Boeing 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Boeing Company and Subsidiaries 55

Notes to Consolidated Financial Statements

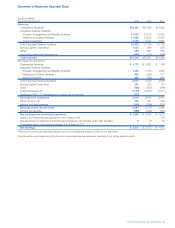

Significant components of our deferred tax assets, net of

deferred tax liabilities, at December 31 were as follows:

2006 2005

Retiree health care accruals $«3,257 $«2,314

Inventory and long-term contract methods

of income recognition 640 1,368

Other employee benefits accruals 1,473 1,363

In-process research and development

related to acquisitions 124 137

Net operating loss, credit, and charitable

contribution carryovers (net of valuation

allowance of $2 and $0) 319 494

Pension benefit accruals (397)(3,688)

Customer and commercial financing (1,517)(1,442)

Unremitted earnings of non-U.S. subsidiaries (48)(32)

Other net unrealized losses 37 8

Net deferred tax assets* $«3,888 $««««522

*Of the deferred tax asset for net operating loss and credit carryovers, $172

expires in years ending from December 31, 2007 through December 31, 2026

and $147 may be carried over indefinitely.

Net deferred tax assets at December 31 were as follows:

2006 2005

Deferred tax assets $12,174 $8,168

Deferred tax liabilities (8,284)(7,646)

Valuation allowance (2)

Net deferred tax assets $««3,888 $«««522

As a result of acquisitions in 2006, primarily related to Aviall, a

net deferred tax liability of $171 was recorded.

As required under SFAS No.123R, a deferred tax liability of

$306 was reclassified to Additional paid in capital. This repre-

sents the tax effect of the net excess tax pool created during

2006 due to share awards paid with a fair market value in

excess of the book accrual for those awards.

Net income tax payments/(refunds) were $28, ($344) and

($903) in 2006, 2005 and 2004, respectively.

We have provided for U.S. deferred income taxes and foreign

withholding tax in the amount of $48 on undistributed earnings

not considered permanently reinvested in our non-U.S. sub-

sidiaries. We have not provided for U.S. deferred income taxes

or foreign withholding tax on the remainder of undistributed

earnings from our non-U.S. subsidiaries because such earnings

are considered to be permanently reinvested and it is not

practicable to estimate the amount of tax that may be payable

upon distribution.

Within the Consolidated Statements of Operations, Other

income included interest of $16 in 2006, $100 in 2005 and

$219 in 2004 related to federal income tax settlements for

prior years.

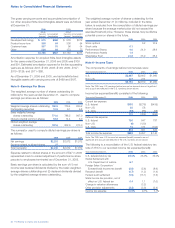

Contingencies

We are subject to income taxes in the U.S. and numerous

non-U.S. jurisdictions.

Amounts accrued for potential tax assessments recorded in

current tax liabilities total $960 and $900 at December 31, 2006

and 2005. Accruals relate to tax issues for U.S. federal, U.S.

state, and taxation of non-U.S. earnings as follows:

RThe accruals associated with U.S. federal tax issues

such as the tax benefits from the Foreign Sales

Corporation/Extraterritorial Income (FSC/ETI) tax rules, the

amount of research and development tax credits claimed,

U.S. taxation of non-U.S. earnings, and valuation issues

regarding charitable contributions claimed were $841 at

December 31, 2006, and $771 at December 31, 2005. IRS

examinations have been completed through 2001. We have

filed an appeal with the IRS for 1998-2001. During 2006,

we settled the McDonnell Douglas Corporation appeal for

1993-1997 which had the effect of decreasing federal

income tax expense by $46.

RThe accruals for domestic state tax issues such as the

allocation of income among various state tax jurisdictions

and the amount of state tax credits claimed were $88 at

December 31, 2006 and $98 at December 31, 2005, net

of federal benefit.

RThe accruals associated with taxation of non-U.S. earnings

were $31 at December 31, 2006 and 2005.

We believe adequate provisions for all outstanding issues have

been made for all jurisdictions and all open years.

Legislative Update

On May 17, 2006, the Tax Increase Prevention and

Reconciliation Act of 2005 was enacted, which repealed the

FSC/ETI exclusion tax benefit binding contract provisions of

the American Jobs Creation Act of 2004. Therefore, 2006 will

be the final year for recognizing any export tax benefits. The

2006 effective tax rate was reduced by 5.8% due to export

tax benefits.

Effective December 31, 2005, the U.S. research tax credit

expired. On December 20, 2006, President Bush signed into

law, the Tax Relief and Health Care Act of 2006 that retroac-

tively renews the research tax credit for 2006 and extends

the credit through December 31, 2007.