Boeing 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The airline industry is becoming increasingly competitive result-

ing in airlines focusing on increasing productivity and improving

service levels. Airlines are changing many aspects of their oper-

ations including simplifying fleets, distribution, and pricing; out-

sourcing non-essential operations; reducing labor costs and

airport costs; increasing asset utilization; and developing new

business models through innovations in network structure, fare

structures, service levels and distribution networks. Such changes

are providing new opportunities for airline industry suppliers.

Worldwide, many airlines continue reporting operating profits

although performance varies significantly by region and busi-

ness model. Recent industry financials generally show increasing

unit revenues and rising fares. Cost-cutting initiatives and effi-

ciency improvements are helping many airlines remain profitable

despite intense competition and high fuel prices. Fuel costs

now comprise one quarter of airline operating costs compared

to less than 15% three years ago. Overall, the industry is fore-

cast to lose half a billion dollars in 2006, but return to profitabil-

ity in 2007. Many airlines that are growing to meet increased

demand are acquiring new capacity from manufacturers.

The industry remains vulnerable to near-term exogenous devel-

opments including disease outbreaks (such as avian flu), the

threat of terrorism, global economic imbalances, increasing

global environmental concerns and fuel prices. Fuel prices are

forecast to remain elevated and volatile in the near-term due to

strong demand driven by economic growth and minimal surplus

capacity to cushion against supply shocks.

Industry Competitiveness The commercial jet aircraft market and

the airline industry remain extremely competitive. We expect the

existing long-term downward trend in passenger revenue yields

worldwide (measured in real terms) to continue into the foresee-

able future. Market liberalization in Europe and Asia has contin-

ued to enable low-cost airlines to gain market share. These

airlines have increased the downward pressure on airfares. This

results in continued cost pressures for all airlines and price pres-

sure on our products. Major productivity gains are essential to

ensure a favorable market position at acceptable profit margins.

Continued access to global markets remains vital to our ability

to fully realize our sales potential and long-term investment

returns. Approximately two-thirds of Commercial Airplanes’

sales and contractual backlog are from customers based

outside the United States.

We face aggressive international competitors who are intent on

increasing their market share. They offer competitive products

and have access to most of the same customers and suppliers.

Airbus has historically invested heavily to create a family of

products to compete with ours. Regional jet makers Embraer

and Bombardier, coming from the less than 100-seat commer-

cial jet market, continue to develop larger and more capable

airplanes. This market environment has resulted in intense

pressures on pricing and other competitive factors.

Worldwide, airplane sales are generally conducted in U.S. dol-

lars. Fluctuating exchange rates affect the profit potential of

our major competitors, all of whom have significant costs in

other currencies. A decline of the U.S. dollar relative to their

local currencies puts pressure on competitors’ revenues and

profits. Competitors often respond by aggressively reducing

costs and increasing productivity, thereby improving their

longer-term competitive posture. Airbus has recently

announced such initiatives targeting a two-year reduction in its

development cycle and a 20% increase in overall productivity

by 2010. If the U.S. dollar strengthens, Airbus can use the extra

efficiency to develop new products and gain market share.

We are focused on improving our processes and continuing

cost-reduction efforts. We continue to leverage our extensive

customer support services network which includes aviation

support, spares, training, maintenance documents and

technical advice for airlines throughout the world. This enables

us to provide a higher level of customer satisfaction and pro-

ductivity. These efforts enhance our ability to pursue pricing

strategies that enable us to price competitively and maintain

satisfactory margins.

Operating Results

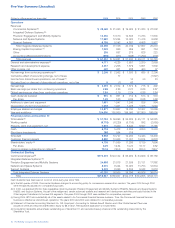

(Dollars in millions) 2006 2005 2004

Revenues* $÷28,465 $÷21,365 $19,925

% of Total Company Revenues 46%40%39%

Operating Earnings $÷÷2,733 $÷÷1,431 $÷«÷745

Operating Margins 9.6%6.7%3.7%

Research and Development $÷÷2,390 $÷÷1,302 $÷÷«941

Contractual Backlog* $174,276 $124,132 $65,482

*Note: In the first quarter of 2006, Commercial Airplanes changed its accounting

policy for concessions received from vendors. The years 2005 and 2004 were

retroactively adjusted for comparative purposes. (See Note 1).

Revenues The increase in revenue of approximately $7,100 mil-

lion in 2006 from 2005 was primarily attributable to higher new

airplane deliveries, including model mix changes, of $6,820 mil-

lion, increased aircraft modification and spares business of

$873 million offset by $593 million primarily attributable to lower

revenue from aircraft trading.

The increase in revenue of $1,440 million in 2005 from 2004

was primarily attributable to higher new airplane deliveries,

including model mix changes, of $845 million, used airplane

sales of $302 million and $293 million primarily attributable to

aircraft modification, and spares.

Increased deliveries in 2005 were achieved despite delivering

29 fewer than expected airplanes due to the IAM strike during

the month of September 2005. This resulted in approximately

$2,000 million lower revenue than anticipated for 2005.

Commercial jet aircraft deliveries as of December 31, including

deliveries under operating lease, which are identified by paren-

theses, were as follows:

26 The Boeing Company and Subsidiaries

Management’s Discussion and Analysis