Boeing 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

capabilities in architectures, system-of-systems integration and

weapon systems technologies to develop solutions which are

designed to enhance our customers’ capabilities in the areas of

situational awareness and survivability. These efforts focus on

increasing mission effectiveness and interoperability, and

improving affordability, reliability and economic ownership.

Continued research and development investments in unmanned

technology and systems have enabled the demonstration of

multi-vehicle coordinated flight and distributed control of high-

performance unmanned combat air vehicles. Research and

development in advanced weapons technologies emphasizes,

among other things, precision guidance and multi-mode target-

ing. Research and development investments in the Global

Tanker Transport Aircraft program represent a significant oppor-

tunity to provide state-of-the-art refueling capabilities to domes-

tic and non-U.S. customers. Investments were also made to

support various intelligence, surveillance, and reconnaissance

business opportunities including P-8A and AEW&C aircraft.

Other research and development efforts include upgrade and

technology insertions to network-enable and enhance the capa-

bility and competitiveness of current product lines such as the

F/A-18E/F Super Hornet, F-15E Eagle, AH-64 Apache, CH-47

Chinook and C-17 Globemaster III.

Backlog PE&MS total backlog decreased 8% from 2005 to

2006 primarily due to deliveries and sales on F/A-18 and F-15

from multi-year contracts awarded in prior years. Total backlog

decreased 13% from 2004 to 2005 primarily due to deliveries

and sales on C-17, F/A-18 and P-8A, and partially offset by

additional F-15 and Chinook orders.

Additional Considerations Items which could have a future

impact on PE&MS operations include the following:

AEW&C During 2006, we recorded charges of $770 million on

our international Airborne Early Warning and Control program.

This development program, also known as Wedgetail in

Australia and Peace Eagle in Turkey, consists of a 737-700

aircraft outfitted with a variety of command and control and

advanced radar systems, some of which have never been

installed on an airplane before. Wedgetail includes six aircraft

and Peace Eagle includes four aircraft. This is an advanced and

complex fixed-price development program involving technical

challenges at the individual subsystem level and in the overall

integration of these subsystems into a reliable and effective

operational capability. The second-quarter charge of $496 mil-

lion included estimated additional program costs and reduc-

tions in expected pricing caused by technical complexities

which resulted in schedule delays and cost growth and

increased the risk of late delivery penalties. The financial impact

recorded in that quarter resulted from a detailed analysis of

flight test data along with a series of additional rigorous techni-

cal and cost reviews after flight testing ramped up. The hard-

ware and software development and integration had not

progressed as quickly as we planned, resulting in the delivery

for the first two aircraft being delayed 15 months. We reorgan-

ized the program to improve systems engineering and integra-

tion and we strengthened the leadership team in both program

management and engineering. In the fourth quarter of 2006,

after a revised estimate of technical progress by us and our

subcontractors, we determined that program subsystems and

software development had not matured as we had anticipated

earlier in the year. We recorded a charge of an additional

$274 million, reflecting further program delays of up to six

months. These programs are ongoing, and while we believe the

most recent cost estimates incorporated in the financial state-

ments are appropriate, the technical complexity of the pro-

grams creates financial risk as additional completion costs may

be necessary or scheduled delivery dates could be missed.

C-17 As of December 31, 2006, we have delivered a total of

159 of the 190 C-17s ordered by the U.S. Air Force, with final

deliveries scheduled for 2009. Despite pending orders, which

would extend deliveries of the C-17 to mid-2009, it is reason-

ably possible that we will decide in 2007 to suspend work on

long-lead items from suppliers and/or to complete production

of the C-17 if further orders are not received. We are still evalu-

ating the full financial impact of a production shut-down, includ-

ing any recovery that would be available from the government.

767 Tanker Program The 767 Tanker Program has orders for

eight 767 Tankers, four from the Italian Air Force and four from

the Japan Self Defense Agency. The USAF is continuing to pur-

sue a replacement for the KC-135 Tanker and has identified it

as its top acquisition priority for 2007. In addition, the Pentagon

requested funding for the development phase of the program in

its 2008 budget request in February 2007. We remain firmly

committed to the USAF Tanker program and are ready to sup-

port our customer in whatever decision is made regarding the

recapitalization of the nation’s current aerial refueling fleet.

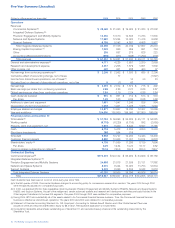

Network and Space Systems Operating Results

(Dollars in millions) 2006 2005 2004

Revenues $11,980 $12,254 $13,023

% of Total Company Revenues 19%23%25%

Operating Earnings $÷÷«958 $÷1,399 $÷÷«577

Operating Margins 8.0%11.4%4.4%

Research and Development $÷÷«301 $÷÷«334 $÷«÷357

Contractual Backlog $÷8,001 $÷6,324 $10,923

Unobligated Backlog $23,723 $27,634 $25,019

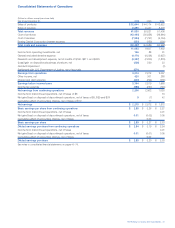

Revenues N&SS revenues decreased 2% in 2006 and 6% in

2005 as significant growth in FCS and higher Delta IV volume

were offset by lower volume in Proprietary and GMD as well as

the divestiture of our Rocketdyne business. Additional impacts

resulted from fewer milestone completions in our commercial

satellite business in 2006 and the completion of a Homeland

Security contract in 2005.

Launch and new-build satellite deliveries were as follows:

2006 2005 2004

Delta II 224

Delta IV 3––

Commercial/Civil Satellites 432

Operating Earnings N&SS operating earnings decreased

$441 million from 2005 to 2006 and increased $822 million

from 2004 to 2005 driven by significant items in all three

periods. The decrease from 2005 to 2006 was driven by the

$569 million net gain on the Rocketdyne sale and higher con-

tract values for Delta IV launch contracts in 2005, partially

The Boeing Company and Subsidiaries 31

Management’s Discussion and Analysis