Boeing 2006 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

737 Next-Generation The accounting quantity for the 737 Next-

Generation program increased by 400 units during 2006 due to

the program’s normal progression of obtaining additional orders

and delivering aircraft.

747 Program In November 2005, we launched the 747-8 family,

which includes the 747-8 Intercontinental passenger airplane

and the 747-8 Freighter. This launch and additional firm orders

have extended the life of this program and have also solidified

product strategy. The accounting quantity for the 747 program

increased by 25 units during 2006. During 2006, we completed

firm configuration of the 747-8 Freighter and the same is

expected for the passenger version in 2007. Deliveries of the

first 747-8 Freighter and Intercontinental passenger airplane are

targeted for late 2009 and late 2010.

767 Program During 2005 and 2006 the 767 program obtained

additional orders, including 10 firm orders during 2006. In

addition, on February 5, 2007, a customer announced its plans

to order 27 767-300 Extended Range Freighters. We continue

pursuing market opportunities for additional 767 sales.

777 Program The accounting quantity for the 777 program

increased by 100 units during 2006 as a result of the

program’s normal progression of obtaining additional orders

and delivering aircraft.

787 Program As we progress toward first flight and entry into

service of the 787, we continue to manage pressures with

respect to weight, schedule, and supplier implementation as

they arise. There are inherent risks associated with the develop-

ment and production of any new airplane, which can impact

expectations. But we still continue to expect delivery of the

787 on schedule and in accordance with our contractual obli-

gations. We are preparing for the first test flight of the 787 in

2007, and for entry into service in 2008.

A key milestone of the program was achieved in 2006 with the

initial flight of the first 747-400 Large Cargo Freighter (LCF),

called the DreamLifter. These specially-modified freighters will

transport major composite structures of the 787 airplanes.

Other key events during 2006 were the first shipment of a major

assembly between supplier partners and the introduction of a

digital computer simulation of the entire 787 production and

assembly process.

Completed Programs

717 Program On January 12, 2005, we announced our deci-

sion to complete production of the 717 aircraft during 2006

due to the lack of overall market demand. The final 717 was

delivered in the second quarter of 2006.

757 Program Production of the 757 program ended in

October 2004. The last aircraft was delivered in the second

quarter of 2005.

For additional information regarding termination liabilities

remaining in Accounts payable and other liabilities for these

two programs see Note 23.

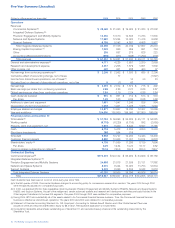

Deferred Production Costs Deferred production costs represent

commercial aircraft inventory production costs incurred on in-

process and delivered units in excess of the estimated average

cost of such units using program accounting. As of December

31, 2006 and 2005 deferred production costs relate to the 777

program and there were no significant excess deferred produc-

tion costs or unamortized tooling costs not recoverable from

existing firm orders.

The deferred production costs and unamortized tooling

included in the 777 program’s inventory at December 31 are

summarized in the following table:

(Dollars in millions) 2006 2005

Deferred production costs $871 $683

Unamortized tooling 329 411

As of December 31, 2006 and 2005, the balance of deferred

production costs and unamortized tooling related to all other

commercial aircraft programs was insignificant relative to the

programs’ balance-to-go cost estimates.

Fleet Support We provide the operators of our commercial air-

planes with assistance and services to facilitate efficient and

safe aircraft operation. Collectively known as fleet support serv-

ices, these activities and services begin prior to aircraft delivery

and continue throughout the operational life of the aircraft. They

include flight and maintenance training, field service support

costs, engineering services and technical data and documents.

The costs for fleet support are expensed as incurred and have

been historically less than 1.5% of total consolidated costs of

products and services. This level of expenditures is anticipated

to continue in the upcoming years. These costs do not vary

significantly with current production rates.

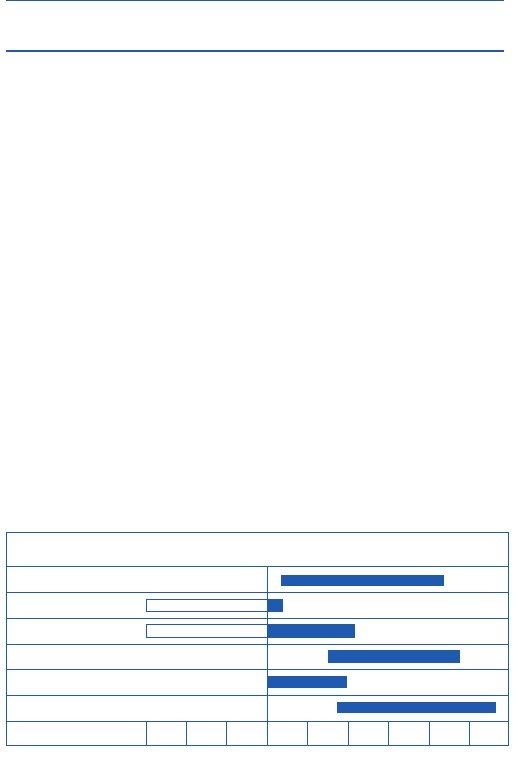

Research and Development The following chart summarizes the

time horizon between go-ahead and certification/initial delivery

for major Commercial Airplanes derivatives and programs.

Our Research and development expense increased $1,088 mil-

lion and $361 million in 2006 and 2005. Research and develop-

ment expense is net of development cost sharing payments

received from suppliers. The increase in 2006 was due to

higher spending of $636 million, primarily on 787 and 747-8,

and $452 million of lower supplier development cost sharing

payments. The increase during 2005 was primarily due to

increased spending on the 787 program and was partially offset

by supplier development cost sharing payments. During the

second and third quarters of 2006, we increased our research

and development expense forecasts for 2006 and 2007 to

28 The Boeing Company and Subsidiaries

Management’s Discussion and Analysis

01 02 03 04 05 06 07 08 09

787-8

777-300ER*

777-200LR*

777-F

747-400BCF

747-8

*Go-ahead prior to 2004.

Go-ahead and Certification/Delivery