment managers are retained with a specific

investment role and corresponding investment guidelines.

Investment managers have the ability to purchase securities

on behalf of the pension fund and invest in derivatives, such as

equity or bond futures, swaps, options, or currency forwards.

Derivatives generally are used to achieve the desired market

exposure of a security or an index, to transfer value-added

performance between asset classes, achieve the desired

currency exposure, adjust portfolio duration, or rebalance the

total portfolio to the target asset allocation.

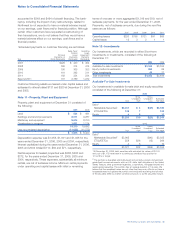

The actual allocations for the pension assets at September 30,

2006 and 2005, and target allocations by asset category, are

as follows:

Percentage of Plan Assets Target

at September 30, Allocations

Asset Category 2006 2005 2006 2005

Equity 55%61%28%50%

Debt 37 31 45 31

Private equity 3366

Real estate 3376

Other 2214 7

100%100%100%100%

Equity includes domestic and international equity securities,

such as common, preferred or other capital stock, as well as

equity futures, currency forwards and residual cash allocated

to the equity managers. Equity includes our common stock in

the amounts of $1,260 (2.8% of plan assets) and $1,494 (3.4%

of plan assets) at September 30, 2006 and 2005. A currency

management strategy was implemented during 2006 which

uses currency forwards and options. Equity and currency

management derivatives based on net notional amounts

totaled 6.6% and 2.3% of plan assets at September 30, 2006

and 2005.

Debt includes domestic and international debt securities,

such as U.S. Treasury securities, U.S. Government agency

securities, corporate bonds and commercial paper; cash

equivalents; investments in bond derivatives such as bond

futures, options, swaps and currency forwards; and redeemable

preferred stock and convertible debt. Bond derivatives based

on net notional amounts totaled 7.0% and 3.9% of plan assets

at September 30, 2006 and 2005. Additionally, Debt includes

“To-Be-Announced” mortgage-backed securities (TBA), which

are contracts to buy or sell mortgage-backed securities to

be delivered at a future agreed upon date, and “Treasury

Forwards”, which similarly have delayed, future settlement

dates. Debt included $1,770 and $1,549 related to TBA securi-

ties and Treasury Forwards at September 30, 2006 and 2005.

Private equity represents private market investments which are

generally limited partnerships. Real estate includes investments

in private and public real estate. The Other category includes

alternative investments such as real assets, global tactical asset

allocation strategies, and hedge funds.

We held $89 and $82 in trust fund assets for OPB plans at

September 30, 2006 and 2005. Most of these funds are

invested in a balanced index fund which is comprised of

approximately 60% equities and 40% debt securities. The

expected rate of return on these assets does not have a

material effect on the net periodic benefit cost.

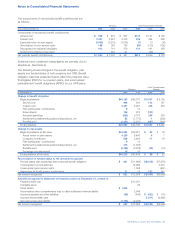

Cash Flows

Contributions Required pension contributions under Employee

Retirement Income Security Act (ERISA) regulations are not

expected to be material in 2007. In February 2007, we made a

discretionary contribution to our plans of $509 (pre-tax). We will

evaluate additional contributions later in the year. We expect to

contribute approximately $17 to our OPB plans in 2007.

Estimated Future Benefit Payments The table below reflects

the total pension benefits expected to be paid from the plans

or from our assets, including both our share of the benefit cost