Boeing 2006 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consolidated Results of Operations

and Financial Condition

Overview

We are a global market leader in design, development, manu-

facturing, sale and support of commercial jetliners, military air-

craft, satellites, missile defense, human space flight and launch

systems and services. We are one of the two major manufac-

turers of 100+ seat airplanes for the worldwide commercial air-

line industry and the second-largest defense contractor in the

U.S. While our principal operations are in the U.S., we rely

extensively on a network of partners, key suppliers and subcon-

tractors located around the world.

Our business strategy is centered on successful execution in

healthy core businesses — Commercial Airplanes and

Integrated Defense Systems (IDS) — supplemented and sup-

ported by Boeing Capital Corporation (BCC). Taken together,

these core businesses generate substantial earnings and cash

flow that permit us to invest in new products and services that

open new frontiers in aerospace. We focus on producing the

airplanes the market demands and we price our products to

provide a fair return for our shareholders while continuing to find

new ways to improve efficiency and quality. IDS is a defense

systems business that integrates its resources in defense, intel-

ligence, communications and space to deliver capability-driven

solutions to its customers at reduced costs. Our strategy is to

leverage our core businesses with a simultaneously intense

focus on growth and productivity. Our strategy also benefits as

commercial and defense markets often offset each others’

cyclicality. BCC delivers value through supporting our business

units and managing overall financial exposures.

In 2006, our revenues grew by 15 percent. Earnings from oper-

ations increased 7%. We continued to invest in key growth pro-

grams as Research and Development expense grew by 48% to

$3.3 billion, reflecting increased spending on the 787 and 747-8

programs and lower cost sharing payments from suppliers.

We generated operating cash flow of $7.5 billion driven by

operating and working capital performance. We reduced debt

by $1.2 billion and repurchased 25 million common shares. Our

contractual backlog grew 35% to $217 billion, driven by 40%

growth at Commercial Airplanes while our total backlog grew

22% to $250 billion. At the end of 2006, we implemented new

accounting rules for pensions and other postretirement benefits,

which together with the annual remeasurement of our pension

plans reduced our shareholders’ equity by $6.5 billion. This

decrease did not affect cash flows or the funded status of our

benefit plans.

We expect continued growth in Commercial Airplane revenues

and deliveries as we execute our record backlog and respond to

global demand by ramping up commercial aircraft production.

We expect IDS revenue to be slightly lower in 2007 and antici-

pate that the U.S. Department of Defense (U.S. DoD) budget

growth will moderate over the next several years. We are

focused on improving financial performance through a combi-

nation of productivity and customer-focused growth.

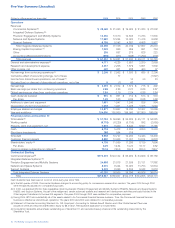

Consolidated Results of Operations

Revenues

(Dollars in millions)

Year ended December 31, 2006 2005 2004

Commercial Airplanes $28,465 $21,365 $19,925

Integrated Defense Systems 32,439 31,106 30,739

Boeing Capital Corporation 1,025 966 959

Other 299 657 275

Accounting differences/eliminations (698)(473)(498)

Total revenues $61,530 $53,621 $51,400

Higher consolidated revenues in 2006 were primarily due to

higher new commercial aircraft deliveries. IDS revenues were up

moderately in 2006 as growth in Precision Engagement and

Mobility Systems and Support Systems was partially offset by

lower volume in Network and Space Systems. BCC revenues

increased in 2006 primarily due to higher investment income and

higher net gain on disposal of assets. Other segment revenues

decreased in 2006 as a result of the buyout of several operating

lease aircraft in the amount of $369 million in 2005. In addition,

revenues decreased in Accounting differences/eliminations due

to higher Commercial Airplanes intercompany deliveries in 2006.

Consolidated revenues also increased in 2005 as compared to

2004. The increase was due to the growth at Commercial

Airplanes driven by higher new aircraft deliveries, increased spares

and aircraft modifications, and higher used aircraft sales. IDS

revenues remained stable in 2005 after strong growth in 2004.

BCC revenues for 2005 were essentially unchanged from 2004.

Earnings from Operations

The following table summarizes our earnings from operations:

(Dollars in millions)

Year ended December 31, 2006 2005 2004

Commercial Airplanes $«2,733 $«1,431 $÷÷745

Integrated Defense Systems 3,032 3,919 2,936

Boeing Capital Corporation 291 232 183

Other (738)(363)(546)

Unallocated expense (1,733)(2,407)(1,311)

Global Settlement with

U.S. Department of Justice (571)

Earnings from operations $«3,014 $«2,812 $«2,007

Our earnings from operations increased in 2006 compared to

2005 primarily driven by improved earnings at Commercial

Airplanes and lower unallocated expense. This was partially

offset by a $571 million charge for global settlement with

U.S. Department of Justice (see Note 22), lower IDS earnings

reflecting a $569 million net gain on the sale of our Rocketdyne

business in 2005 and $770 million of charges on the Airborne

Early Warning & Control (AEW&C) development program in

2006 partially offset by improved margins on other programs

and a $320 million charge related to the exit of the Connexion

by Boeing business recorded in Other segment. (See Note 9).

An increase in earnings from operations in 2005 compared to

2004 was primarily due to strong operating performance by our

business segments partially offset by higher unallocated

expense. Included in 2004 results is a charge of $555 million

related to the United States Air Force (USAF) 767 tanker program

and expenses incurred to end production of the 717 aircraft.

24 The Boeing Company and Subsidiaries

Management’s Discussion and Analysis of Financial Condition and Results of Operations