Boeing 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.48 The Boeing Company and Subsidiaries

Notes to Consolidated Financial Statements

Fleet Support

We provide the operators of all our commercial airplane models

assistance and services to facilitate efficient and safe aircraft

operation. Collectively known as fleet support services, these

activities and services include flight and maintenance training,

field service support costs, engineering services and technical

data and documents. Fleet support activity begins prior to air-

craft delivery as the customer receives training, manuals and

technical consulting support, and continues throughout the

operational life of the aircraft. Services provided after delivery

include field service support, consulting on maintenance, repair,

and operational issues brought forth by the customer or regula-

tors, updating manuals and engineering data, and the issuance

of service bulletins that impact the entire model’s fleet. Field

service support involves our personnel located at customer

facilities providing and coordinating fleet support activities and

requests. The costs for fleet support are expensed as incurred

as Cost of services.

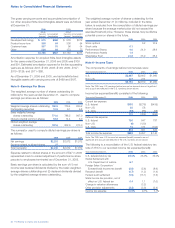

Research and Development

Research and development (R&D) includes costs incurred

for experimentation, design and testing and are expensed as

incurred unless the costs are related to certain contractual

arrangements. Costs that are incurred pursuant to such

contractual arrangements are recorded over the period that

revenue is recognized, consistent with our contract accounting

policy. We have certain research and development arrange-

ments that meet the requirement for best efforts research and

development accounting. Accordingly, the amounts funded by

the customer are recognized as an offset to our research and

development expense rather than as contract revenues.

We have established cost sharing arrangements with some

suppliers for the 787 program, which have enhanced our

internal development capabilities and have offset a substantial

portion of the financial risk of developing this aircraft. Our cost

sharing arrangements explicitly state that the supplier contribu-

tions are for reimbursements of costs we incur for experimenta-

tion, basic design and testing activities during the development

of the 787. In each arrangement, we retain substantial rights to

the 787 part or component covered by the arrangement. The

amounts received from these cost sharing arrangements are

recorded as a reduction to research and development expenses

since we have no obligation to refund any amounts received per

the arrangements regardless of the outcome of the development

efforts. Specifically, under the terms of each agreement, pay-

ments received from suppliers for their share of the costs are

typically based on milestones and are recognized as earned

when we achieve the milestone events and no ongoing obligation

on our part exists. In the event we receive a milestone payment

prior to the completion of the milestone, the amount will be

classified in Accounts payable and other liabilities until earned.

Share-based Compensation

Our primary types of share-based compensation consist of

Performance Shares, ShareValue Trust distributions, stock

options and other stock unit awards.

In 2005 we adopted the provisions of SFAS No. 123 (Revised

2004), Share-Based Payment (SFAS No. 123R) using the modi-

fied prospective method. Prior to 2005, we used a fair value

based method of accounting for share-based compensation

provided to our employees in accordance with SFAS No. 123.

(See Note 16).

Income Taxes

Provisions for federal, state and non-U.S. income taxes are

calculated on reported Earnings before income taxes based

on current tax law and also include, in the current period, the

cumulative effect of any changes in tax rates from those used

previously in determining deferred tax assets and liabilities.

Such provisions differ from the amounts currently receivable

or payable because certain items of income and expense are

recognized in different time periods for financial reporting

purposes rather than for income tax purposes. Significant

judgment is required in determining income tax provisions and

evaluating tax positions. We establish reserves for income tax

when, despite the belief that our tax positions are fully support-

able, we believe that it is probable that our positions will be

challenged and possibly disallowed by various authorities. The

consolidated tax provision and related accruals include the

impact of such reasonably estimable losses and related interest

and penalties as deemed appropriate. To the extent that the

probable tax outcome of these matters changes, such changes

in estimate will impact the income tax provision in the period in

which such determination is made.

Postretirement Plans

We sponsor various pension plans covering substantially all

employees. We also provide postretirement benefit plans other

than pensions, consisting principally of healthcare coverage to

eligible retirees and qualifying dependents. Benefits under the

pension and other postretirement benefit plans are generally

based on age at retirement and years of service and for some

pension plans, benefits are also based on the employee’s annual

earnings. The net periodic cost of our pension and other post-

retirement plans is determined using the projected unit credit

method and several actuarial assumptions, the most significant

of which are the discount rate, the long-term rate of asset

return, and medical trend (rate of growth for medical costs).

A portion of net periodic pension and other postretirement

income or expense is not recognized in net earnings in the year

incurred because it is allocated to production as product costs,

and reflected in inventory at the end of a reporting period. If

gains and losses, which occur when actual experience differs

from actuarial assumptions, exceed ten percent of the greater

of plan assets or plan liabilities we amortize them over the

average future service period of employees.