Boeing 2006 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.74 The Boeing Company and Subsidiaries

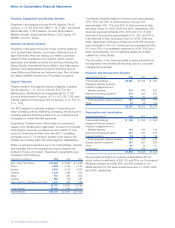

Notes to Consolidated Financial Statements

Note 22 – Legal Proceedings

Various legal proceedings, claims and investigations related

to products, contracts and other matters are pending against

us. Many potentially significant legal proceedings are related

to matters covered by our insurance. Potential material

contingencies are discussed below.

We are subject to various U.S. Government investigations,

from which civil, criminal or administrative proceedings could

result or have resulted. Such proceedings involve, or could

involve claims by the Government for fines, penalties,

compensatory and treble damages, restitution and/or forfeitures.

Under government regulations, a company, or one or more of

its operating divisions or subdivisions, can also be suspended

or debarred from government contracts, or lose its export

privileges, based on the results of investigations. We believe,

based upon current information, that the outcome of any such

government disputes and investigations will not have a

material adverse effect on our financial position, except as

set forth below.

A-12 Litigation

In 1991, the U.S. Navy notified McDonnell Douglas Corporation

(now one of our subsidiaries) and General Dynamics Corporation

(together, the Team) that it was terminating for default the

Team’s contract for development and initial production of the

A-12 aircraft. The Team filed a legal action to contest the

Navy’s default termination, to assert its rights to convert the

termination to one for “the convenience of the Government,”

and to obtain payment for work done and costs incurred on the

A-12 contract but not paid to date. As of December 31, 2006,

inventories included approximately $584 of recorded costs

on the A-12 contract, against which we have established a

loss provision of $350. The amount of the provision, which

was established in 1990, was based on McDonnell Douglas

Corporation’s belief, supported by an opinion of outside

counsel, that the termination for default would be converted to

a termination for convenience, and that the best estimate of

possible loss on termination for convenience was $350.

On August 31, 2001, the U.S. Court of Federal Claims issued

a decision after trial upholding the Government’s default termi-

nation of the A-12 contract. The court did not, however, enter

a money judgment for the U.S. Government on its claim for

unliquidated progress payments. In 2003, the Court of Appeals

for the Federal Circuit, finding that the trial court had applied

the wrong legal standard, vacated the trial court’s 2001 decision

and ordered the case sent back to that court for further

proceedings. This follows an earlier trial court decision in favor

of the Team and reversal of that initial decision on appeal.

If, after all judicial proceedings have ended, the courts

determine, contrary to our belief, that a termination for default

was appropriate, we would incur an additional loss of approxi-

mately $275, consisting principally of remaining inventory costs

and adjustments, and, if the courts further hold that a money

judgment should be entered against the Team, we would be

required to pay the U.S. Government one-half of the unliqui-

dated progress payments of $1,350 plus statutory interest from

February 1991 (currently totaling approximately $1,270). In that

event, our loss would total approximately $1,585 in pre-tax

charges. Should, however, the March 31, 1998 judgment of the

U.S. Court of Federal Claims in favor of the Team be reinstated,

we would be entitled to receive payment of approximately

$1,056, including interest.

We believe that the termination for default is contrary to

law and fact and that the loss provision established by

McDonnell Douglas Corporation in 1990, which was supported

by an opinion from outside counsel, continues to provide

adequately for the reasonably possible reduction in value of

A-12 net contracts in process as of December 31, 2006.

Final resolution of the A-12 litigation will depend upon the

outcome of further proceedings or possible negotiations with

the U.S. Government.

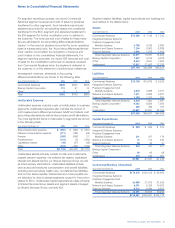

Global Settlement of the Evolved Expendable Launch

Vehicle (EELV) and Druyun Matters

On June 30, 2006, we entered into a global settlement

through two separate agreements disposing of potential

criminal charges and civil claims with the Civil Division of the

U.S. Justice Department and U.S. Attorneys in Los Angeles,

CA and Alexandria, VA relating to two separate procurement

integrity incidents. The first incident in 1999, involved posses-

sion by four Boeing employees of Lockheed Martin competitor

information related to the EELV program. The second incident

related to conflict of interest charges in hiring former govern-

ment official Darleen Druyun. In the agreement with the U.S.

Attorneys in Los Angeles and Alexandria, we agreed to pay a

$50 penalty, committed to maintaining our strengthened ethics

and compliance program for the two-year term of the agree-

ment (through June 2008) and agreed to provide both U.S.

Attorneys offices with certain compliance reports. Concurrent

with entering into the U.S. Attorney agreement, we entered into

a Civil Agreement with the Civil Division of the U.S. Department

of Justice under which we agreed to pay $565 in settlement of

all potential civil claims. We are also subject to an Administrative

Agreement with the U.S. Air Force through March 2008 which

requires certain compliance activities and reports.

As a result of the global settlement, we have recorded an

additional expense of $571, which represents the cumulative

payment of $615 under the two separate agreements, net of

$44 previously accrued in connection with program and

contracts issues relating to the EELV investigation.

One additional proceeding that relates to the subject matter of

the global settlement is Lockheed’s June 2003 lawsuit against

us in the U.S. District Court for the Middle District of Florida

based upon the EELV incident wherein Lockheed sought

injunctive relief, compensatory damages in excess of $2,000,

and treble damages and punitive damages, and we filed

counterclaims against Lockheed similarly seeking compensatory

and punitive damages. Proceedings in that lawsuit had been