Boeing 2006 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Boeing Company and Subsidiaries 39

Management’s Discussion and Analysis

Goodwill Impairment

Goodwill and other acquired intangible assets with indefinite

lives are not amortized but are tested for impairment annually,

and when an event occurs or circumstances change such that

it is reasonably possible that an impairment may exist. Our

annual testing date is April 1. We test goodwill for impairment

by first comparing the book value of net assets to the fair value

of the related operations. If the fair value is determined to be

less than book value, a second step is performed to compute

the amount of the impairment. In this process, a fair value for

goodwill is estimated, based in part on the fair value of the

operations, and is compared to its carrying value. The shortfall

of the fair value below carrying value represents the amount of

goodwill impairment.

We estimate the fair values of the related operations using dis-

counted cash flows. Forecasts of future cash flows are based

on our best estimate of future sales and operating costs, based

primarily on existing firm orders, expected future orders, con-

tracts with suppliers, labor agreements, and general market

conditions. Changes in these forecasts could significantly

change the amount of impairment recorded, if any.

The cash flow forecasts are adjusted by an appropriate dis-

count rate derived from our market capitalization plus a suitable

control premium at the date of evaluation. Therefore, changes

in the stock price may also affect the amount of impairment

recorded. At the date of our previous impairment test, a 10%

increase or decrease in the value of our common stock would

have had no impact on the financial statements.

Postretirement Plans

We have defined benefit pension plans covering substantially all

our employees. We also have postretirement benefits consisting

principally of healthcare coverage for eligible retirees and quali-

fying dependents. Accounting rules require an annual measure-

ment of our projected obligations and plan assets. These

measurements require several assumptions, the most significant

of which are the discount rate, the expected long-term rate of

asset return, and the medical trend rate (rate of growth for

medical costs). Changes in assumptions can significantly affect

our future annual expense. In addition, as result of our adoption

of SFAS No. 158, changes in assumptions could significantly

increase or decrease Shareholders’ Equity (net of taxes) at

future measurement dates.

We use a discount rate that is based on a point-in-time esti-

mate as of our September 30 annual measurement date.

Changes in the discount rate will increase or decrease our

recorded liabilities with a corresponding adjustment to

Shareholders’ Equity as of the measurement date. In future

reporting periods, the adjustment for a change in the discount

rate will be recognized in Other comprehensive loss in the

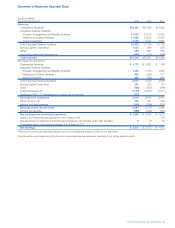

period in which it occurs. In the following table, we show the

sensitivity of our pension and other postretirement benefit plan

liabilities and net periodic cost to a 25 basis point change in

the discount rate.

As of September 30, 2006 (Dollars in millions)

Change in discount rate

Increase 25 bps Decrease 25 bps

Pension Plans

Projected benefit obligation (pensions) (1,271) 1,555

Net periodic pension cost (145) 165

Other postretirement benefit plans

Accumulated postretirement

benefit obligation (181) 212

Net periodic postretirement benefit cost (14) 15

Pension expense is also sensitive to changes in the expected

long-term rate of asset return. An increase or decrease of

25 basis points in the expected long-term rate of asset return

would have increased or decreased 2006 pension income by

approximately $108 million. Differences between the actual

return on plan assets and the expected long-term rate of return

are reflected in Shareholders’ Equity (net of taxes) as of our

annual measurement date. In future reporting periods, the

difference between the actual return on plan assets and the

expected long-term rate of return will be recognized in Other

comprehensive loss in the period in which it occurs.

The assumed medical trend rates have a significant affect on the

following year’s expense recorded liabilities and Shareholders’

Equity. In the following table, we show the sensitivity of our

other postretirement benefit plan liabilities and net periodic cost

to a 100 basis point change.

As of September 30, 2006 (Dollars in millions)

Change in medical trend rate

Increase 100 bps Decrease 100 bps

Other postretirement benefit plans

Accumulated postretirement

benefit obligation 683 (652)

Net periodic postretirement benefit cost 127 (116)

Standards Issued and Not Yet Implemented

See Note 2 in the Notes to our consolidated financial state-

ments included herein.

Contingent Items

Various legal proceedings, claims and investigations are pend-

ing against us. Most significant legal proceedings are related

to matters covered by our insurance. Major contingencies are

discussed in Note 22, including our contesting the default ter-

mination of the A-12 aircraft, employment and benefits litigation

brought by several of our employees, and litigation/arbitration

involving BSSI.